AIB: Back from the brink of brand extinction

Rothco

Introduction & Background

AIB, Ireland’s largest bank, had the distinction of recording the lowest consumer trust score ever: the banking category in Ireland had scored a mere 6% in the annual Edelman Trust Barometer in 2013, so as the largest representative of banking, we can assume that there was, at most, 6% trust in AIB. AIB had a Net Promoter Score of minus 37 among customers, and our NPS was even lower among our own employees. Media commentary on the AIB brand was 99% negative. Social media sentiment was 90% negative.

The situation really was that bad: we were a bank synonymous with Ireland’s financial crisis; a brand on its last breath, in the unenviable position of being the most hated, mistrusted brand in Ireland.

In 2013, a full five years after AIB’s bailout by the Irish taxpayer, the relationship between the bank and the Irish public was at an all time low. With every austerity measure introduced, it was ‘the banks’ – and chief among them, AIB – that received the public’s wrath. We were not in control of our own story, not in control of our own brand. In effect, the brand was left at the mercy of the media, who delighted in both feeding and providing an outlet for the public’s anger.

AIB was a lightning rod for the nation’s anger and outrage. Sensational newspaper headlines called for Bank executives to be hanged for their lavish lifestyles and inflated salaries, all paid for by the Irish public as the country plummeted further and further into recession. AIB staff members regularly chose to be dropped off at nearby addresses rather than admit to taxi drivers that they were Bank employees.

This is a comeback story; the story of how AIB recovered from the brink of brand extinction. This is the story of how – through a course of strategic marketing and groundbreaking communications solutions – AIB made a remarkable brand turnaround by backing not just our customers, but backing the power of an Organising Brand Idea.

Marketing Objectives

Commercial Objective

Our Commercial Objective, simply put, was to return AIB to profitability in a mere two years – although there was nothing simple about this undertaking. We needed to make AIB attractive to investors, who would be looking to our Net Promoter Score (NPS) as an indicator of the state of our brand and the quality of our customer base. This would prove challenging, given that we were starting with an NPS of minus 37.

Marketing Objective

What does an NPS of -37 actually mean? It means that our own customers were not just passively cynical about AIB, they had turned into active brand detractors; they were some of our loudest critics. If the AIB brand were to survive, we would need to reduce the negativity that came from our own customer base. Our Marketing Objective was to improve our NPS score by at least half, and turn our net rejecters into net promoters.

Role for Communications

A brand equals the sum of all the interactions a customer has with it, made up of:

i) their engagement with the physical products and services it offers

ii) what others say about it – word of mouth and the media

iii) what it says about itself – advertising and PR

In the immediate aftermath of the bailout, our product offering was severely restricted. We effectively stopped advertising, meaning the AIB brand was being dictated by damaging customer service experiences and austerity headlines. We were surrounded by negativity at every turn – from the general public, the media, our own customers and staff.

It was time for us to take back control of the conversation about the AIB brand; this was the role for our communications.

The Task

We needed a credible idea that was capable not just of helping to restore our reputation, but one that could also carry product messages (to help us achieve our commercial objective). This wasn’t as simple as turning our communications back on an “open for business” message. Nearly everything that could go against AIB was going against us.

The Brand

Fundamentally, brand equals trust. With a banking category Trust score of just 6%, and with a Net Promoter Score of minus 37, it is not unreasonable to question whether or not we even had a brand. What we did have was a public perception of AIB as an out-of-touch institution that was entirely selfserving and ‘customer-last’.

The Consumer

Consumers’ wants and needs of their bank had changed. On the one hand, they still needed a bank, but at the same time they wanted the bank to remain at arm’s length. Online banking and mobile apps were making it possible for consumers to do much of their day-to-day banking without setting foot in a bank branch, and the ease and simplicity of online services such as PayPal and Airbnb were changing their expectations of financial services brands.

The Competitive Set

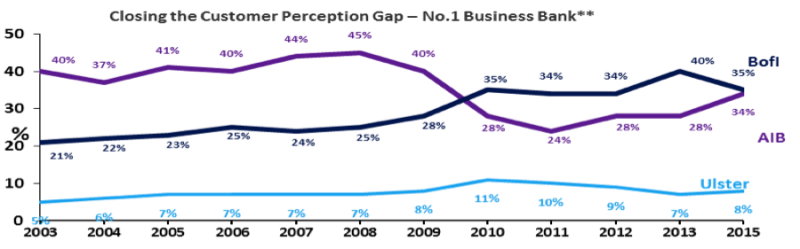

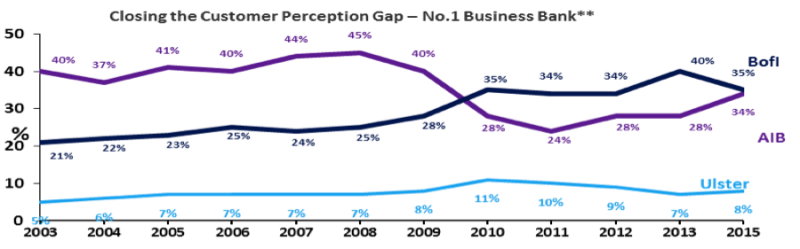

AIB was starting at a competitive disadvantage. By falling silent to ride out the storm of consumer anger, we had essentially handed our competitors the chance to lure our customers away. We were doing little to defend ourselves from our competitors who had new communications platforms and were advertising tempting offers to pick up our defecting customers. Where AIB had once been strong among SMEs, Bank of Ireland had closed the gap in perception as the Number 1 Business Bank. And among our personal customers, the Credit Union was seen to be more trustworthy and reassuring for small value loans.

The Message and the Tone

Whatever we said was going to be heavily scrutinised, so we had to be cautious with our message. AIB still had a role to play in people’s lives, but we couldn’t overstate our importance. In addition to choosing our message wisely, we had to be conscious of the tone of our communications. We needed the right balance between being humble about the past and being confident in our ability to put our customers first. There was great risk with regards to the message and the tone: get these wrong and our communications would remind the public of the sins of the past and re-incite their anger towards AIB.

The Budget

As part of the terms of our bailout, our marketing budget was – and still remains – capped at 2012 levels.

We had the pieces of a broken brand. We had customers who wanted very little to do with us. We had other banks in the market coming to eat our lunch. We had an audience that was ready to use our words as a stick to beat us with. And we had limited funds to pull this brand rehabilitation effort off. This was a daunting task that would require all of our marketing experience, ingenuity and energy to solve.

The Strategy

We started by adopting a set of behavioural guidelines to combat the source of much of AIB’s problems: lack of trust.

1. Prove by doing

Proof and evidence of amends are crucial in the repair and rebuilding process of trust. In order to be believed, we needed to avoid making any claims or promises in our communications, and deal entirely in the space of action.

2. Always be useful

Whilst the public may have held deep anger and resentment towards AIB, they still had a requirement for financial transaction in their daily lives. Our customers were looking for us to help them find easier, simpler, more convenient ways to go about their banking needs. In short, the best thing we could do on our journey of rebuilding trust was – be useful.

We would lay the foundations for trust and credibility by sticking tightly to these principles. But those alone wouldn’t be enough.

While we were looking for a solution to a reputation management problem, we came to realise that the problem we needed to solve was so much bigger. AIB wasn’t just a brand that needed fresh communications; AIB was an entire organisation that needed something to rally around if it was going to do more than just survive.

Our strategy was to unite the entire organisation behind a meaningful brand idea – an Organising Brand Idea. Finding the right idea would help all AIB stakeholders make decisions – about products, marketing, initiatives, etc. – which would allow the bank to deliver a consistent brand experience to its customers. An idea like Pedigree’s “We’re for dogs” – it is more than an endline, it’s a mantra.

We needed to find what we could stand for that would be meaningful to our customers. And it was only when we undertook deep, immersive qualitative research with a cross-section of AIB customers that we uncovered this penetrating insight:

People wanted a bank they could believe in, that also believed in them.

