Cadbury Dairy Milk It's a matter of Taste

Publicis Dublin and PHD Ireland

Introduction & Background

This is the story of how a group of passionate Marketers reversed the decline of an Irish Super-brand.

Cadbury Dairy Milk (CDM), the brand with a glass and a half full of creamy milk, has been the definitive chocolate bar in Ireland since 1933 and remains so today. Produced in Coolock and Rathmore with milk from Irish cows, the brand evokes memory and nostalgia for all Irish consumers. Its ubiquity says much about the Irish consumer’s relationship with chocolate where consumption per capita is one of the highest in the world. It’s three times bigger than its nearest competitor and is the 6th biggest grocery brand in the country. Whilst Kraft (Cadbury) manufactures many other products CDM is the backbone of the Irish business, which employs 1000 people across the country. CDM is more than a bar of chocolate, it’s the heart of the Irish Kraft operation.

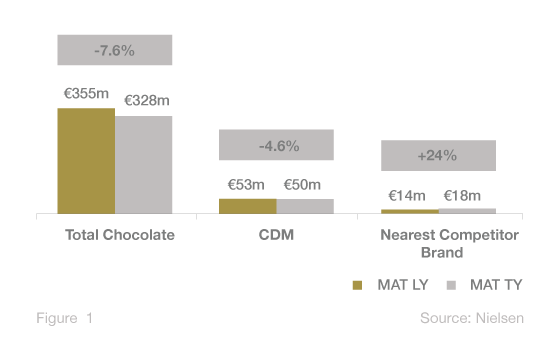

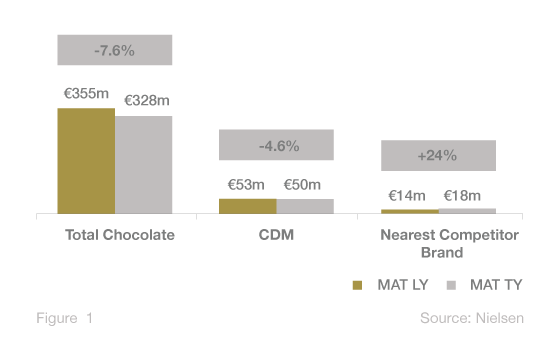

In 2010, the brand owner could see some worrying trends. CDM was losing market share and its nearest competitor was experiencing considerable growth. With 24% YoY growth (2009/10), it was the fastest growing confectionary brand. CDM’s sales had declined in the same period by 5% (Figure 1). This may sound modest but, with a brand this size, nothing is modest. 5% represents over €3m in value.

When researched, CDM was losing the battle for ‘has a great taste’ and ‘has a texture I like’. (Hall & Partners June 2010).

But how could this be? Up to this point Kraft Ireland had imported some of the world’s most famous advertising (Gorilla, Eyebrows etc) and this had created and maintained the brand’s strong affinity scores. Significantly more respondents said that CDM ‘is a brand for people like me’ than agreed with the same statement for its nearest competitor.However, it seemed like the battle was being lost at an attribute level and this was eroding market share at an alarming rate. Strangely, chocolate was no longer being defined by ‘chocolatyness’. In short, CDM had a place in people’s hearts, but not in their mouths.

The marketing department in Kraft had a fight on its hands. With share slipping away and no suitable copy available internationally, how do you convince a centralized new brand owner in Europe to invest in original creative in Ireland? Especially when the work you have been running has been lauded from D&AD to Cannes to The One Show. How do you make engaging work about brand attributes? How do you row against the tide of a category re-definition whereby ‘smooth’ chocolate was the best tasting chocolate in consumers’ eyes. How do you re-excite the public about one of the most familiar brands in the country?

Marketing Objectives

The business imperative defined the marketing objectives: We needed to reverse the decline of CDM whilst retaining margin (and revenue) and help justify an Irish operation.

Therefore the marketing objectives were as follows:

- To reverse the decline in CDM’s market share. Individual campaigns are often judged by metrics other than market share. ‘Affinity’, ‘Preference’ and many other measures can often justify a marketing decision. However, in this case, the business demanded an impact on the bottom line. This was as much about the business case for Ireland as a manufacturing base as it was about the more esoteric metrics of marketing departments.

- To re-establish CDM’s strength (its chocolaty taste) as the category standard. This would allow Kraft to dictate the game and, we hoped, would have a halo effect on the other count lines. If chocolaty taste was the category standard and Kraft owned this space, it could be leveraged for Twirl, Flake and Time Out as well as CDM.

