SuperValu: How a brave local brand defied the forces of globalisation

DDFH&B

Introduction & Background

This is a story about long term effectiveness. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation.

SuperValu was founded in 1979 with a base of just 16 stores, mainly in Munster. While they had grown to 182 stores by 2004, and acquired Superquinn (another Irish retailer) in 2011, they were a retailer with two speeds, an urban speed and a rural speed.

The urban speed was still reeling from the Superquinn takeover, when stores were rebranded to SuperValu in 2014. Superquinn had a more premium brand perception, much closer to the Waitrose proposition in the UK. Consumers were in a state of chassis as they felt they were paying convenience store prices in large supermarkets and were unfamiliar with the brand and mistrustful of its quality.

The rural speed was entirely different. SuperValu stores were at the centre of every community in Ireland. They were seen as a retailer with a heart, they looked after their own, and their rural consumers already knew they were a quality retailer who supported local producers and offered good value for money.

To further complicate the background to this story, Tesco has been present in Ireland since 1997, when it took over another major Irish supermarket chain, Quinnsworth. Between this inevitable drift of the UK retailer to our shores, and the arrival of the discounters in Ireland, the category as we knew it had changed forever and all bets were off.

Marketing Objectives

In 2012, we began our journey to number one by launching the SuperValu own brand range with the ADFX Grand Prix-winning ‘Hello’ campaign. This allowed us to successfully convince our audiences of the value offered by SuperValu. We needed to continue to build the brand and at the beginning of 2013 we set out to define SuperValu’s purpose and differentiate the brand in the long term. The resulting ADFX award-winning ‘We Believe’ campaign in 2013 allowed us to organise our communications under three key brand pillars: local, quality and value.

Our 2015 campaign needed to build on this success and help us to take the lead in the category, something we had been close to for a while.

Commercial objectives

- Reclaim the number one position in Ireland

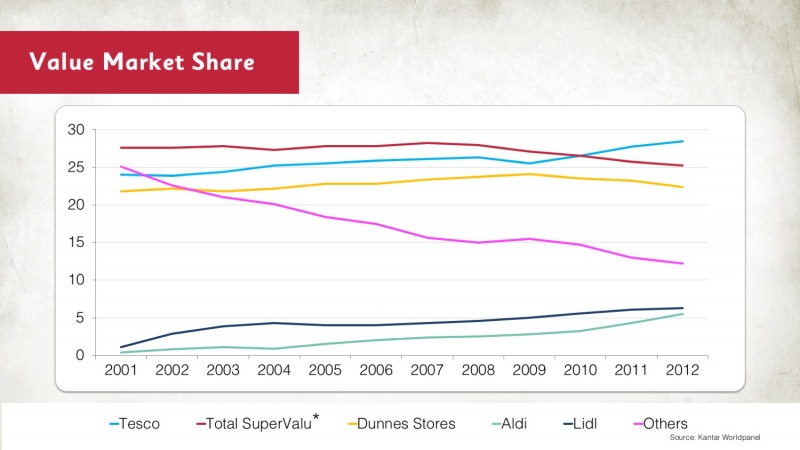

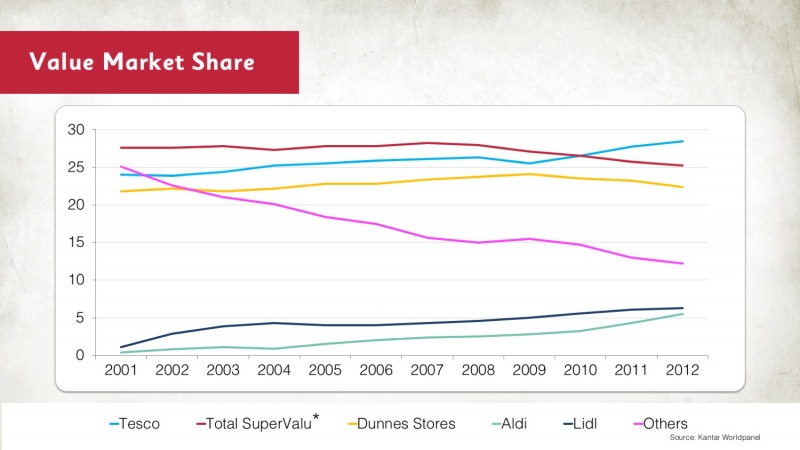

See Figure 1. Value Market Share

*Total SuperValu is the combined share of SuperValu and Superquinn before they joined forces in 2014

Since 2010, Tesco had been stealing our share and the discounters were growing at an alarming rate. We could either lie down and take it or stand up and fight back.

In 2015, winning the battle for market share had become even more of a mission. We had been neck in neck with Tesco since the SuperValu takeover, but there was a climate of constant jostling for position and we now needed to take the lead and then consolidate that leadership.

- Increase Sales

As part of the 2015 campaign, our sales target for overall sales was +1.8%.

- Increase average spend and (4) drive footfall

We needed to increase average spend per basket and drive footfall with new segments.

Marketing objectives

While the ‘We Believe’ campaign had reflected the brand position and its point of view from the inside out, SuperValu now needed to forge a stronger emotional connection with its consumers and win their hearts and minds if they were to achieve their number one position.

- We were given a specific target audience objective – increase our share of Premium Professionals and Quality Families and win new Dublin shoppers.

In 2015, a new segmentation study from Musgraves identified a number of important segments for SuperValu, Premium Professionals (22% of the population) and Quality Families (21%). We needed to increase share of spend with these groups as they are the most profitable for the business and recruit new shoppers from other segments.

We also needed to recruit new shoppers from Dublin. Given the brand’s historic weakness in the Dublin region, this would be a significant measure of success for SuperValu.

- Sustain SuperValu’s brand metrics

Since the recession, the threat of discounters meant that a number of key brand metrics were under pressure as SuperValu either struggled to hold off competitor gains or was in decline. To achieve greater customer loyalty, we needed to continue to improve brand metrics in each of the key brand priority areas – Value, Quality and Local. However, as quality has been redefined by the discounters, our quality credentials - previously a strong point of differentiation for the brand – were being challenged, although we were the leading supermarket in Range, Quality and Local.