In order to be a bank that our customers could believe in, we needed to demonstrate that we believed in them. The way we would do this was by showing that we backed our customers.

Why backing?

Backing is a universal, emotional idea - an idea that delivers a feeling.

The feeling of being backed is a powerful feeling. Not ‘supported’. Not ‘helped’. Backed.

This Organising Brand Idea – ‘BACKING’ – is how we would return AIB to profitability.

The Idea

An idea built on trust

Our idea was to establish AIB as the bank that ‘backs’ its customers, because people wanted to believe in a bank that believed in them.

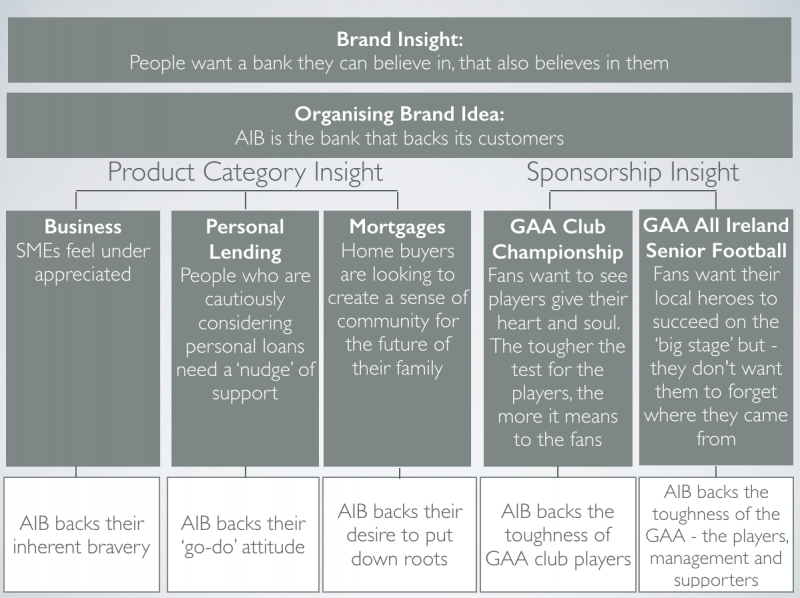

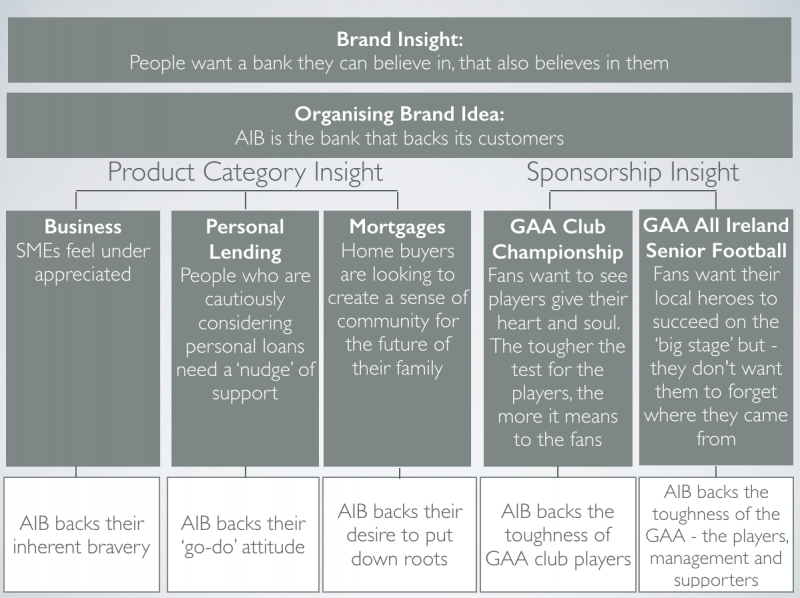

This idea of ‘BACKING’ would be central to all of our communications for all of our key target segments – Business, Personal Loans, Mortgages, as well as our key GAA sponsorship audience.

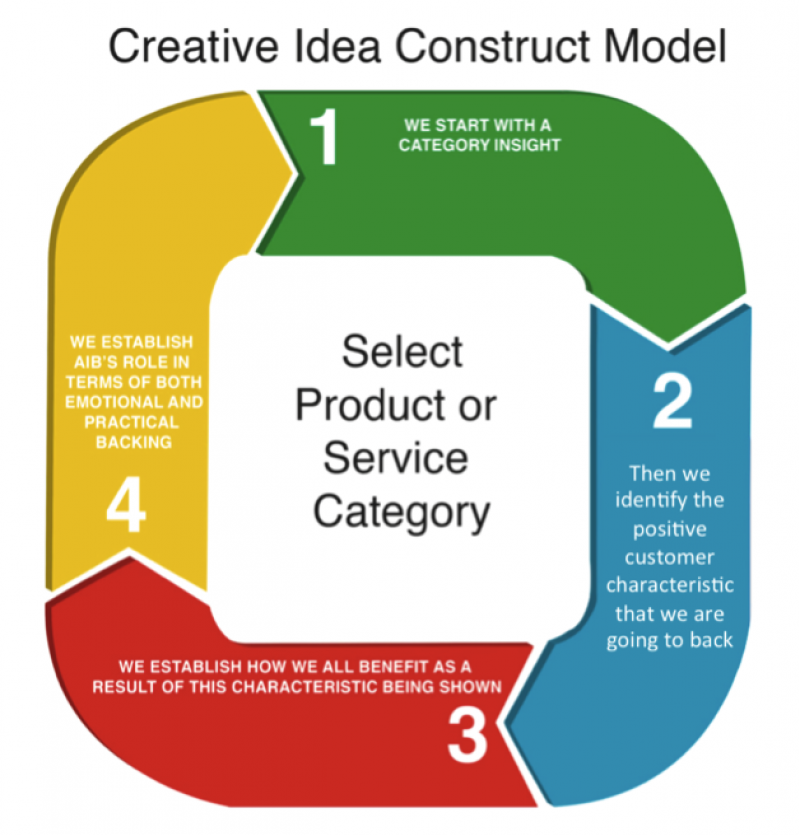

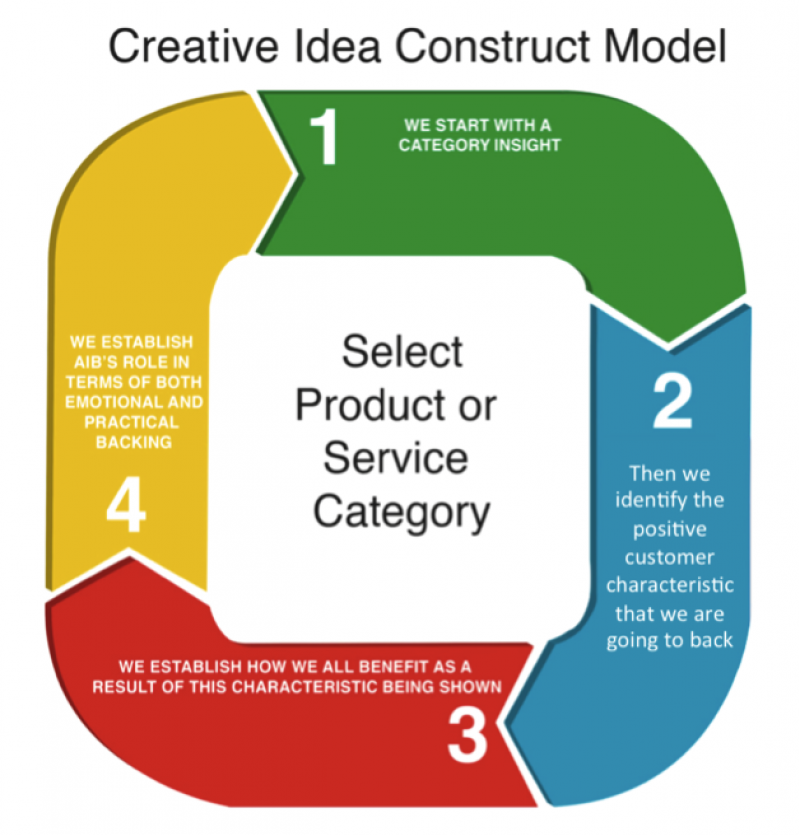

Filtering a big idea into product categories

A framework was introduced for all campaigns to ensure that we were building an overriding brand creative idea for everything to sit under.