- To win the internal battle for hearts and minds and re-assert Cadbury Dairy Milk as a pillar of the Irish operation; a brand with a future in a market with a future.

The Task

From a business point of view, we had to regain lost share and deliver value growth to the brand. This would require the activity to be the most responsive in recent history. All avenues were explored and communications was not the first port of call. The company examined all of the levers at its disposal before focusing on advertising. NPD was discussed but the costs of doing local NPD were prohibitive. And anyway, even the highest performing innovations would only yield a 0.5% market share improvement at best. Distribution was pretty much 100% and regulatory pressure was actually limiting the opportunities in the impulse channel. It was also decided that price promotion could only address the market share issue in the short term. So price promotion had to be used judiciously at the same levels as normal.

The task was further complicated by the fact that the obvious creative strategy was not the most fashionable one. In an era of Gorillas playing drums how do you convince one of the world’s most sophisticated marketing operations to eschew the world’s most famous advertising campaign to make a ‘flowing chocolate’ ad? And it wasn’t just the international colleagues who were skeptical; when you said ‘taste ad’ to the local team, they had an immediate reference in a seminal piece of creative that was produced in 1989 and had run for two decades.

Was this not a step back in time? If this goes wrong, does this not underline the naivety of a local marketing operation? In the shell-shocked, confidence-lacking Ireland of 2010, these were prescient concerns. This approach would take guts, commitment and chutzpa to execute effectively.

Added to this lack of confidence, what constitutes success? It’s not a launch. It’s high volume and relatively high value so one or two percentage points make a big difference.We needed to be careful about expectation management, defining what success would look like and focus on evaluation. What would be the point of a success that if couldn’t quantify it for the business?

This turned into as strategic a piece of communications planning as you are likely to come across. In medical parlance, this was keyhole surgery. The key to success was to define precisely where the problem lay, to build a strategy to address that specific problem and make sure that there is no collateral damage to Affinity.

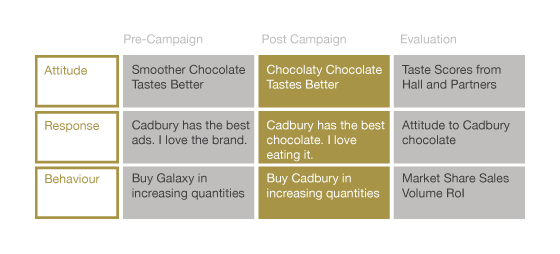

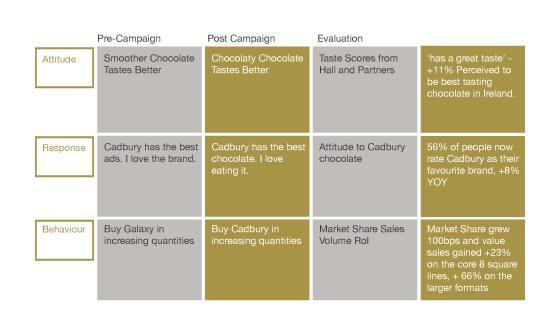

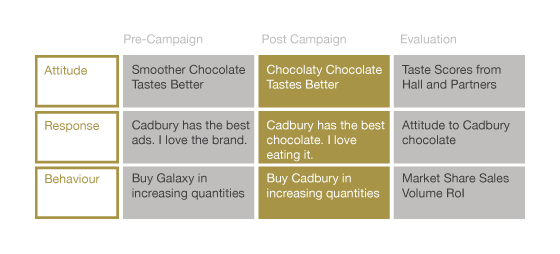

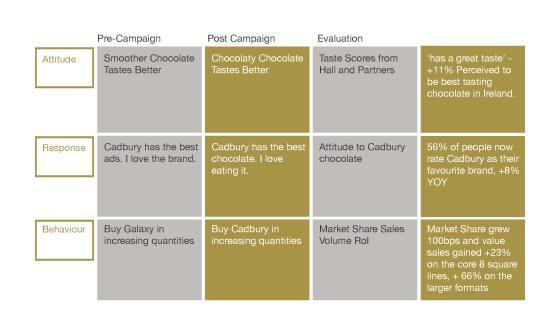

So, in summary, the vision was to re-enforce the taste credentials of Cadbury Dairy Milk, reminding consumers that CDM is the best tasting chocolate. The moves we wanted to make in Attitude, Response and Consumer Behaviour and were defined as follows:

The Strategy

In order to measure the task, we used Hall & Partners quantitative research that helped identify the drivers of taste, that gave us a benchmark for performance and that we could evaluate our activity against. We identified five drivers of brand preference:

- Has a texture I like

- Has a Great Taste

- Has a Creamy Taste

- Has the Best Ingredients

- Has a Chocolaty Taste.