The Task

SuperValu’s ambitions have always gone way beyond being an indigenous supermarket chain across Ireland. Ultimately, SuperValu’s long term ambition was to reclaim their position as the number one supermarket in Ireland.

Over the past three years, we have had a number of strategic tasks to achieve before we could get there, in order to strengthen the brand. At times this was made harder by the commercial environment we were operating in.

Ireland was in the middle of a recession when we launched our ‘Say Hello’ campaign. The discounters were popping up in every town and the whole category as we knew it had exploded. This campaign was all about value. Having a strong own brand offering could allow us to grow sales and deliver a higher profit margin. Having a really strong own brand range helped us grow and maintain customer loyalty.

This campaign won three ADFX awards including the Grand Prix and two Gold awards in 2012.

Our 2014 campaign ‘We Believe’ was all about further strengthening our brand and building equity. SuperValu had a lot to talk about. As a big brand with national presence, there is a huge amount of activity such as tactical and price-led communications, NPD and food leadership, local and national sponsorships, supplier development and local initiatives.

But with such an array of initiatives, the brand sometimes struggled to clearly portray the impact of the collective. They needed a common thread to tie these brand priorities together.

‘We Believe’ allowed us to organise our communications under three strategic pillars: Local, Quality and Value. It allowed us to talk about our local credentials and sponsorships such as Tidy Towns and GAA. It allowed us to tell a quality story through our top tier own brand range Signature Tastes and our SuperValu range. And it allowed us to continue to convince on Value.

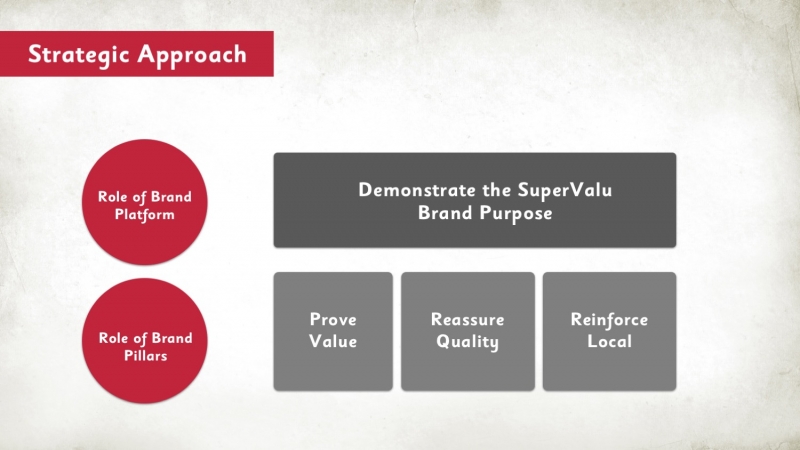

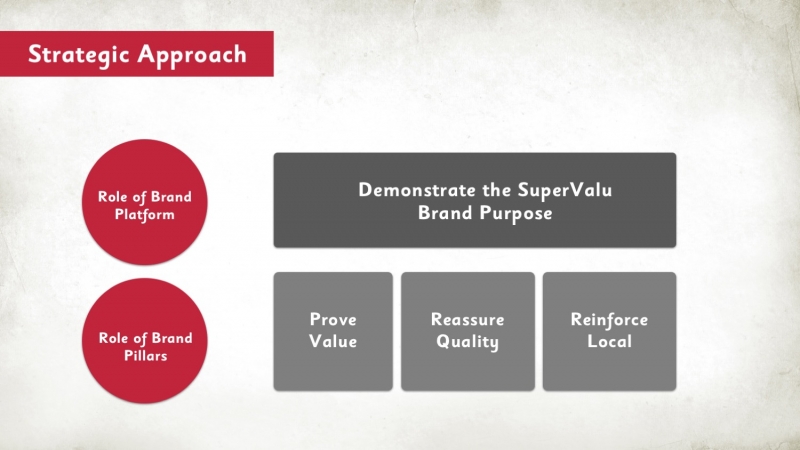

Figure 2. Strategic Approach

Having strengthened the brand successfully and lived through the acquisition of Superquinn and all the upheaval that entailed for consumers, 2015 was the year that we needed to really take a leadership position and step up.

A focus on quality was needed to set ourselves ahead of competitors. We had never made a big quality play or really opened the conversation with consumers as we had been busy building our brand, but we realised our 2015 campaign needed to really excite and engage Irish consumers if we were to get to our number one position.

Worryingly, we were being outspent by our competitors, particularly by Lidl and Aldi who were investing high levels of media spending. As a result, they were seeing big shifts in brand image metrics.