Snapshot of our Organising Brand Idea

Snapshot of our Organising Brand Idea

The first step in this framework was to identify the product category insight.

From there we would identify a positive customer characteristic that AIB could back.

Once identified, we would establish how the wider population would benefit from this form of backing.

Finally, we would look at how AIB could offer customers emotional and practical support to get there.

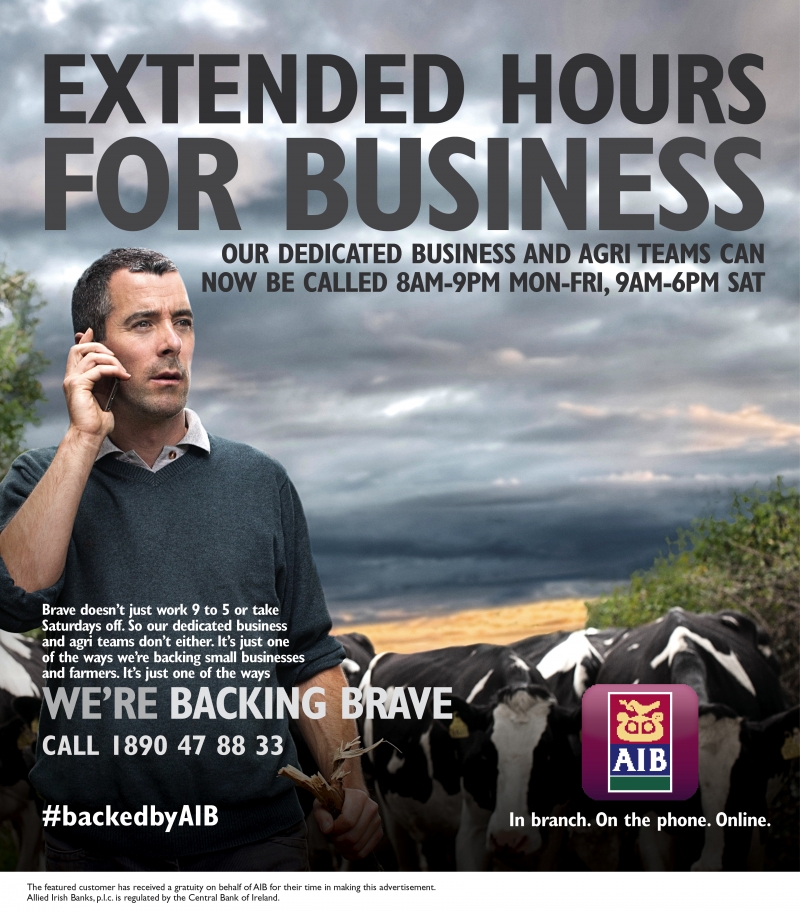

Business

“Backing Brave” launched in 2014, celebrating the enterprising and uncompromising spirit of small business owners. AIB backs the bravery of SMEs who put everything on the line to run their business, and supports them with loan approvals of €30,000 in 48 hours and Extended Opening Hours.

Mortgages

“Backing Putting Down Roots” launched in 2015, demonstrating that AIB understands that when a customer wants to buy a house, they are looking to create a sense of community for the future of their family in their new home. AIB backs those who meticulously and lovingly search for a home and a neighbourhood, and supports them with a personal mortgage advisor, 12-month mortgage approval and no account maintenance or transaction fees on their current account.

Personal Credit

Personal Credit

“Backing Doing” launched in 2015 and celebrated the ‘go-do’ attitude of customers who apply for a personal loan. AIB backs those who take the leap to make a goal a reality, and supports them with 3-hour loan approval.

In the same spirit of our product campaigns, we launched ‘backing’ at the most grassroots level, sowing the seeds of the idea via our sponsorship of the GAA.

GAA Club Championships

“#TheToughest” showed our support of GAA players in the Club Championships. Our campaign was born out of the category insight that because of the nature of the competition – which consists of nearly 2,000 clubs across Ireland competing in multiple rounds of knockout stages over a 10-month period – the Club Championships are the toughest competition of them all. AIB backs the toughness of this competition.

This campaign was an important step in establishing our brand idea of ‘backing’, as we were only there to show our support for this incredibly athletic competition in our nation’s beloved sport (not to sell our products).

GAA All Ireland Senior Football Championships

“Backing Club and County” launched in 2015 and extended our idea of #TheToughest to AIB’s sponsorship of the All Ireland Senior Football Championships. AIB backs the toughness of GAA by acknowledging the effort and commitment from players, management and supporters of all levels.

Choice of Media

We would create clear open space between ourselves and all other banks by choosing to completely break with the conventions of communications in the financial services world. We would behave more like a tech brand / a modern consumer brand. This meant we would be utterly unexpected and often disruptive not just in what we said, but also in where we said it. This included everything from Business, Personal Credit and Mortgages. For example, as part of the “Backing Brave” campaign, AIB created the Start-Up Academy; this programme sees a number of events across the country where start-ups go to learn and network with other start-ups.

The Toughest Trade

One of the most innovative uses of media which demonstrated how we broke with convention is The Toughest Trade.

We extended the reach of #TheToughest beyond GAA fans to a broader spectrum of the Irish public through innovative use of branded content. We created a TV documentary called “The Toughest Trade” which invites audiences to witness the toughness of GAA players and the sport as they watch two GAA players swap lives with professional sports stars from baseball, soccer, American football and cricket.

The Results

We had set out to achieve the seemingly insurmountable task of reviving the near-extinct AIB brand through a unifying Organising Brand Idea that would not just change how the public, customers and staff felt about AIB, but one that was also capable of affecting the bank’s bottom line.

Our Commercial Objective was to return AIB to a position of profitability.

AIB Profitability

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015(half year) |

|

Operational Loss €10 billion |

Operational Loss €8.1 billion |

Operational Loss €3.5 billion |

Operational Loss €1.6 billion |

Operational Profit €1.1 billion |

Operational Profit €1.26 billion |

In terms of profitability, after experiencing profit losses every year from 2010-2013, AIB’s first return to profitability occurred in 2014, with an Operational Profit of €1.1 billion, which further grew to €1.23 billion profit in the first half of 2015. We in no way are suggesting that this was down to advertising alone, but what we can show is how individual product campaigns have contributed valuable business to AIB and have positively affected brand perceptions.

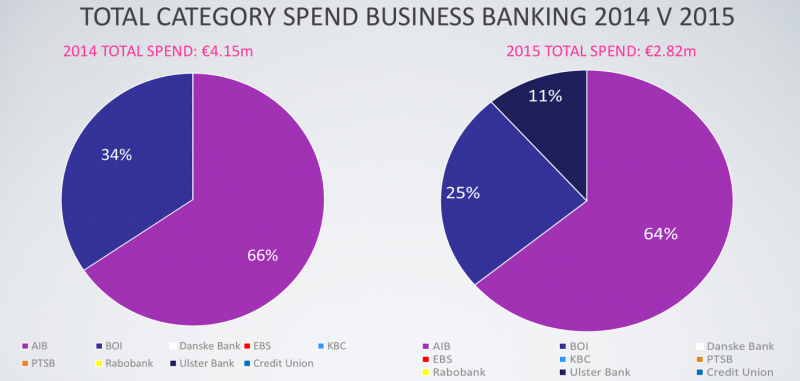

Business: “Backing Brave”

AIB successfully reversed the Business Bank perception trend – which saw Bank of Ireland gradually grow to a 12-point lead in Perception as the Number 1 Business Bank for SMEs between 2010-2013.