At this point, CDM was losing out in three out of five drivers (texture, great taste and creamy taste). After many years of being told that smoothness was the key to great chocolate taste, consumers had bought into the concept. However, CDM still led in for “Best Ingredients” and “Chocolaty Taste”. So the answer was apparent; play to CDM’s strengths and help consumers believe that ‘great taste’ is defined by ‘best ingredients’ and ‘chocolaty-ness’, not smoothness.

In terms of the activity, we had to engage the company to play to our advantage of having a powerful marketing, sales, merchandising and agency machine, on the ground, in Ireland. When all of these functions fire together, they are a formidable force. A strong advertising campaign can galvanize the efforts of manufacturing, sales, marketing and distribution. It creates momentum and carries the company forward.

In terms of the agency relationships, we needed a team of strategists, creatives and executors working together, with absolute conviction to a concise and agreed brief. Considerable time was spent on cross agency briefing and team building to ensure this happened effectively.

The Idea

Our Idea was simple: Dramatise the joy of eating Cadbury Dairy Milk chocolate.

Consumers had been told that eating chocolate was an indulgent, solitary experience and there was some degree of guilt associated with it. We wanted to bring energy and positivity to the execution to celebrate the most chocolaty experience of them all.

Once the strategy was identified, the challenge became one of execution. In advertising short hand there are ‘brand ads’ and ‘product ads’. Accepted wisdom is that it’s brand ads that really move people. They work on a different level; a deeper level. They may be obtuse but they use art and craft to move the audience and make them connect with brands (and pay more for them) despite themselves. Sony’s ‘Colour Like No Other’, Cadbury’s drumming Gorilla, almost anything from Guinness titillates their audiences and represents the pinnacle of the craft we have chosen....some would say.

‘Product Ads’ working with the same potency, are a rarer phenomenon: They’re the journeymen communications that clients ‘make agencies make’. Maybe M&S Food or some of the Stella Artois work are exceptions but generally, these are the hard working stopgaps between the works of creative genius. What some recent campaigns did teach us however is that product imagery, done well, can be as layered and connect as deeply as some of the best brand ads. Art does not have to be the exclusive domain of the brand ad. It’s in the eye of the beholder. In this case the chocolate-eating audience. We all agreed that, in order to make a product ad that would be effective, we’d have to push the creative and enjoin the very best craftspeople in our task. No matter what the cost or logistical implications.

TV would be the main thrust of the activity. In terms of production values for the advertising, we could not compromise. We engaged, through an Irish producer, the director Jonathan Notaro from Brand New School. The techniques he had developed in photosonic photography and CG meant that we could be truly fresh in terms of execution. There were concerns however. How to control a shoot on a script that was open to such creative interpretation. How to influence a director that had a reputation as a maverick but the talent to back it up. All these factors added to the fun in the development phase.

Communication Activity

Firstly, we defined our media behavior. “Behaving like Disney and not like an FMCG” was the existent media behavior platform for Dairy Milk. A media platform that won the hearts of planners and media owners alike... In many ways, this was still relevant but it needed a twist. We needed to make people feel irresistibly tempted by bringing the same joy of the creative idea to the media communications activity. Our media behavior was defined as:

“Behaving like the Magical Chocolate Kingdom”

It was Disney again giving us inspiration. But this time, something more specific about their world: the “Magic Kingdom of Disney”. Their ability to make people step out of the real word, into the magical world (we also wanted to pull them into our chocolate world full of taste), their ability to sell the greatest story of all times (happily ever after. No guilt in there, just enjoyment) gave us endless inspiration.

Three stages were created to communicate our message more effectively

1st Stage: “Own” - Owning the best chocolate taste. Using media to denote leadership:

- Indulgent 60” TV focusing on irresistibly tempting programming for Women 16- 34.

- Confident Outdoor campaign breaking category rules. Using the largest and most indulgent formats around the country allowing us to show Dairy Milk in all its glory (including Ireland’s largest outdoor site).

- Innovating with the use of targeting data sending a personalized bar to “influencing women” in Ireland. Over 40,000 chocolate lovers received a home-delivered Dairy Milk pack creating ripples of WOM from day one of the campaign.