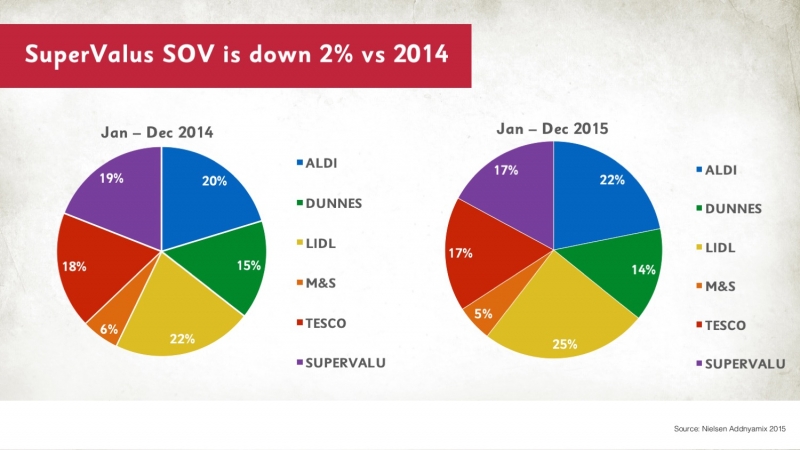

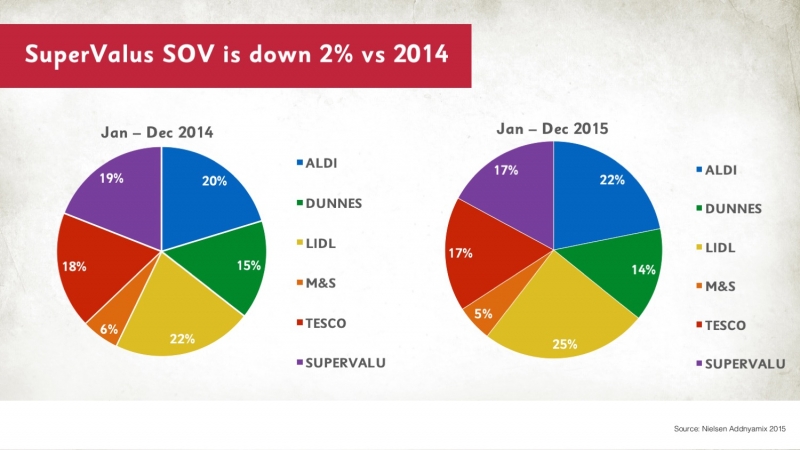

Figure 3 SuperValu SOV is down

Our final big hurdle was to win in Dublin. There was a lack of familiarity with SuperValu in Dublin and many Dublin consumers still perceived the retailer as a small supermarket or a large convenience store retailer. Consumers from previously owned Superquinn stores were an even tougher audience to convert. Extensive qualitative research with these groups showed that for SuperValu to succeed in Dublin, they would need to understand their Dublin consumer and brand neighbourhood, and improve their stores and their offering in Dublin.

Figure 4 Brand Image – Main Shopping Dub vs. Outside Dub

The Strategy

With Lidl, Aldi and Tesco becoming more Irish than the Irish themselves, we knew we needed to move away from the pack and the continuous promotional activity in the category, and put the customer back at the heart of our communications.

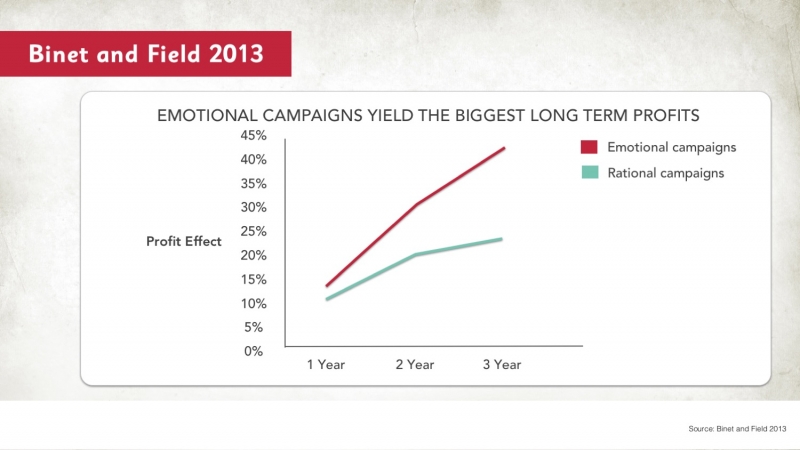

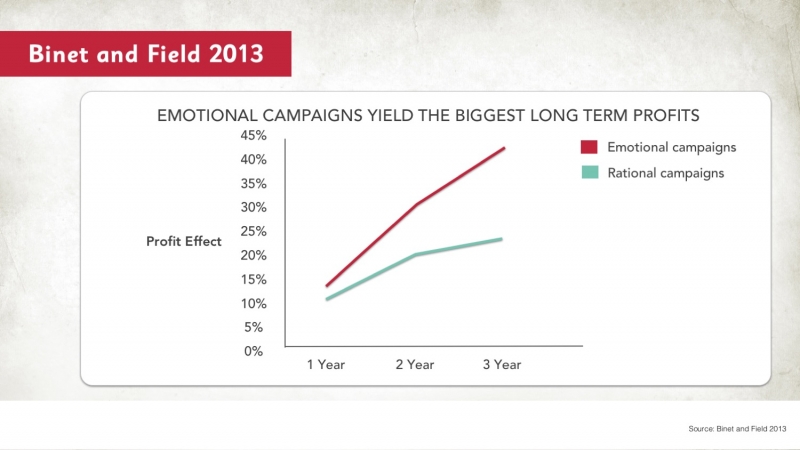

Supervalu’s brand essence ‘Real Food, Real People’ and the ‘We Believe’ campaign reflected our brand position and our point of view from the inside out. We needed to stay true to our roots and what we believed in, but we also needed to forge a stronger emotional connection with our customers and open the conversation. We were familiar with Les Binet’s 2013 research and knew we needed to dial up the emotion in our communications.

Figure 5 Binet & Field 2013

We needed to embark on a campaign of engagement.

Qualitative research with Premium Professionals and Quality Families told us that the professionals did not feel like SuperValu was a brand for them. They were never featured in previous communications and the brand didn’t reflect their lifestyle or what was important to them. Quality Families were not that familiar with the brand and seemed confused about the SuperValu brand personality and offering.

However, research also revealed that both groups shared a number of similarities. They valued fresh, quality produce and were motivated by healthy living.

In planning, we asked people in the agency to send us a paragraph and a short video of their favourite meal of the week, cooking or talking about it. For Dave, a Premium Professional, it was about spending a Saturday afternoon cooking for friends that night. For Liz, it was about cooking for the family on a Sunday, doing a proper roast and easing her working mother guilt. Cooking and sharing food was key to family occasions and a big part of people’s social lives. We put together a mood edit for our creative teams.

We needed to harness the idea that now, more than ever, food is bringing people together. This was initially a recessionary behaviour but it is one we have held onto. At its most emotional, SuperValu was part of this and we wanted to reflect this in our new campaign.

Being Irish has always been about the fun that happens when people come together. What we were seeing now was that these occasions involved more emphasis on good quality food and wine as a result of our increased appetite for travelling and eating out.

We realised we could differentiate ourselves by reminding people what was really important – coming together with family and friends and the experience of preparing, cooking and sharing a meal with all of the fun and highs and lows which that can involve.