In a single year, we saw an 11-point shift in AIB’s perception score, closing the gap between AIB and Bank of Ireland to less than 1 point following our “Backing Brave” campaign in 2014.

“Backing Brave” had an immediate impact on Business Lending, achieving customer acquisition rates at 52% market share of new business. This campaign also led to a 16.5% increase in new Start Up Accounts.

“Backing Brave” had an immediate impact on Business Lending, achieving customer acquisition rates at 52% market share of new business. This campaign also led to a 16.5% increase in new Start Up Accounts.

SME and Agriculture loan applications increased by 13% on 2014, with drawdowns up 28% year on year. AIB approved 95% of all SME credit applications across a variety of sectors and SME lending delivered just under €1 billion in new lending in 2015.

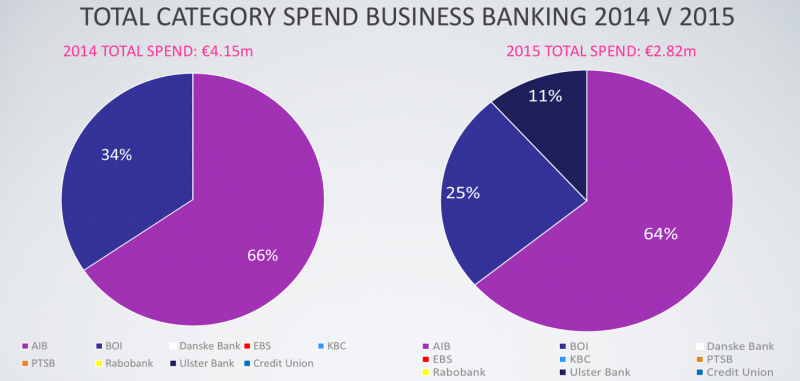

We achieved all of the above with our Share of Voice decreased from 23% in 2014 to 21% in 2015 due to increased competitiveness from Bank of Ireland, Ulster Bank and KBC.

(Source: Nielsen Addynamix Jan 2014 – Dec 15)

Return on Marketing Investment

For a full campaign spend of €2.3 million, AIB saw a ROI of €31 for every €1 spent.

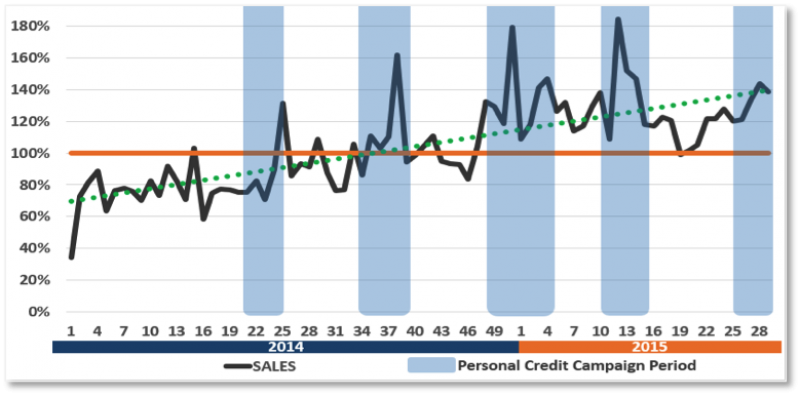

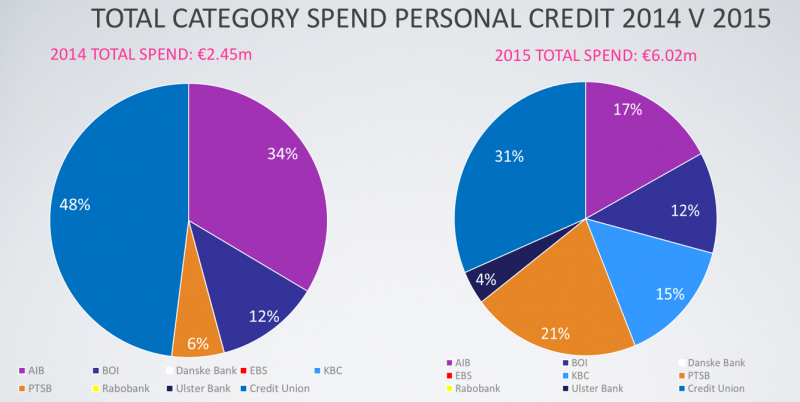

Personal Lending: “Backing Doing”

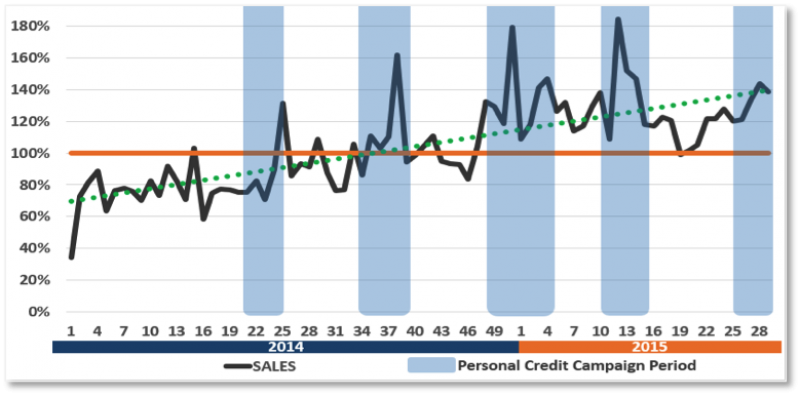

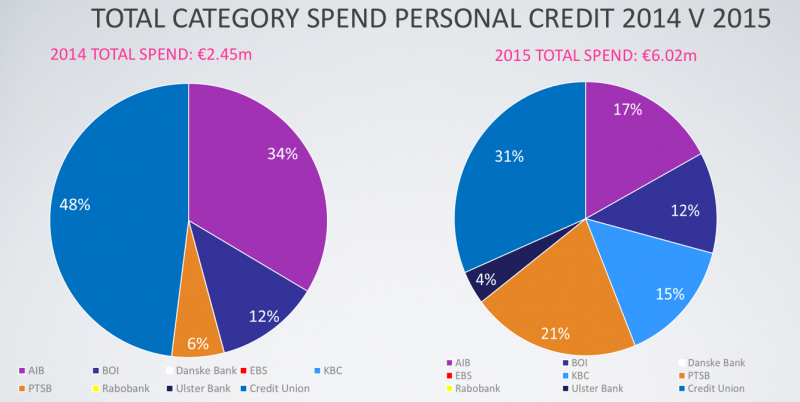

There is a very clear correlation between Personal Credit marketing investment and overall sales performance – where sales increased 134% vs plan during in-campaign periods. This campaign delivered a staggering +40% year-on-year increase in loan sales.

There is a very clear correlation between Personal Credit marketing investment and overall sales performance – where sales increased 134% vs plan during in-campaign periods. This campaign delivered a staggering +40% year-on-year increase in loan sales.

For a full campaign spend of €1.82 million, we achieved 42,500 drawdowns against a target of 17,500. This equates to a total value in drawdowns of €503 million.

We achieved all of the above with a 50% decrease in our Share of Voice in 2015 due to increased spends from PTSB and KBC.

(Source: Nielsen Addynamix Jan 2014 – Dec 15)

Return on Marketing Investment

AIB's New Lending Net Interest Income for 2015 was €50 million, up from €35 million in 2014. Net income was €15 million (note: net interest income doesn’t include cost to sell a loan – i.e. it excludes distribution and marketing costs). Therefore, when you calculate ROI and take out our incremental marketing investment of €0.63 million, we arrive at a ROI of €23 for every €1 spent.