- Owning the streets and point-of-sales with irresistible sampling, leaving our audience desiring more Dairy Milk.

- Video-on-demand targeting chocolate occasions.

2nd Stage: “Tempt” – Tempting the individual to indulge. Using media to build tempting triggers around Points-of-Sale.

- We created “Temptation Trails” with the use of Outdoor. Simple concept (inspired by the various temptation trails created at the Magical Kingdom) but it delivered outstanding results.

- We identified where chocolate lovers shop and built trails leading to these points-of-sales, ensuring our audience was drooling by the time they stepped into the store.

- Over eight different outdoor formats were used for each Temptation Trail.

- Pioneered in Ireland with the use of intelligent mobile messaging targeting young women when they stepped into a Temptation Trail with an irresistible price offer.

- An extensive social media campaign with daily temptations and rewards “Tasty Treats”.

3rd Stage: “Multiply” - Using media to spread Dairy Milk’s taste of joy:

- Smartphones were transformed into virtual bars of Dairy Milk through “Share- a-Square” app.

- Users who shared eight squares (as the iconic Irish 8 square Dairy Milk bar) were rewarded with a free bar.

- Mouth-watering female magazine activity facilitating the download of Share-a- Square directly from the press ad.

- An owned episode in Irish version of “Apprentice” focusing on various Irish ingredients that deliver Dairy Milk’s unique taste:

- National competition to vote for the best tasting Apprentice-designed bar followed the episode.

- Interactive digital formats allowing users to cast their vote.

- Presence in-store

This singular creative strategy, a disruptive and confident media strategy and the power of an energized Cadbury sales and merchandising effort resulted in a seminal campaign, one that exceeded everyone’s expectations.

The Results

Case studies in ADFX are often littered with eye-popping effectiveness results. Doubling market share, triple figure sales growth etc. This is NOT that kind of case study. As stated at the outset, this was keyhole; the precise application of strategy to improve the health of the brand with as little trauma as possible. This was about arresting and reversing a trend. And, for those who understand that dynamics of this kind of progress in this kind of brand, the improvements are, quite simply, stunning.

If we start with the criteria we outlined at the beginning of the case

The Impact

The visuals, that were established in TV and then amplified in outdoor and instore, were designed to stimulate a visceral, physiological response in the audience. We poured over edits and debated (sometimes in a very animated manner!) the merits of each frame. The execution was layered with imagery to convey all aspects of the perfect, chocolaty, chocolate-eating experience. Imagery designed to convey mouth coating, chunkiness, the release of flavour were apparent in the visuals and this helped regain the definition of a great chocolate eating experience for CDM.

Some exciting things happened when consumers got to see the campaign. It was immediately effective in terms if its impact on taste scores. Eight weeks into the launch in September 2011, the ‘has a great taste’ scores improved by 11% v March 2011, ‘has the best ingredients’ by 7% and ‘is really moreish’ by 4% (Figure 3) . This was way more that we could have hoped for in a short period of time.

What was equally exciting was the effect that the campaign had on engagement scores. Repetoire consideration reached the highest recorded level ever for CDM as did H& P measures for ‘Salience’, ‘Persuasion’ and ‘Involvement’.

The campaign became a bit of a Youtube sensation going on to become one of the top 5 viewed ads of the year. Facebook fans quadrupled and brand preference scores reached their highest levels on record with 53% of consumers answering that they ‘buy nowadays”. Not bad for a ‘product’ ad!

All very interesting, but what about the bottom line? To give this some context, for a mature brand such as this, a successful NPD launch (the most potent weapon for gaining market share) can deliver a 0.5% increase. This campaign delivered a 1% increase in total chocolate, which set a new record for share. Internal sales grew by 17% and sales improved by between +30bps (for the 8 square format) to 1000bps for the large formats.

The media performance was hugely efficient, as outlined below:

- Outdoor and TV ad recognition scores were quite sensational. TV was 4 times more efficient than “Gorilla” (H&P). This was achieved with 30% less investment than in Gorilla.

- Taste of Joy outperformed the results achieved by Gorilla:

- Bought last 7 days. Gorilla 20% Vs. Taste 26%

- Buy Nowadays. Gorilla 44% Vs. Taste 53%

- Brand Preference. Gorilla 34% Vs. Taste 38%

Temptation Trails delivered a 40% sales increase in Convenience Stores and a 225% increase in Grocery Retail stores.