In order to have a place at the table, we realised we needed to stop talking about ourselves. We needed to create a programme of sharing that would capitalise on the consumer behaviour of online food research and social sharing and facilitate that conversation as a brand.

The Idea

With these insights, we went back to our brand essence of ‘Real Food, Real People.’

SuperValu are passionate about good food and we decided to create a highly participative campaign inviting consumers to share what they do with the best quality Irish food. We would provide a rich source of inspiration and practical ideas for consumers so that they could pay an idea in or take one out.

The campaign platform ‘Good Food Karma’ was born.

With our media partner Starcom, a large-scale advertising campaign was developed with digital at the heart of it. Communications featured real people and families and showed the benefits of cooking and enjoying time together over food. They reflected the reality, the chaos and the joy of families and friends preparing, cooking and enjoying great food together.

30_GoodFoodKarmaLaunchRadio.mp3

The Good Food Karma campaign was designed to roll out across the year with different executions focusing on key quality offerings within the business: Better Beef, Quality Own Brand range and the Food Academy programme. This drove the breadth of the quality offering from SuperValu. A heavyweight ATL campaign was launched across TV, outdoor, radio and print, encouraging people to go online to share or be inspired with recipes through the Good Food Karma hub and on social media. A TV campaign reinforced with large format outdoor was central to reaching people and prompting them to share. We created a bespoke hashtag #GoodFoodKarma across social channels, encouraging customers to share their inspiration and engage in conversation around food.

We had two objectives for digital media within our campaign; broad awareness (particularly with Premium Professionals who are large consumers of all things digital) and using the channel to maximise engagement with our campaign. Digital awareness was led by large format display and rich media formats on desktop, mobile and tablet across the campaign.

Social Media

Social media would allow us to not only to drive engagement but to drive the adoption of #goodfoodkarma. With dwindling attention spans on video content, we leveraged this by developing a short-form video strategy which guaranteed awareness and engagement at the same time. Recipes were short to allow people to instantly consume a brand message with links driving further through to the brand website.

Content Partners

Affinity with what SuperValu were doing could be built through content partnerships with trusted digital brands. We knew that these channels would be the best environment to build engagement as they know their audiences and can write content that appeals to them.

Mobile

With premium professionals as the core target for digital, we knew that mobile was key. We also knew that mobile was an all-day companion for them and could complement the level of awareness offered by TV.

Mobile & tablet was 35% of our display media spend and was up-weighted in the evening, while tablet was a particular focus for delivery of media impressions at the weekend. We mapped delivery of mobile impressions to focus on the peak time in front of the TV (6pm – 11.30pm) to ensure that we were present while our high-reaching TV ads ran, maximising potential for engagement.

Public Relations

PR played a significant role in supporting all ATL initiatives throughout the duration of the campaign with events such as the Good Food Karma Arena at the National Ploughing Championships and a partnership with The Ryan Tubridy Show to launch the Home Truths report, with David Coleman kick-starting the #GoodFoodKarma conversation. This culminated with Kevin Dundon helping the winner host their Good Food Karma Circle during a live OB from their kitchen table.

SuperValu’s ambition of creating great moments and championing a social movement would ultimately be measured in social engagement and increases in organic traffic.

To provide for this, we clearly established the key food moments, such as Easter, summer and Christmas, most appropriate to engage with the target audiences, and regularly monitored engagement for continual optimisation to ensure brand advocacy was at the forefront of our interactions with the customer.

The Results

1. We achieved our objective of reclaiming our position as the No.1 retailer in Ireland and we have maintained it.

- The 2012 Hello campaign achieved a 0.8% growth in market share, bucking the trend as the total grocery market was in 0.5% decline.

- With the We Believe campaign, Nielsen tracking shows that prior to launch, market-share growth was tracking at +0.5%. In the post-campaign period this increased to +1.7%.

- SuperValu achieved the number one market share spot in April 2015 just as we launched Good Food Karma. Disappointingly, we lost our position very quickly again to Tesco. However, what the category TVR share of voice figures show is that Tesco dramatically increased their spend in April, May and August that year, which may have contributed to our loss. We grew our share of the market to a leadership position by 2.5% in November, and by January we had 25%, which we have maintained (Kantar Worldpanel).

2. We exceeded our sales target, achieving sales of +2% April – December 2015

The Good Food Karma campaign has been extremely effective at driving overall SuperValu sales with sales growth of +4% evident in the first two weeks of the campaign compared to the same period the previous year, and a 5% yoy increase at Christmas, winning Christmas in the retail category (Musgraves).

SuperValu achieved retail sales of €2.6 billion for 2015, which it has described as a ‘new milestone’ for the brand, representing an overall annual sales increase of 2%, which represents an increase of €51.6 million (Musgraves).

Our Good Food Karma campaign for Food Academy resulted in 30% sales increase of Food Academy produce during the campaign period (Musgraves).

3. Average spend increased

Over the 12-week period that Good Food Karma launched, we saw an increase in the average spend of our customers by 3% - from €18.50 to €19.50. This is significant when you consider we have an average of 12,000 transactions per store per week in over 223 stores. For the 12 weeks subsequent to this, we maintained that average spend uplift.

4. We increased footfall.

SuperValu gained 60,000 new shoppers in 2015. We launched Good Food Karma in week 17 of 2015. Specifically within that week of launch, we saw a 4.35% increase in average footfall.

Marketing effectiveness

5. We increased penetration with key segments

SuperValu made strong gains with Premium Professionals.

We have significantly gained Premium Professional shoppers. We have 20.5% more of these shoppers at year end (+ 30k shoppers). The other big driver of segment growth comes from Health & Wellbeing (+4%) and Quick and Easy Family (+16%).

We have gained in NPS scores with Quality Families but this has not yet translated to segment growth. This remains a key focus for 2016.

Dublin Shoppers

In total for the whole Irish market, we gained 60,000 shoppers across the period of the campaign. SuperValu’s Dublin growth is 4.5%, which equates to 19,000 net new shoppers in Dublin over the period of the campaign.