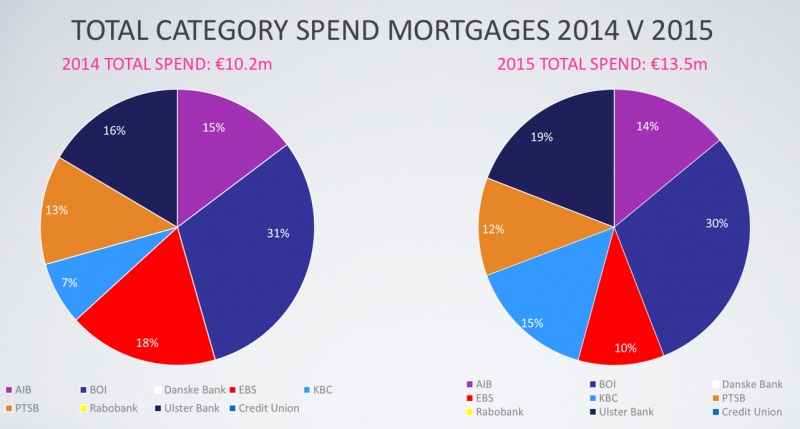

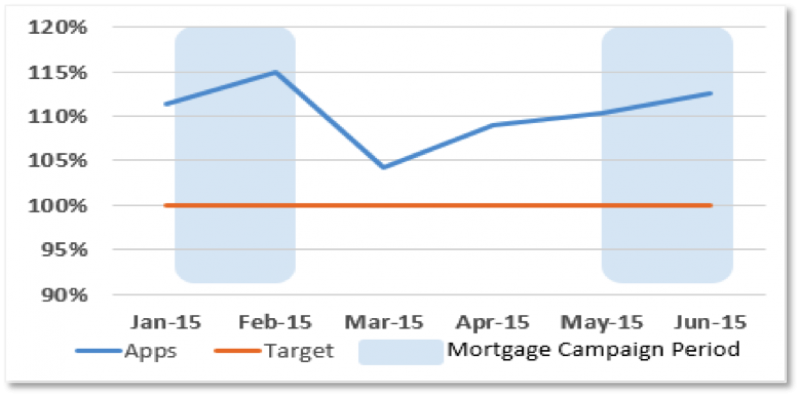

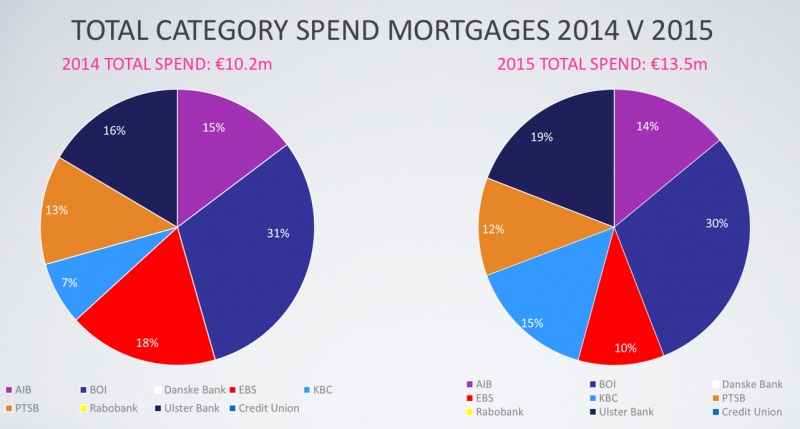

Mortgages: “Backing Putting Down Roots”

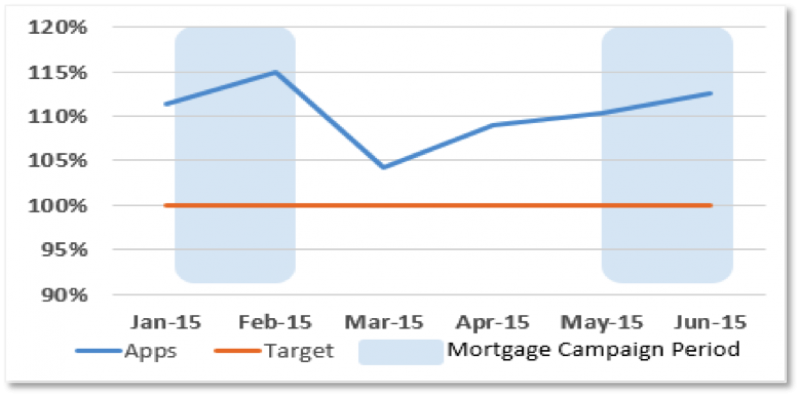

There is a clear correlation between campaign investment and applications, where applications have increased by 112% on average during in-campaign periods.

We achieved all of the above with a 1% reduction in our Share of Voice between 2014-2015 despite Bank of Ireland outspending the category by a rate of 2:1 and KBC doubling their Share of Voice over the same period.

(Source: Nielsen Addynamix Jan 2014 – Dec 15)

Return on Marketing Investment

For a full campaign spend of €3.1 million, we achieved 14,661 applications (vs 13,332 target) and 5,212 drawdowns (vs 4,228 target). This equates to a total value in drawdowns of €1.06 billion and a ROI of €580 for every €1 spent.

Net Promoter Score

As part of our demonstration of a trend towards returning to profitability, we would need to see an improvement in the -37 Net Promoter Score for AIB recorded in 2012, ideally at least halving this figure.

|

2012 |

2013 |

2014 |

2015 |

|

-37 |

-24 |

-17 |

-4 |

AIB has seen a 33-point improvement in its NPS in the three years during which we were activating our Organising Brand Idea. We reduced brand detraction by more than the half that we were aiming for – we nearly eliminated our negative scores altogether. This is a significant turnaround for AIB, because it tells the story of how our customers feel about the brand: namely, that a brand which barely existed just three years prior has remarkably returned to health.

Our Marketing Objective was to turn our net rejecters into net promoters.

As we have previously shown, AIB saw a 33-point improvement in its Net Promoter Score from a low of minus 37 in 2012 to minus 4 in 2015.

Role for Communications

We sought to use our Communications to take back control of the conversation about the AIB brand.

At the same time that NPS shifted positively, AIB Brand social media sentiment grew to 75% positive - this was 90% negative in 2013.

Our brand advocacy also saw an uplift in our Brand Power score, which reached 20.4% in 2015 – this is not only the highest point since the measurement commenced in 2013, it is also the highest in the financial services category. ‘Customer Centricity’, ‘Usefulness’ as well as ‘Trust’ have reached their highest levels so far. (Millward Brown 2015)

|

|

Q4 2013 |

Q4 2014 |

Q4 2015 |

|

Customer Centricity (index) |

119 |

135 |

155 |

|

Usefulness (index) |

138 |

148 |

164 |

|

Trust (%) |

17% |

23% |

25% |

(Source: Millward Brown, 2015)

One of the biggest contributors to a positive conversation about AIB has been our GAA sponsorship. Not only has this sponsorship helped improve AIB’s relationship with consumers – 60% of people aware of the sponsorship feel closer to the brand – but the level of engagement with #TheToughest is helping to lift AIB’s social media sentiment.

AIB’s Club Championship sponsorship activity has achieved over 160,000 social interactions, 2 million video views (more than all the video views of every Irish bank combined) and earned an estimated €10 million in PR editorial value. Added to that, our All Ireland Senior Football sponsorship has achieved over 300,000 interactions, over 2 million video views and €1.4 million in PR editorial value. Clearly, the sheer volume of conversation has helped to change the conversation.

But what about our own staff, who previously were too ashamed to admit that they worked for AIB?