Media Investment was €530k for September and €350k Feb

Importantly, the success of the campaign was not confined to outside the business. The activity proved that the local marketing team could plan and execute campaigns outside of the international system to the benefit of the business here. The ‘Taste’ campaign of 2011 has become a template for the company in Ireland and an example of great marketing throughout the Kraft/Cadbuy organization internationally. Greta Hammel, Marketing Manager (Chocolate) Ireland commented “when I present in [Kraft] Zurich to the category heads now, I can speak with the credibility and conviction of a marketer who’s delivered a best-in-class campaign. I think it helps me to make a more compelling argument and leaves me and my team [to an extent] in charge of our own destiny”.

As stated from outset this campaign was about arresting a 5% decline in Cadbury Dairy Milk sales.

The investment in the campaign across September and February was €1.2 million on media and production. We achieved payback in two ways:

- We arrested a decline. Even if sales had declined by half the previous years rate (2.5%) this amounted to a saving of €1.3 million for Kraft.

- In addition to arresting the decline we actually increased value sales by 3% (YTD market data April 2012). This 3% increase is valued at €1.6 million annually.

So in summary the short term (one year) payback on our €1.2 million investment is projected to be €2.9 million and more importantly we now have a brand with momentum that should continue to regain share from Galaxy.

Other influencers:

Distribution remained static and Price Promotions were run to the same schedule as the previous years, so neither of these factors could account for this growth.

In a broader context, the impact of the campaign continues to be felt on the business in Ireland. The fact the local team can identify and remedy issues before they become debilitating. The fact that marketing can have a fundamentally positive effect on the business and can strengthen the argument for de-centralised manufacturing. The depth that this kind of activity can bring to a brand that, if ignored, could just slip into a globalized homogeny and lose the connection to the consumer that makes it a high value super-brand in the first place.

Not bad for a product ad. Not bad for a little marketing department in a little country. Not a bad template for the future.

* Sources: Sales data: Nielsen Marketrack, Consumer measures: Hall & Partners.

This is the story of how a group of passionate Marketers reversed the decline of an Irish Super-brand.

Cadbury Dairy Milk (CDM), the brand with a glass and a half full of creamy milk, has been the definitive chocolate bar in Ireland since 1933 and remains so today. Produced in Coolock and Rathmore with milk from Irish cows, the brand evokes memory and nostalgia for all Irish consumers. Its ubiquity says much about the Irish consumer’s relationship with chocolate where consumption per capita is one of the highest in the world. It’s three times bigger than its nearest competitor and is the 6th biggest grocery brand in the country. Whilst Kraft (Cadbury) manufactures many other products CDM is the backbone of the Irish business, which employs 1000 people across the country. CDM is more than a bar of chocolate, it’s the heart of the Irish Kraft operation.

In 2010, the brand owner could see some worrying trends. CDM was losing market share and its nearest competitor was experiencing considerable growth. With 24% YoY growth (2009/10), it was the fastest growing confectionary brand. CDM’s sales had declined in the same period by 5% (Figure 1). This may sound modest but, with a brand this size, nothing is modest. 5% represents over €3m in value.

When researched, CDM was losing the battle for ‘has a great taste’ and ‘has a texture I like’. (Hall & Partners June 2010).

But how could this be? Up to this point Kraft Ireland had imported some of the world’s most famous advertising (Gorilla, Eyebrows etc) and this had created and maintained the brand’s strong affinity scores. Significantly more respondents said that CDM ‘is a brand for people like me’ than agreed with the same statement for its nearest competitor.However, it seemed like the battle was being lost at an attribute level and this was eroding market share at an alarming rate. Strangely, chocolate was no longer being defined by ‘chocolatyness’. In short, CDM had a place in people’s hearts, but not in their mouths.

The marketing department in Kraft had a fight on its hands. With share slipping away and no suitable copy available internationally, how do you convince a centralized new brand owner in Europe to invest in original creative in Ireland? Especially when the work you have been running has been lauded from D&AD to Cannes to The One Show. How do you make engaging work about brand attributes? How do you row against the tide of a category re-definition whereby ‘smooth’ chocolate was the best tasting chocolate in consumers’ eyes. How do you re-excite the public about one of the most familiar brands in the country?

The business imperative defined the marketing objectives: We needed to reverse the decline of CDM whilst retaining margin (and revenue) and help justify an Irish operation.

Therefore the marketing objectives were as follows:

- To reverse the decline in CDM’s market share. Individual campaigns are often judged by metrics other than market share. ‘Affinity’, ‘Preference’ and many other measures can often justify a marketing decision. However, in this case, the business demanded an impact on the bottom line. This was as much about the business case for Ireland as a manufacturing base as it was about the more esoteric metrics of marketing departments.