6. We sustained SuperValu’s brand metrics

Dublin scores are up across Price, Range, and Quality for ‘Fresh Fruit & Veg’ and ‘Fresh Meat’ (Red C January 2016).

SuperValu is maintaining the gains made on brand image in Dublin following the Christmas period. Above average February scores for overall brand image suggest this positive position will be maintained over the coming months (March 2016 Red C).

SuperValu increased brand affinity with consumers; ‘Is a store for people like me’ rose from 22 to 25 (March-December 2015, Red C).

The role for communications

Red C tracking shows Good Food Karma advertising had the highest awareness of any retailer throughout 2015 despite our SOV being lower than competitors (Red C January 2016).

Good Food Karma performed very well in tracking with a star rating of 71 (Retail norm 68) and a future desire score of 82 (Retail norm 75). SuperValu’s Christmas advertising was a huge success with the TV Brand Ad receiving a score of 78, smashing through RED Star Norm scores (57) and Red Star Retail Norms

(69). Other TV executions such as Food Academy also performed very well (72) with strong emotional and rational impact noted and future desire score of 83 (Retail norm 75).

At least 92% of the adult population in Ireland saw our launch ads on TV over the 5 weeks at least once, with a further 1 million impressions on VOD.

Combined with this, a total of 62% of the 25-44-year-old population saw our outdoor creative at least once – reinforcing our clear call to action to go online and ‘Find your Good Food Karma.’

Our objective to increase organic traffic to the food pages on SuperValu.ie by 20% was smashed, seeing a 44% increase vs the same period last year.

Digital results

- Traffic to the site increased by +243% from Social Media

- + 100% increase in traffic to food pages on SV.ie

- 2 million video views of GFK content on SV site

- Seven times industry average engagement rate on Facebook

- 14,500 #goodfoodkarma mentions

- 450,000 views of the GFK Christmas ad on social and YouTube (22,000 views on Christmas Day alone)

Total PR value of the campaign was €738,181 (Reputations Agency).

Discounting other factors

Did anything else from SuperValu launch at the same time?

Nothing significant.

Did SuperValu increase its use of promotions?

In a price-sensitive market, all retailers have increased their use of promotions over the last few years. However, SuperValu did not heavily discount their products relative to competitors.

Did ‘Good Food Karma’ benefit from higher media investment than Tesco and its competitors?

No, SuperValu achieved higher advertising recall levels with a comparably smaller budget.

Estimating net profit and ROMI

Unfortunately, we do not have a ROMI figure for the ‘Hello’ Campaign in 2012.

However, the 2014 ‘We Believe’ campaign achieved a ROMI of 130%

Calculating ROMI for Good Food Karma:

Incremental sales from April to December 2015:

Incremental sales = X

Net profit:

Incremental Sales – Total Margin X% = X

ROMI:

Net profit / Total x 100 = 212%

The return on marketing investment was 212%, which is hugely significant given the challenges we faced in such a competitive category.

The Impact

We have already seen that consumer perceptions and affinity with the brand have improved post-launch of ‘Good Food Karma.’

Red C data from March 2014 recorded an increase in SuperValu’s Net Promoter Score from 26 in Dec 2013 to 31 in March 2014 post ‘We Believe’ campaign. This score rose to 32 in August 2015 and has been maintained at 32 into 2016, indicating that the impact of the new campaign continues to affect shoppers and shape attitudes towards the brand.

It is also worth noting that we see stronger NPS scores amongst Health and Wellbeing (+23) and Quality Families (+13) segments (Red C May – October 2015).

Recent tracking indicates that we have started to convince our more discerning and less familiar Dublin shopper on SuperValu’s Value credentials and the brand has made great traction in convincing this shopper on almost all other brand image scores, particularly around quality. Quality meat, fruit & veg continue to see increases. The growth we saw at the end of last year has been maintained in Dublin with further growth noted in sourcing products with care, and scores for sourcing food locally and playing an active role in the community continue to increase.

Given the brand’s historic weakness in the Dublin region, this is a significant measure of success for SuperValu and suggests that the hard-to-please Dublin shopper is warming to the brand.

But it is not just a shift in consumer behaviour which we have witnessed.

The Good Food Karma campaign has been something for SuperValu as an organisation to get behind. They are now on a mission to ‘Get Ireland Cooking’ and to become the retailer most associated with food inspiration. This is a distinctive position in the market and will no doubt continue to strengthen their position.

New Learnings

- SuperValu learning – in a globalised world, a local brand can't afford to rest on its laurels. They need to continually test and learn and reinvent and improve. SuperValu succeeded by finding the real role of their brand in people's lives.

- Media learning – the Good Food Karma campaign was a brand response but not in the way that we used to know it. We were indirectly promoting sales by inviting people to cook more and share their recipes and ideas.

Summary

This paper proves the long-term effectiveness of three communications campaigns for SuperValu over a four-year period. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation. SuperValu converted a hard-to-please Dublin consumer who was grieving the loss of another supermarket, and moved away from the dogfight in the category to find a unique position in the market that started a conversation with Irish consumers around food and got people cooking.

This is a story about long term effectiveness. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation.

SuperValu was founded in 1979 with a base of just 16 stores, mainly in Munster. While they had grown to 182 stores by 2004, and acquired Superquinn (another Irish retailer) in 2011, they were a retailer with two speeds, an urban speed and a rural speed.

The urban speed was still reeling from the Superquinn takeover, when stores were rebranded to SuperValu in 2014. Superquinn had a more premium brand perception, much closer to the Waitrose proposition in the UK. Consumers were in a state of chassis as they felt they were paying convenience store prices in large supermarkets and were unfamiliar with the brand and mistrustful of its quality.

The rural speed was entirely different. SuperValu stores were at the centre of every community in Ireland. They were seen as a retailer with a heart, they looked after their own, and their rural consumers already knew they were a quality retailer who supported local producers and offered good value for money.

To further complicate the background to this story, Tesco has been present in Ireland since 1997, when it took over another major Irish supermarket chain, Quinnsworth. Between this inevitable drift of the UK retailer to our shores, and the arrival of the discounters in Ireland, the category as we knew it had changed forever and all bets were off.