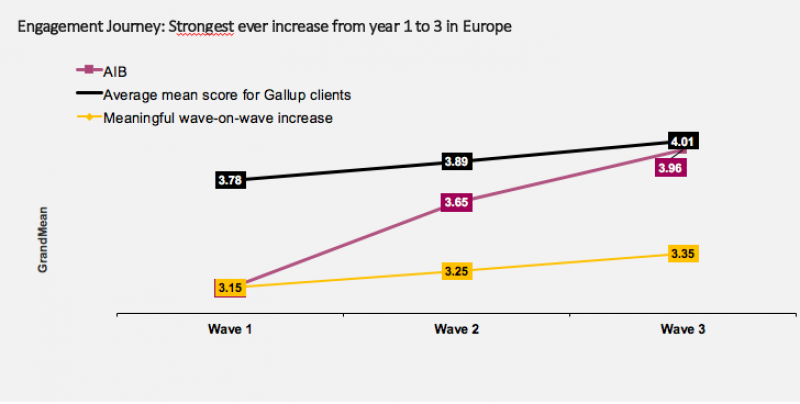

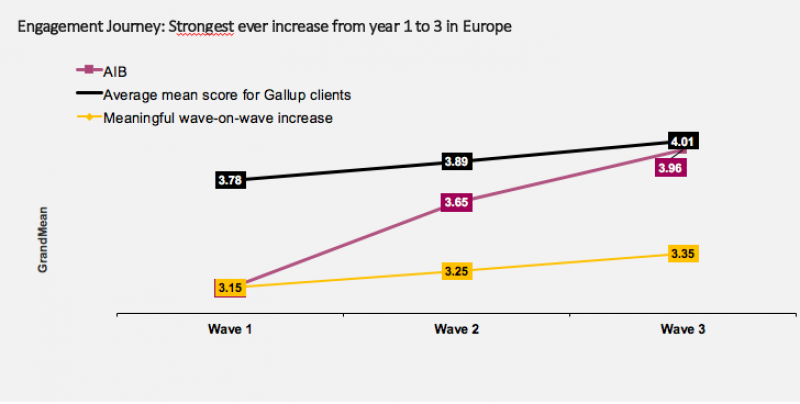

AIB Employee Engagement research undertaken by Gallup (a measure that includes how valued and energised about their work employees feel) has shown that AIB has made more than eight years’ worth of significant increases in Employee Engagement from 2013-2015, the biggest two year increase that Gallup has ever seen among its European clients.

(Source: Gallup Employee Engagement, 2015)

The Impact

AIB had come to be defined by its role in the financial crash and subsequent bailout by the Irish taxpayer. To the public, the entire organisation was full of self-serving ‘fat cats’ who didn’t care about their customers; now owned by the state, AIB was a bank that wasn’t going to change, no matter what. This was the prevailing attitude toward our organisation and our brand.

Through a sustained effort to bed down an Organising Brand Idea of AIB as the bank that backs its customers, we were able to change how our customers think about us. Our actions, our products and our proof points signaled to our customers that things had changed at AIB and opened up the possibility that we had changed to become truly customer-first.

Prior to our campaigns, our customers were more than happy to keep AIB at arm’s length. There was no role for the brand AIB, no need for any kind of closeness when their trust had been violated before. Because we chose not to shy away from emotional territory, we were able to show our customers that our brand still has a role to play in their lives. By identifying a positive characteristic in our customers that we back, our customers now feel like we understand where they are coming from, and that we appreciate them.

Finally, prior to our communications, we were facing widespread cynicism, but it was through proof, utility and standing for something meaningful that our customers could park their cynicism and give AIB the benefit of the doubt.

New Learnings

On the surface, the solution to the task at hand could have been a re-positioning effort which culminated in a brand campaign. But what we were dealing with was an entire organisation that needed to become unified if they were going to survive. In order to change the fate and fortune of the AIB brand, we needed more than just an advertising idea. We needed an Organising Brand Idea that was born out of a consumer truth; an idea that was built of and for the consumer, wherein the AIB brand would make a bold move and take a back seat in our communications from hereon in.

Summary

This is a comeback story; the story of how we brought an iconic brand back from the brink of brand extinction. AIB was a brand on its last breath, in the unenviable position of being the most hated brand in Ireland. We had some of the worst Brand Advocacy and Trust scores recorded. Our customers had come to see us as customer-last. Tom Kinsella, CMO of AIB is on record as having described this task as “the job nobody wanted”. Through our unifying Organising Brand Idea of ‘backing’ our customers, we would return the brand to health and help the business return to profitability.

AIB, Ireland’s largest bank, had the distinction of recording the lowest consumer trust score ever: the banking category in Ireland had scored a mere 6% in the annual Edelman Trust Barometer in 2013, so as the largest representative of banking, we can assume that there was, at most, 6% trust in AIB. AIB had a Net Promoter Score of minus 37 among customers, and our NPS was even lower among our own employees. Media commentary on the AIB brand was 99% negative. Social media sentiment was 90% negative.

The situation really was that bad: we were a bank synonymous with Ireland’s financial crisis; a brand on its last breath, in the unenviable position of being the most hated, mistrusted brand in Ireland.

In 2013, a full five years after AIB’s bailout by the Irish taxpayer, the relationship between the bank and the Irish public was at an all time low. With every austerity measure introduced, it was ‘the banks’ – and chief among them, AIB – that received the public’s wrath. We were not in control of our own story, not in control of our own brand. In effect, the brand was left at the mercy of the media, who delighted in both feeding and providing an outlet for the public’s anger.

AIB was a lightning rod for the nation’s anger and outrage. Sensational newspaper headlines called for Bank executives to be hanged for their lavish lifestyles and inflated salaries, all paid for by the Irish public as the country plummeted further and further into recession. AIB staff members regularly chose to be dropped off at nearby addresses rather than admit to taxi drivers that they were Bank employees.

This is a comeback story; the story of how AIB recovered from the brink of brand extinction. This is the story of how – through a course of strategic marketing and groundbreaking communications solutions – AIB made a remarkable brand turnaround by backing not just our customers, but backing the power of an Organising Brand Idea.

Commercial Objective

Our Commercial Objective, simply put, was to return AIB to profitability in a mere two years – although there was nothing simple about this undertaking. We needed to make AIB attractive to investors, who would be looking to our Net Promoter Score (NPS) as an indicator of the state of our brand and the quality of our customer base. This would prove challenging, given that we were starting with an NPS of minus 37.

Marketing Objective

What does an NPS of -37 actually mean? It means that our own customers were not just passively cynical about AIB, they had turned into active brand detractors; they were some of our loudest critics. If the AIB brand were to survive, we would need to reduce the negativity that came from our own customer base. Our Marketing Objective was to improve our NPS score by at least half, and turn our net rejecters into net promoters.

Role for Communications

A brand equals the sum of all the interactions a customer has with it, made up of:

i) their engagement with the physical products and services it offers

ii) what others say about it – word of mouth and the media

iii) what it says about itself – advertising and PR

In the immediate aftermath of the bailout, our product offering was severely restricted. We effectively stopped advertising, meaning the AIB brand was being dictated by damaging customer service experiences and austerity headlines. We were surrounded by negativity at every turn – from the general public, the media, our own customers and staff.

It was time for us to take back control of the conversation about the AIB brand; this was the role for our communications.

We needed a credible idea that was capable not just of helping to restore our reputation, but one that could also carry product messages (to help us achieve our commercial objective). This wasn’t as simple as turning our communications back on an “open for business” message. Nearly everything that could go against AIB was going against us.

The Brand

Fundamentally, brand equals trust. With a banking category Trust score of just 6%, and with a Net Promoter Score of minus 37, it is not unreasonable to question whether or not we even had a brand. What we did have was a public perception of AIB as an out-of-touch institution that was entirely selfserving and ‘customer-last’.