- To re-establish CDM’s strength (its chocolaty taste) as the category standard. This would allow Kraft to dictate the game and, we hoped, would have a halo effect on the other count lines. If chocolaty taste was the category standard and Kraft owned this space, it could be leveraged for Twirl, Flake and Time Out as well as CDM.

- To win the internal battle for hearts and minds and re-assert Cadbury Dairy Milk as a pillar of the Irish operation; a brand with a future in a market with a future.

From a business point of view, we had to regain lost share and deliver value growth to the brand. This would require the activity to be the most responsive in recent history. All avenues were explored and communications was not the first port of call. The company examined all of the levers at its disposal before focusing on advertising. NPD was discussed but the costs of doing local NPD were prohibitive. And anyway, even the highest performing innovations would only yield a 0.5% market share improvement at best. Distribution was pretty much 100% and regulatory pressure was actually limiting the opportunities in the impulse channel. It was also decided that price promotion could only address the market share issue in the short term. So price promotion had to be used judiciously at the same levels as normal.

The task was further complicated by the fact that the obvious creative strategy was not the most fashionable one. In an era of Gorillas playing drums how do you convince one of the world’s most sophisticated marketing operations to eschew the world’s most famous advertising campaign to make a ‘flowing chocolate’ ad? And it wasn’t just the international colleagues who were skeptical; when you said ‘taste ad’ to the local team, they had an immediate reference in a seminal piece of creative that was produced in 1989 and had run for two decades.

Was this not a step back in time? If this goes wrong, does this not underline the naivety of a local marketing operation? In the shell-shocked, confidence-lacking Ireland of 2010, these were prescient concerns. This approach would take guts, commitment and chutzpa to execute effectively.

Added to this lack of confidence, what constitutes success? It’s not a launch. It’s high volume and relatively high value so one or two percentage points make a big difference.We needed to be careful about expectation management, defining what success would look like and focus on evaluation. What would be the point of a success that if couldn’t quantify it for the business?

This turned into as strategic a piece of communications planning as you are likely to come across. In medical parlance, this was keyhole surgery. The key to success was to define precisely where the problem lay, to build a strategy to address that specific problem and make sure that there is no collateral damage to Affinity.

So, in summary, the vision was to re-enforce the taste credentials of Cadbury Dairy Milk, reminding consumers that CDM is the best tasting chocolate. The moves we wanted to make in Attitude, Response and Consumer Behaviour and were defined as follows:

In order to measure the task, we used Hall & Partners quantitative research that helped identify the drivers of taste, that gave us a benchmark for performance and that we could evaluate our activity against. We identified five drivers of brand preference:

- Has a texture I like

- Has a Great Taste

- Has a Creamy Taste

- Has the Best Ingredients

- Has a Chocolaty Taste.

At this point, CDM was losing out in three out of five drivers (texture, great taste and creamy taste). After many years of being told that smoothness was the key to great chocolate taste, consumers had bought into the concept. However, CDM still led in for “Best Ingredients” and “Chocolaty Taste”. So the answer was apparent; play to CDM’s strengths and help consumers believe that ‘great taste’ is defined by ‘best ingredients’ and ‘chocolaty-ness’, not smoothness.

In terms of the activity, we had to engage the company to play to our advantage of having a powerful marketing, sales, merchandising and agency machine, on the ground, in Ireland. When all of these functions fire together, they are a formidable force. A strong advertising campaign can galvanize the efforts of manufacturing, sales, marketing and distribution. It creates momentum and carries the company forward.

In terms of the agency relationships, we needed a team of strategists, creatives and executors working together, with absolute conviction to a concise and agreed brief. Considerable time was spent on cross agency briefing and team building to ensure this happened effectively.

Our Idea was simple: Dramatise the joy of eating Cadbury Dairy Milk chocolate.

Consumers had been told that eating chocolate was an indulgent, solitary experience and there was some degree of guilt associated with it. We wanted to bring energy and positivity to the execution to celebrate the most chocolaty experience of them all.

Once the strategy was identified, the challenge became one of execution. In advertising short hand there are ‘brand ads’ and ‘product ads’. Accepted wisdom is that it’s brand ads that really move people. They work on a different level; a deeper level. They may be obtuse but they use art and craft to move the audience and make them connect with brands (and pay more for them) despite themselves. Sony’s ‘Colour Like No Other’, Cadbury’s drumming Gorilla, almost anything from Guinness titillates their audiences and represents the pinnacle of the craft we have chosen....some would say.