In 2012, we began our journey to number one by launching the SuperValu own brand range with the ADFX Grand Prix-winning ‘Hello’ campaign. This allowed us to successfully convince our audiences of the value offered by SuperValu. We needed to continue to build the brand and at the beginning of 2013 we set out to define SuperValu’s purpose and differentiate the brand in the long term. The resulting ADFX award-winning ‘We Believe’ campaign in 2013 allowed us to organise our communications under three key brand pillars: local, quality and value.

Our 2015 campaign needed to build on this success and help us to take the lead in the category, something we had been close to for a while.

Commercial objectives

- Reclaim the number one position in Ireland

See Figure 1. Value Market Share

*Total SuperValu is the combined share of SuperValu and Superquinn before they joined forces in 2014

Since 2010, Tesco had been stealing our share and the discounters were growing at an alarming rate. We could either lie down and take it or stand up and fight back.

In 2015, winning the battle for market share had become even more of a mission. We had been neck in neck with Tesco since the SuperValu takeover, but there was a climate of constant jostling for position and we now needed to take the lead and then consolidate that leadership.

- Increase Sales

As part of the 2015 campaign, our sales target for overall sales was +1.8%.

- Increase average spend and (4) drive footfall

We needed to increase average spend per basket and drive footfall with new segments.

Marketing objectives

While the ‘We Believe’ campaign had reflected the brand position and its point of view from the inside out, SuperValu now needed to forge a stronger emotional connection with its consumers and win their hearts and minds if they were to achieve their number one position.

- We were given a specific target audience objective – increase our share of Premium Professionals and Quality Families and win new Dublin shoppers.

In 2015, a new segmentation study from Musgraves identified a number of important segments for SuperValu, Premium Professionals (22% of the population) and Quality Families (21%). We needed to increase share of spend with these groups as they are the most profitable for the business and recruit new shoppers from other segments.

We also needed to recruit new shoppers from Dublin. Given the brand’s historic weakness in the Dublin region, this would be a significant measure of success for SuperValu.

- Sustain SuperValu’s brand metrics

Since the recession, the threat of discounters meant that a number of key brand metrics were under pressure as SuperValu either struggled to hold off competitor gains or was in decline. To achieve greater customer loyalty, we needed to continue to improve brand metrics in each of the key brand priority areas – Value, Quality and Local. However, as quality has been redefined by the discounters, our quality credentials - previously a strong point of differentiation for the brand – were being challenged, although we were the leading supermarket in Range, Quality and Local.

SuperValu’s ambitions have always gone way beyond being an indigenous supermarket chain across Ireland. Ultimately, SuperValu’s long term ambition was to reclaim their position as the number one supermarket in Ireland.

Over the past three years, we have had a number of strategic tasks to achieve before we could get there, in order to strengthen the brand. At times this was made harder by the commercial environment we were operating in.

Ireland was in the middle of a recession when we launched our ‘Say Hello’ campaign. The discounters were popping up in every town and the whole category as we knew it had exploded. This campaign was all about value. Having a strong own brand offering could allow us to grow sales and deliver a higher profit margin. Having a really strong own brand range helped us grow and maintain customer loyalty.

This campaign won three ADFX awards including the Grand Prix and two Gold awards in 2012.

Our 2014 campaign ‘We Believe’ was all about further strengthening our brand and building equity. SuperValu had a lot to talk about. As a big brand with national presence, there is a huge amount of activity such as tactical and price-led communications, NPD and food leadership, local and national sponsorships, supplier development and local initiatives.

But with such an array of initiatives, the brand sometimes struggled to clearly portray the impact of the collective. They needed a common thread to tie these brand priorities together.

‘We Believe’ allowed us to organise our communications under three strategic pillars: Local, Quality and Value. It allowed us to talk about our local credentials and sponsorships such as Tidy Towns and GAA. It allowed us to tell a quality story through our top tier own brand range Signature Tastes and our SuperValu range. And it allowed us to continue to convince on Value.

Figure 2. Strategic Approach

Having strengthened the brand successfully and lived through the acquisition of Superquinn and all the upheaval that entailed for consumers, 2015 was the year that we needed to really take a leadership position and step up.

A focus on quality was needed to set ourselves ahead of competitors. We had never made a big quality play or really opened the conversation with consumers as we had been busy building our brand, but we realised our 2015 campaign needed to really excite and engage Irish consumers if we were to get to our number one position.

Worryingly, we were being outspent by our competitors, particularly by Lidl and Aldi who were investing high levels of media spending. As a result, they were seeing big shifts in brand image metrics.

Figure 3 SuperValu SOV is down

Our final big hurdle was to win in Dublin. There was a lack of familiarity with SuperValu in Dublin and many Dublin consumers still perceived the retailer as a small supermarket or a large convenience store retailer. Consumers from previously owned Superquinn stores were an even tougher audience to convert. Extensive qualitative research with these groups showed that for SuperValu to succeed in Dublin, they would need to understand their Dublin consumer and brand neighbourhood, and improve their stores and their offering in Dublin.

Figure 4 Brand Image – Main Shopping Dub vs. Outside Dub

With Lidl, Aldi and Tesco becoming more Irish than the Irish themselves, we knew we needed to move away from the pack and the continuous promotional activity in the category, and put the customer back at the heart of our communications.

Supervalu’s brand essence ‘Real Food, Real People’ and the ‘We Believe’ campaign reflected our brand position and our point of view from the inside out. We needed to stay true to our roots and what we believed in, but we also needed to forge a stronger emotional connection with our customers and open the conversation. We were familiar with Les Binet’s 2013 research and knew we needed to dial up the emotion in our communications.

Figure 5 Binet & Field 2013

We needed to embark on a campaign of engagement.

Qualitative research with Premium Professionals and Quality Families told us that the professionals did not feel like SuperValu was a brand for them. They were never featured in previous communications and the brand didn’t reflect their lifestyle or what was important to them. Quality Families were not that familiar with the brand and seemed confused about the SuperValu brand personality and offering.