The Consumer

Consumers’ wants and needs of their bank had changed. On the one hand, they still needed a bank, but at the same time they wanted the bank to remain at arm’s length. Online banking and mobile apps were making it possible for consumers to do much of their day-to-day banking without setting foot in a bank branch, and the ease and simplicity of online services such as PayPal and Airbnb were changing their expectations of financial services brands.

The Competitive Set

AIB was starting at a competitive disadvantage. By falling silent to ride out the storm of consumer anger, we had essentially handed our competitors the chance to lure our customers away. We were doing little to defend ourselves from our competitors who had new communications platforms and were advertising tempting offers to pick up our defecting customers. Where AIB had once been strong among SMEs, Bank of Ireland had closed the gap in perception as the Number 1 Business Bank. And among our personal customers, the Credit Union was seen to be more trustworthy and reassuring for small value loans.

The Message and the Tone

Whatever we said was going to be heavily scrutinised, so we had to be cautious with our message. AIB still had a role to play in people’s lives, but we couldn’t overstate our importance. In addition to choosing our message wisely, we had to be conscious of the tone of our communications. We needed the right balance between being humble about the past and being confident in our ability to put our customers first. There was great risk with regards to the message and the tone: get these wrong and our communications would remind the public of the sins of the past and re-incite their anger towards AIB.

The Budget

As part of the terms of our bailout, our marketing budget was – and still remains – capped at 2012 levels.

We had the pieces of a broken brand. We had customers who wanted very little to do with us. We had other banks in the market coming to eat our lunch. We had an audience that was ready to use our words as a stick to beat us with. And we had limited funds to pull this brand rehabilitation effort off. This was a daunting task that would require all of our marketing experience, ingenuity and energy to solve.

We started by adopting a set of behavioural guidelines to combat the source of much of AIB’s problems: lack of trust.

1. Prove by doing

Proof and evidence of amends are crucial in the repair and rebuilding process of trust. In order to be believed, we needed to avoid making any claims or promises in our communications, and deal entirely in the space of action.

2. Always be useful

Whilst the public may have held deep anger and resentment towards AIB, they still had a requirement for financial transaction in their daily lives. Our customers were looking for us to help them find easier, simpler, more convenient ways to go about their banking needs. In short, the best thing we could do on our journey of rebuilding trust was – be useful.

We would lay the foundations for trust and credibility by sticking tightly to these principles. But those alone wouldn’t be enough.

While we were looking for a solution to a reputation management problem, we came to realise that the problem we needed to solve was so much bigger. AIB wasn’t just a brand that needed fresh communications; AIB was an entire organisation that needed something to rally around if it was going to do more than just survive.

Our strategy was to unite the entire organisation behind a meaningful brand idea – an Organising Brand Idea. Finding the right idea would help all AIB stakeholders make decisions – about products, marketing, initiatives, etc. – which would allow the bank to deliver a consistent brand experience to its customers. An idea like Pedigree’s “We’re for dogs” – it is more than an endline, it’s a mantra.

We needed to find what we could stand for that would be meaningful to our customers. And it was only when we undertook deep, immersive qualitative research with a cross-section of AIB customers that we uncovered this penetrating insight:

People wanted a bank they could believe in, that also believed in them.

In order to be a bank that our customers could believe in, we needed to demonstrate that we believed in them. The way we would do this was by showing that we backed our customers.

Why backing?

Backing is a universal, emotional idea - an idea that delivers a feeling.

The feeling of being backed is a powerful feeling. Not ‘supported’. Not ‘helped’. Backed.

This Organising Brand Idea – ‘BACKING’ – is how we would return AIB to profitability.

An idea built on trust

Our idea was to establish AIB as the bank that ‘backs’ its customers, because people wanted to believe in a bank that believed in them.

This idea of ‘BACKING’ would be central to all of our communications for all of our key target segments – Business, Personal Loans, Mortgages, as well as our key GAA sponsorship audience.

Filtering a big idea into product categories

A framework was introduced for all campaigns to ensure that we were building an overriding brand creative idea for everything to sit under.

Snapshot of our Organising Brand Idea

Snapshot of our Organising Brand Idea

The first step in this framework was to identify the product category insight.

From there we would identify a positive customer characteristic that AIB could back.

Once identified, we would establish how the wider population would benefit from this form of backing.

Finally, we would look at how AIB could offer customers emotional and practical support to get there.

Business

“Backing Brave” launched in 2014, celebrating the enterprising and uncompromising spirit of small business owners. AIB backs the bravery of SMEs who put everything on the line to run their business, and supports them with loan approvals of €30,000 in 48 hours and Extended Opening Hours.

Mortgages

“Backing Putting Down Roots” launched in 2015, demonstrating that AIB understands that when a customer wants to buy a house, they are looking to create a sense of community for the future of their family in their new home. AIB backs those who meticulously and lovingly search for a home and a neighbourhood, and supports them with a personal mortgage advisor, 12-month mortgage approval and no account maintenance or transaction fees on their current account.

Personal Credit

Personal Credit

“Backing Doing” launched in 2015 and celebrated the ‘go-do’ attitude of customers who apply for a personal loan. AIB backs those who take the leap to make a goal a reality, and supports them with 3-hour loan approval.

In the same spirit of our product campaigns, we launched ‘backing’ at the most grassroots level, sowing the seeds of the idea via our sponsorship of the GAA.

GAA Club Championships

“#TheToughest” showed our support of GAA players in the Club Championships. Our campaign was born out of the category insight that because of the nature of the competition – which consists of nearly 2,000 clubs across Ireland competing in multiple rounds of knockout stages over a 10-month period – the Club Championships are the toughest competition of them all. AIB backs the toughness of this competition.

This campaign was an important step in establishing our brand idea of ‘backing’, as we were only there to show our support for this incredibly athletic competition in our nation’s beloved sport (not to sell our products).

GAA All Ireland Senior Football Championships

“Backing Club and County” launched in 2015 and extended our idea of #TheToughest to AIB’s sponsorship of the All Ireland Senior Football Championships. AIB backs the toughness of GAA by acknowledging the effort and commitment from players, management and supporters of all levels.

Choice of Media

We would create clear open space between ourselves and all other banks by choosing to completely break with the conventions of communications in the financial services world. We would behave more like a tech brand / a modern consumer brand. This meant we would be utterly unexpected and often disruptive not just in what we said, but also in where we said it. This included everything from Business, Personal Credit and Mortgages. For example, as part of the “Backing Brave” campaign, AIB created the Start-Up Academy; this programme sees a number of events across the country where start-ups go to learn and network with other start-ups.

The Toughest Trade

One of the most innovative uses of media which demonstrated how we broke with convention is The Toughest Trade.

We extended the reach of #TheToughest beyond GAA fans to a broader spectrum of the Irish public through innovative use of branded content. We created a TV documentary called “The Toughest Trade” which invites audiences to witness the toughness of GAA players and the sport as they watch two GAA players swap lives with professional sports stars from baseball, soccer, American football and cricket.

We had set out to achieve the seemingly insurmountable task of reviving the near-extinct AIB brand through a unifying Organising Brand Idea that would not just change how the public, customers and staff felt about AIB, but one that was also capable of affecting the bank’s bottom line.

Our Commercial Objective was to return AIB to a position of profitability.

AIB Profitability

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015(half year) |

|

Operational Loss €10 billion |

Operational Loss €8.1 billion |

Operational Loss €3.5 billion |

Operational Loss €1.6 billion |

Operational Profit €1.1 billion |

Operational Profit €1.26 billion |

In terms of profitability, after experiencing profit losses every year from 2010-2013, AIB’s first return to profitability occurred in 2014, with an Operational Profit of €1.1 billion, which further grew to €1.23 billion profit in the first half of 2015. We in no way are suggesting that this was down to advertising alone, but what we can show is how individual product campaigns have contributed valuable business to AIB and have positively affected brand perceptions.