‘Product Ads’ working with the same potency, are a rarer phenomenon: They’re the journeymen communications that clients ‘make agencies make’. Maybe M&S Food or some of the Stella Artois work are exceptions but generally, these are the hard working stopgaps between the works of creative genius. What some recent campaigns did teach us however is that product imagery, done well, can be as layered and connect as deeply as some of the best brand ads. Art does not have to be the exclusive domain of the brand ad. It’s in the eye of the beholder. In this case the chocolate-eating audience. We all agreed that, in order to make a product ad that would be effective, we’d have to push the creative and enjoin the very best craftspeople in our task. No matter what the cost or logistical implications.

TV would be the main thrust of the activity. In terms of production values for the advertising, we could not compromise. We engaged, through an Irish producer, the director Jonathan Notaro from Brand New School. The techniques he had developed in photosonic photography and CG meant that we could be truly fresh in terms of execution. There were concerns however. How to control a shoot on a script that was open to such creative interpretation. How to influence a director that had a reputation as a maverick but the talent to back it up. All these factors added to the fun in the development phase.

Communication Activity

Firstly, we defined our media behavior. “Behaving like Disney and not like an FMCG” was the existent media behavior platform for Dairy Milk. A media platform that won the hearts of planners and media owners alike... In many ways, this was still relevant but it needed a twist. We needed to make people feel irresistibly tempted by bringing the same joy of the creative idea to the media communications activity. Our media behavior was defined as:

“Behaving like the Magical Chocolate Kingdom”

It was Disney again giving us inspiration. But this time, something more specific about their world: the “Magic Kingdom of Disney”. Their ability to make people step out of the real word, into the magical world (we also wanted to pull them into our chocolate world full of taste), their ability to sell the greatest story of all times (happily ever after. No guilt in there, just enjoyment) gave us endless inspiration.

Three stages were created to communicate our message more effectively

1st Stage: “Own” - Owning the best chocolate taste. Using media to denote leadership:

- Indulgent 60” TV focusing on irresistibly tempting programming for Women 16- 34.

- Confident Outdoor campaign breaking category rules. Using the largest and most indulgent formats around the country allowing us to show Dairy Milk in all its glory (including Ireland’s largest outdoor site).

- Innovating with the use of targeting data sending a personalized bar to “influencing women” in Ireland. Over 40,000 chocolate lovers received a home-delivered Dairy Milk pack creating ripples of WOM from day one of the campaign.

- Owning the streets and point-of-sales with irresistible sampling, leaving our audience desiring more Dairy Milk.

- Video-on-demand targeting chocolate occasions.

2nd Stage: “Tempt” – Tempting the individual to indulge. Using media to build tempting triggers around Points-of-Sale.

- We created “Temptation Trails” with the use of Outdoor. Simple concept (inspired by the various temptation trails created at the Magical Kingdom) but it delivered outstanding results.

- We identified where chocolate lovers shop and built trails leading to these points-of-sales, ensuring our audience was drooling by the time they stepped into the store.

- Over eight different outdoor formats were used for each Temptation Trail.

- Pioneered in Ireland with the use of intelligent mobile messaging targeting young women when they stepped into a Temptation Trail with an irresistible price offer.

- An extensive social media campaign with daily temptations and rewards “Tasty Treats”.

3rd Stage: “Multiply” - Using media to spread Dairy Milk’s taste of joy:

- Smartphones were transformed into virtual bars of Dairy Milk through “Share- a-Square” app.

- Users who shared eight squares (as the iconic Irish 8 square Dairy Milk bar) were rewarded with a free bar.

- Mouth-watering female magazine activity facilitating the download of Share-a- Square directly from the press ad.

- An owned episode in Irish version of “Apprentice” focusing on various Irish ingredients that deliver Dairy Milk’s unique taste:

- National competition to vote for the best tasting Apprentice-designed bar followed the episode.

- Interactive digital formats allowing users to cast their vote.

- Presence in-store

This singular creative strategy, a disruptive and confident media strategy and the power of an energized Cadbury sales and merchandising effort resulted in a seminal campaign, one that exceeded everyone’s expectations.

Case studies in ADFX are often littered with eye-popping effectiveness results. Doubling market share, triple figure sales growth etc. This is NOT that kind of case study. As stated at the outset, this was keyhole; the precise application of strategy to improve the health of the brand with as little trauma as possible. This was about arresting and reversing a trend. And, for those who understand that dynamics of this kind of progress in this kind of brand, the improvements are, quite simply, stunning.