However, research also revealed that both groups shared a number of similarities. They valued fresh, quality produce and were motivated by healthy living.

In planning, we asked people in the agency to send us a paragraph and a short video of their favourite meal of the week, cooking or talking about it. For Dave, a Premium Professional, it was about spending a Saturday afternoon cooking for friends that night. For Liz, it was about cooking for the family on a Sunday, doing a proper roast and easing her working mother guilt. Cooking and sharing food was key to family occasions and a big part of people’s social lives. We put together a mood edit for our creative teams.

We needed to harness the idea that now, more than ever, food is bringing people together. This was initially a recessionary behaviour but it is one we have held onto. At its most emotional, SuperValu was part of this and we wanted to reflect this in our new campaign.

Being Irish has always been about the fun that happens when people come together. What we were seeing now was that these occasions involved more emphasis on good quality food and wine as a result of our increased appetite for travelling and eating out.

We realised we could differentiate ourselves by reminding people what was really important – coming together with family and friends and the experience of preparing, cooking and sharing a meal with all of the fun and highs and lows which that can involve.

In order to have a place at the table, we realised we needed to stop talking about ourselves. We needed to create a programme of sharing that would capitalise on the consumer behaviour of online food research and social sharing and facilitate that conversation as a brand.

With these insights, we went back to our brand essence of ‘Real Food, Real People.’

SuperValu are passionate about good food and we decided to create a highly participative campaign inviting consumers to share what they do with the best quality Irish food. We would provide a rich source of inspiration and practical ideas for consumers so that they could pay an idea in or take one out.

The campaign platform ‘Good Food Karma’ was born.

With our media partner Starcom, a large-scale advertising campaign was developed with digital at the heart of it. Communications featured real people and families and showed the benefits of cooking and enjoying time together over food. They reflected the reality, the chaos and the joy of families and friends preparing, cooking and enjoying great food together.

30_GoodFoodKarmaLaunchRadio.mp3

The Good Food Karma campaign was designed to roll out across the year with different executions focusing on key quality offerings within the business: Better Beef, Quality Own Brand range and the Food Academy programme. This drove the breadth of the quality offering from SuperValu. A heavyweight ATL campaign was launched across TV, outdoor, radio and print, encouraging people to go online to share or be inspired with recipes through the Good Food Karma hub and on social media. A TV campaign reinforced with large format outdoor was central to reaching people and prompting them to share. We created a bespoke hashtag #GoodFoodKarma across social channels, encouraging customers to share their inspiration and engage in conversation around food.

We had two objectives for digital media within our campaign; broad awareness (particularly with Premium Professionals who are large consumers of all things digital) and using the channel to maximise engagement with our campaign. Digital awareness was led by large format display and rich media formats on desktop, mobile and tablet across the campaign.

Social Media

Social media would allow us to not only to drive engagement but to drive the adoption of #goodfoodkarma. With dwindling attention spans on video content, we leveraged this by developing a short-form video strategy which guaranteed awareness and engagement at the same time. Recipes were short to allow people to instantly consume a brand message with links driving further through to the brand website.

Content Partners

Affinity with what SuperValu were doing could be built through content partnerships with trusted digital brands. We knew that these channels would be the best environment to build engagement as they know their audiences and can write content that appeals to them.

Mobile

With premium professionals as the core target for digital, we knew that mobile was key. We also knew that mobile was an all-day companion for them and could complement the level of awareness offered by TV.

Mobile & tablet was 35% of our display media spend and was up-weighted in the evening, while tablet was a particular focus for delivery of media impressions at the weekend. We mapped delivery of mobile impressions to focus on the peak time in front of the TV (6pm – 11.30pm) to ensure that we were present while our high-reaching TV ads ran, maximising potential for engagement.

Public Relations

PR played a significant role in supporting all ATL initiatives throughout the duration of the campaign with events such as the Good Food Karma Arena at the National Ploughing Championships and a partnership with The Ryan Tubridy Show to launch the Home Truths report, with David Coleman kick-starting the #GoodFoodKarma conversation. This culminated with Kevin Dundon helping the winner host their Good Food Karma Circle during a live OB from their kitchen table.

SuperValu’s ambition of creating great moments and championing a social movement would ultimately be measured in social engagement and increases in organic traffic.

To provide for this, we clearly established the key food moments, such as Easter, summer and Christmas, most appropriate to engage with the target audiences, and regularly monitored engagement for continual optimisation to ensure brand advocacy was at the forefront of our interactions with the customer.

1. We achieved our objective of reclaiming our position as the No.1 retailer in Ireland and we have maintained it.

- The 2012 Hello campaign achieved a 0.8% growth in market share, bucking the trend as the total grocery market was in 0.5% decline.

- With the We Believe campaign, Nielsen tracking shows that prior to launch, market-share growth was tracking at +0.5%. In the post-campaign period this increased to +1.7%.

- SuperValu achieved the number one market share spot in April 2015 just as we launched Good Food Karma. Disappointingly, we lost our position very quickly again to Tesco. However, what the category TVR share of voice figures show is that Tesco dramatically increased their spend in April, May and August that year, which may have contributed to our loss. We grew our share of the market to a leadership position by 2.5% in November, and by January we had 25%, which we have maintained (Kantar Worldpanel).

2. We exceeded our sales target, achieving sales of +2% April – December 2015

The Good Food Karma campaign has been extremely effective at driving overall SuperValu sales with sales growth of +4% evident in the first two weeks of the campaign compared to the same period the previous year, and a 5% yoy increase at Christmas, winning Christmas in the retail category (Musgraves).

SuperValu achieved retail sales of €2.6 billion for 2015, which it has described as a ‘new milestone’ for the brand, representing an overall annual sales increase of 2%, which represents an increase of €51.6 million (Musgraves).

Our Good Food Karma campaign for Food Academy resulted in 30% sales increase of Food Academy produce during the campaign period (Musgraves).