Business: “Backing Brave”

AIB successfully reversed the Business Bank perception trend – which saw Bank of Ireland gradually grow to a 12-point lead in Perception as the Number 1 Business Bank for SMEs between 2010-2013.

In a single year, we saw an 11-point shift in AIB’s perception score, closing the gap between AIB and Bank of Ireland to less than 1 point following our “Backing Brave” campaign in 2014.

“Backing Brave” had an immediate impact on Business Lending, achieving customer acquisition rates at 52% market share of new business. This campaign also led to a 16.5% increase in new Start Up Accounts.

“Backing Brave” had an immediate impact on Business Lending, achieving customer acquisition rates at 52% market share of new business. This campaign also led to a 16.5% increase in new Start Up Accounts.

SME and Agriculture loan applications increased by 13% on 2014, with drawdowns up 28% year on year. AIB approved 95% of all SME credit applications across a variety of sectors and SME lending delivered just under €1 billion in new lending in 2015.

We achieved all of the above with our Share of Voice decreased from 23% in 2014 to 21% in 2015 due to increased competitiveness from Bank of Ireland, Ulster Bank and KBC.

(Source: Nielsen Addynamix Jan 2014 – Dec 15)

Return on Marketing Investment

For a full campaign spend of €2.3 million, AIB saw a ROI of €31 for every €1 spent.

Personal Lending: “Backing Doing”

There is a very clear correlation between Personal Credit marketing investment and overall sales performance – where sales increased 134% vs plan during in-campaign periods. This campaign delivered a staggering +40% year-on-year increase in loan sales.

There is a very clear correlation between Personal Credit marketing investment and overall sales performance – where sales increased 134% vs plan during in-campaign periods. This campaign delivered a staggering +40% year-on-year increase in loan sales.

For a full campaign spend of €1.82 million, we achieved 42,500 drawdowns against a target of 17,500. This equates to a total value in drawdowns of €503 million.

We achieved all of the above with a 50% decrease in our Share of Voice in 2015 due to increased spends from PTSB and KBC.

(Source: Nielsen Addynamix Jan 2014 – Dec 15)

Return on Marketing Investment

AIB's New Lending Net Interest Income for 2015 was €50 million, up from €35 million in 2014. Net income was €15 million (note: net interest income doesn’t include cost to sell a loan – i.e. it excludes distribution and marketing costs). Therefore, when you calculate ROI and take out our incremental marketing investment of €0.63 million, we arrive at a ROI of €23 for every €1 spent.

Mortgages: “Backing Putting Down Roots”

There is a clear correlation between campaign investment and applications, where applications have increased by 112% on average during in-campaign periods.

We achieved all of the above with a 1% reduction in our Share of Voice between 2014-2015 despite Bank of Ireland outspending the category by a rate of 2:1 and KBC doubling their Share of Voice over the same period.

(Source: Nielsen Addynamix Jan 2014 – Dec 15)

Return on Marketing Investment

For a full campaign spend of €3.1 million, we achieved 14,661 applications (vs 13,332 target) and 5,212 drawdowns (vs 4,228 target). This equates to a total value in drawdowns of €1.06 billion and a ROI of €580 for every €1 spent.

Net Promoter Score

As part of our demonstration of a trend towards returning to profitability, we would need to see an improvement in the -37 Net Promoter Score for AIB recorded in 2012, ideally at least halving this figure.

|

2012 |

2013 |

2014 |

2015 |

|

-37 |

-24 |

-17 |

-4 |

AIB has seen a 33-point improvement in its NPS in the three years during which we were activating our Organising Brand Idea. We reduced brand detraction by more than the half that we were aiming for – we nearly eliminated our negative scores altogether. This is a significant turnaround for AIB, because it tells the story of how our customers feel about the brand: namely, that a brand which barely existed just three years prior has remarkably returned to health.

Our Marketing Objective was to turn our net rejecters into net promoters.

As we have previously shown, AIB saw a 33-point improvement in its Net Promoter Score from a low of minus 37 in 2012 to minus 4 in 2015.

Role for Communications

We sought to use our Communications to take back control of the conversation about the AIB brand.

At the same time that NPS shifted positively, AIB Brand social media sentiment grew to 75% positive - this was 90% negative in 2013.

Our brand advocacy also saw an uplift in our Brand Power score, which reached 20.4% in 2015 – this is not only the highest point since the measurement commenced in 2013, it is also the highest in the financial services category. ‘Customer Centricity’, ‘Usefulness’ as well as ‘Trust’ have reached their highest levels so far. (Millward Brown 2015)

|

|

Q4 2013 |

Q4 2014 |

Q4 2015 |

|

Customer Centricity (index) |

119 |

135 |

155 |

|

Usefulness (index) |

138 |

148 |

164 |

|

Trust (%) |

17% |

23% |

25% |

(Source: Millward Brown, 2015)

One of the biggest contributors to a positive conversation about AIB has been our GAA sponsorship. Not only has this sponsorship helped improve AIB’s relationship with consumers – 60% of people aware of the sponsorship feel closer to the brand – but the level of engagement with #TheToughest is helping to lift AIB’s social media sentiment.

AIB’s Club Championship sponsorship activity has achieved over 160,000 social interactions, 2 million video views (more than all the video views of every Irish bank combined) and earned an estimated €10 million in PR editorial value. Added to that, our All Ireland Senior Football sponsorship has achieved over 300,000 interactions, over 2 million video views and €1.4 million in PR editorial value. Clearly, the sheer volume of conversation has helped to change the conversation.

But what about our own staff, who previously were too ashamed to admit that they worked for AIB?

AIB Employee Engagement research undertaken by Gallup (a measure that includes how valued and energised about their work employees feel) has shown that AIB has made more than eight years’ worth of significant increases in Employee Engagement from 2013-2015, the biggest two year increase that Gallup has ever seen among its European clients.

(Source: Gallup Employee Engagement, 2015)

AIB had come to be defined by its role in the financial crash and subsequent bailout by the Irish taxpayer. To the public, the entire organisation was full of self-serving ‘fat cats’ who didn’t care about their customers; now owned by the state, AIB was a bank that wasn’t going to change, no matter what. This was the prevailing attitude toward our organisation and our brand.

Through a sustained effort to bed down an Organising Brand Idea of AIB as the bank that backs its customers, we were able to change how our customers think about us. Our actions, our products and our proof points signaled to our customers that things had changed at AIB and opened up the possibility that we had changed to become truly customer-first.

Prior to our campaigns, our customers were more than happy to keep AIB at arm’s length. There was no role for the brand AIB, no need for any kind of closeness when their trust had been violated before. Because we chose not to shy away from emotional territory, we were able to show our customers that our brand still has a role to play in their lives. By identifying a positive characteristic in our customers that we back, our customers now feel like we understand where they are coming from, and that we appreciate them.

Finally, prior to our communications, we were facing widespread cynicism, but it was through proof, utility and standing for something meaningful that our customers could park their cynicism and give AIB the benefit of the doubt.

On the surface, the solution to the task at hand could have been a re-positioning effort which culminated in a brand campaign. But what we were dealing with was an entire organisation that needed to become unified if they were going to survive. In order to change the fate and fortune of the AIB brand, we needed more than just an advertising idea. We needed an Organising Brand Idea that was born out of a consumer truth; an idea that was built of and for the consumer, wherein the AIB brand would make a bold move and take a back seat in our communications from hereon in.

This is a comeback story; the story of how we brought an iconic brand back from the brink of brand extinction. AIB was a brand on its last breath, in the unenviable position of being the most hated brand in Ireland. We had some of the worst Brand Advocacy and Trust scores recorded. Our customers had come to see us as customer-last. Tom Kinsella, CMO of AIB is on record as having described this task as “the job nobody wanted”. Through our unifying Organising Brand Idea of ‘backing’ our customers, we would return the brand to health and help the business return to profitability.