If we start with the criteria we outlined at the beginning of the case

The visuals, that were established in TV and then amplified in outdoor and instore, were designed to stimulate a visceral, physiological response in the audience. We poured over edits and debated (sometimes in a very animated manner!) the merits of each frame. The execution was layered with imagery to convey all aspects of the perfect, chocolaty, chocolate-eating experience. Imagery designed to convey mouth coating, chunkiness, the release of flavour were apparent in the visuals and this helped regain the definition of a great chocolate eating experience for CDM.

Some exciting things happened when consumers got to see the campaign. It was immediately effective in terms if its impact on taste scores. Eight weeks into the launch in September 2011, the ‘has a great taste’ scores improved by 11% v March 2011, ‘has the best ingredients’ by 7% and ‘is really moreish’ by 4% (Figure 3) . This was way more that we could have hoped for in a short period of time.

What was equally exciting was the effect that the campaign had on engagement scores. Repetoire consideration reached the highest recorded level ever for CDM as did H& P measures for ‘Salience’, ‘Persuasion’ and ‘Involvement’.

The campaign became a bit of a Youtube sensation going on to become one of the top 5 viewed ads of the year. Facebook fans quadrupled and brand preference scores reached their highest levels on record with 53% of consumers answering that they ‘buy nowadays”. Not bad for a ‘product’ ad!

All very interesting, but what about the bottom line? To give this some context, for a mature brand such as this, a successful NPD launch (the most potent weapon for gaining market share) can deliver a 0.5% increase. This campaign delivered a 1% increase in total chocolate, which set a new record for share. Internal sales grew by 17% and sales improved by between +30bps (for the 8 square format) to 1000bps for the large formats.

The media performance was hugely efficient, as outlined below:

- Outdoor and TV ad recognition scores were quite sensational. TV was 4 times more efficient than “Gorilla” (H&P). This was achieved with 30% less investment than in Gorilla.

- Taste of Joy outperformed the results achieved by Gorilla:

- Bought last 7 days. Gorilla 20% Vs. Taste 26%

- Buy Nowadays. Gorilla 44% Vs. Taste 53%

- Brand Preference. Gorilla 34% Vs. Taste 38%

Temptation Trails delivered a 40% sales increase in Convenience Stores and a 225% increase in Grocery Retail stores.

Media Investment was €530k for September and €350k Feb

Importantly, the success of the campaign was not confined to outside the business. The activity proved that the local marketing team could plan and execute campaigns outside of the international system to the benefit of the business here. The ‘Taste’ campaign of 2011 has become a template for the company in Ireland and an example of great marketing throughout the Kraft/Cadbuy organization internationally. Greta Hammel, Marketing Manager (Chocolate) Ireland commented “when I present in [Kraft] Zurich to the category heads now, I can speak with the credibility and conviction of a marketer who’s delivered a best-in-class campaign. I think it helps me to make a more compelling argument and leaves me and my team [to an extent] in charge of our own destiny”.

As stated from outset this campaign was about arresting a 5% decline in Cadbury Dairy Milk sales.

The investment in the campaign across September and February was €1.2 million on media and production. We achieved payback in two ways:

- We arrested a decline. Even if sales had declined by half the previous years rate (2.5%) this amounted to a saving of €1.3 million for Kraft.

- In addition to arresting the decline we actually increased value sales by 3% (YTD market data April 2012). This 3% increase is valued at €1.6 million annually.

So in summary the short term (one year) payback on our €1.2 million investment is projected to be €2.9 million and more importantly we now have a brand with momentum that should continue to regain share from Galaxy.

Other influencers:

Distribution remained static and Price Promotions were run to the same schedule as the previous years, so neither of these factors could account for this growth.

In a broader context, the impact of the campaign continues to be felt on the business in Ireland. The fact the local team can identify and remedy issues before they become debilitating. The fact that marketing can have a fundamentally positive effect on the business and can strengthen the argument for de-centralised manufacturing. The depth that this kind of activity can bring to a brand that, if ignored, could just slip into a globalized homogeny and lose the connection to the consumer that makes it a high value super-brand in the first place.

Not bad for a product ad. Not bad for a little marketing department in a little country. Not a bad template for the future.

* Sources: Sales data: Nielsen Marketrack, Consumer measures: Hall & Partners.