3. Average spend increased

Over the 12-week period that Good Food Karma launched, we saw an increase in the average spend of our customers by 3% - from €18.50 to €19.50. This is significant when you consider we have an average of 12,000 transactions per store per week in over 223 stores. For the 12 weeks subsequent to this, we maintained that average spend uplift.

4. We increased footfall.

SuperValu gained 60,000 new shoppers in 2015. We launched Good Food Karma in week 17 of 2015. Specifically within that week of launch, we saw a 4.35% increase in average footfall.

Marketing effectiveness

5. We increased penetration with key segments

SuperValu made strong gains with Premium Professionals.

We have significantly gained Premium Professional shoppers. We have 20.5% more of these shoppers at year end (+ 30k shoppers). The other big driver of segment growth comes from Health & Wellbeing (+4%) and Quick and Easy Family (+16%).

We have gained in NPS scores with Quality Families but this has not yet translated to segment growth. This remains a key focus for 2016.

Dublin Shoppers

In total for the whole Irish market, we gained 60,000 shoppers across the period of the campaign. SuperValu’s Dublin growth is 4.5%, which equates to 19,000 net new shoppers in Dublin over the period of the campaign.

6. We sustained SuperValu’s brand metrics

Dublin scores are up across Price, Range, and Quality for ‘Fresh Fruit & Veg’ and ‘Fresh Meat’ (Red C January 2016).

SuperValu is maintaining the gains made on brand image in Dublin following the Christmas period. Above average February scores for overall brand image suggest this positive position will be maintained over the coming months (March 2016 Red C).

SuperValu increased brand affinity with consumers; ‘Is a store for people like me’ rose from 22 to 25 (March-December 2015, Red C).

The role for communications

Red C tracking shows Good Food Karma advertising had the highest awareness of any retailer throughout 2015 despite our SOV being lower than competitors (Red C January 2016).

Good Food Karma performed very well in tracking with a star rating of 71 (Retail norm 68) and a future desire score of 82 (Retail norm 75). SuperValu’s Christmas advertising was a huge success with the TV Brand Ad receiving a score of 78, smashing through RED Star Norm scores (57) and Red Star Retail Norms

(69). Other TV executions such as Food Academy also performed very well (72) with strong emotional and rational impact noted and future desire score of 83 (Retail norm 75).

At least 92% of the adult population in Ireland saw our launch ads on TV over the 5 weeks at least once, with a further 1 million impressions on VOD.

Combined with this, a total of 62% of the 25-44-year-old population saw our outdoor creative at least once – reinforcing our clear call to action to go online and ‘Find your Good Food Karma.’

Our objective to increase organic traffic to the food pages on SuperValu.ie by 20% was smashed, seeing a 44% increase vs the same period last year.

Digital results

- Traffic to the site increased by +243% from Social Media

- + 100% increase in traffic to food pages on SV.ie

- 2 million video views of GFK content on SV site

- Seven times industry average engagement rate on Facebook

- 14,500 #goodfoodkarma mentions

- 450,000 views of the GFK Christmas ad on social and YouTube (22,000 views on Christmas Day alone)

Total PR value of the campaign was €738,181 (Reputations Agency).

Discounting other factors

Did anything else from SuperValu launch at the same time?

Nothing significant.

Did SuperValu increase its use of promotions?

In a price-sensitive market, all retailers have increased their use of promotions over the last few years. However, SuperValu did not heavily discount their products relative to competitors.

Did ‘Good Food Karma’ benefit from higher media investment than Tesco and its competitors?

No, SuperValu achieved higher advertising recall levels with a comparably smaller budget.

Estimating net profit and ROMI

Unfortunately, we do not have a ROMI figure for the ‘Hello’ Campaign in 2012.

However, the 2014 ‘We Believe’ campaign achieved a ROMI of 130%

Calculating ROMI for Good Food Karma:

Incremental sales from April to December 2015:

Incremental sales = X

Net profit:

Incremental Sales – Total Margin X% = X

ROMI:

Net profit / Total x 100 = 212%

The return on marketing investment was 212%, which is hugely significant given the challenges we faced in such a competitive category.

We have already seen that consumer perceptions and affinity with the brand have improved post-launch of ‘Good Food Karma.’

Red C data from March 2014 recorded an increase in SuperValu’s Net Promoter Score from 26 in Dec 2013 to 31 in March 2014 post ‘We Believe’ campaign. This score rose to 32 in August 2015 and has been maintained at 32 into 2016, indicating that the impact of the new campaign continues to affect shoppers and shape attitudes towards the brand.

It is also worth noting that we see stronger NPS scores amongst Health and Wellbeing (+23) and Quality Families (+13) segments (Red C May – October 2015).

Recent tracking indicates that we have started to convince our more discerning and less familiar Dublin shopper on SuperValu’s Value credentials and the brand has made great traction in convincing this shopper on almost all other brand image scores, particularly around quality. Quality meat, fruit & veg continue to see increases. The growth we saw at the end of last year has been maintained in Dublin with further growth noted in sourcing products with care, and scores for sourcing food locally and playing an active role in the community continue to increase.

Given the brand’s historic weakness in the Dublin region, this is a significant measure of success for SuperValu and suggests that the hard-to-please Dublin shopper is warming to the brand.

But it is not just a shift in consumer behaviour which we have witnessed.

The Good Food Karma campaign has been something for SuperValu as an organisation to get behind. They are now on a mission to ‘Get Ireland Cooking’ and to become the retailer most associated with food inspiration. This is a distinctive position in the market and will no doubt continue to strengthen their position.

- SuperValu learning – in a globalised world, a local brand can't afford to rest on its laurels. They need to continually test and learn and reinvent and improve. SuperValu succeeded by finding the real role of their brand in people's lives.

- Media learning – the Good Food Karma campaign was a brand response but not in the way that we used to know it. We were indirectly promoting sales by inviting people to cook more and share their recipes and ideas.

This paper proves the long-term effectiveness of three communications campaigns for SuperValu over a four-year period. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation. SuperValu converted a hard-to-please Dublin consumer who was grieving the loss of another supermarket, and moved away from the dogfight in the category to find a unique position in the market that started a conversation with Irish consumers around food and got people cooking.