Orchard Thieves: Thieving the spotlight

Rothco and Starcom

Introduction & Background

**Public version of this case study re-edited 26 Sept 2016**

For decades, being a cider drinker in Ireland meant being a Bulmers* drinker. Up until May 2015, it’s fair to say that cider tasted like Bulmers in this country, and consumers had little or no choice.

This is the story of how the newly created Orchard Thieves Cider launched into the marketplace, won the hearts and minds of cider drinkers nationally, and took a big bite out of Bulmers’ apple in its first year.

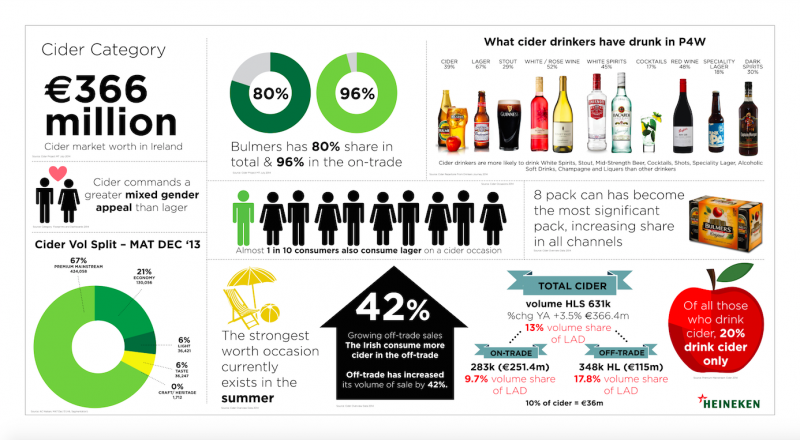

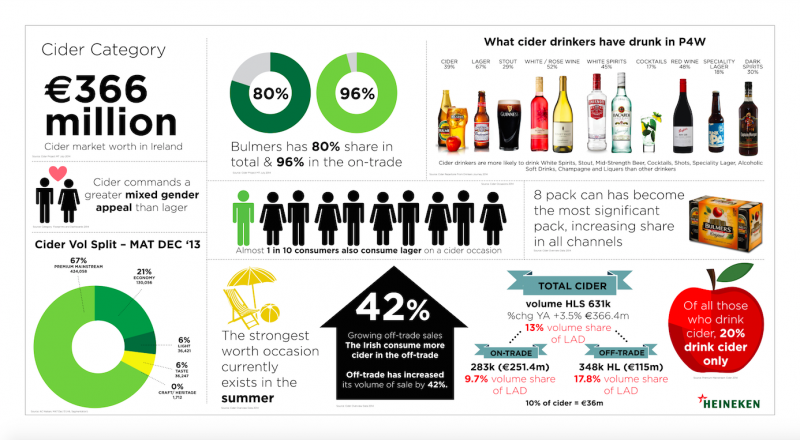

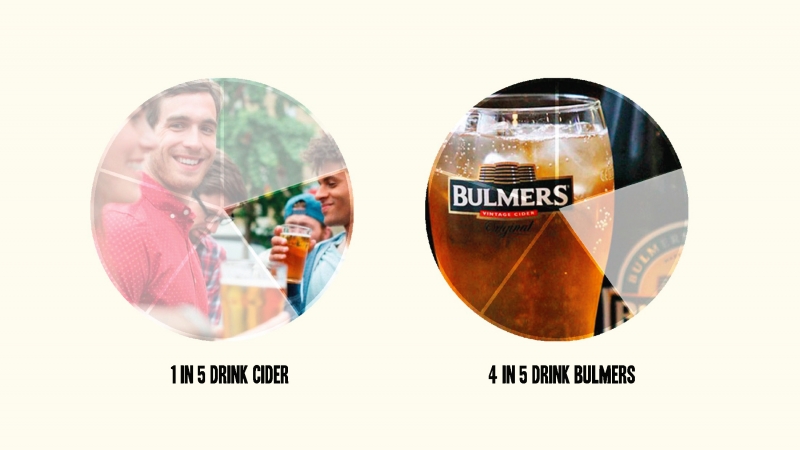

The Irish cider market was worth €366 million at the start of 2015. Bulmers was the biggest player in the category with approx. 80% market share (and this rose to 96% in the on trade). This presented an interesting but challenging opportunity for Heineken Ireland; to attempt to re-excite a monopolised cider category and break the Bulmers habit.

Orchard Thieves Cider launched in May following an accelerated nine months pre-launch development programme. It was decided early on in the process that this wasn’t going to be a me-too brand, and if we were going to be successful and expand the category, we needed to do it on our own terms.

A bold approach was employed across all elements of the launch. From the strategy to the planning and execution of this new-to-market brand, this was a brand that was designed to be noticed and - more importantly - adopted by our audience.

The results of our ambitious approach didn’t disappoint, with 85% awareness and over 57% trial as measured by TNS. Market share rose to 6.5% by end of December 2015, and as of the end of February, Orchard Thieves Cider has thieved 7.1% share of cider, rising to 14% in supermarkets.

This is our story.

*Bulmers in Ireland is also known as Magners in the UK and has been considered a premium cider since 1997.

Marketing Objectives

Business Objective:

Heineken Ireland has an ambition to be innovative. With increased pressure on its lager business from a declining market (beer consumption down from 118 litres per capita to 89 litres over previous 10 years) and the rise of craft beers, opportunities needed to be sought in adjacent categories. The launch of Orchard Thieves cider crucially needed to reach people we could not reach with beer, and drive recruitment. From the business’s perspective, success would be:

- Achieve 2% cider share in Year 1; 10% by year 5.

Marketing Objectives:

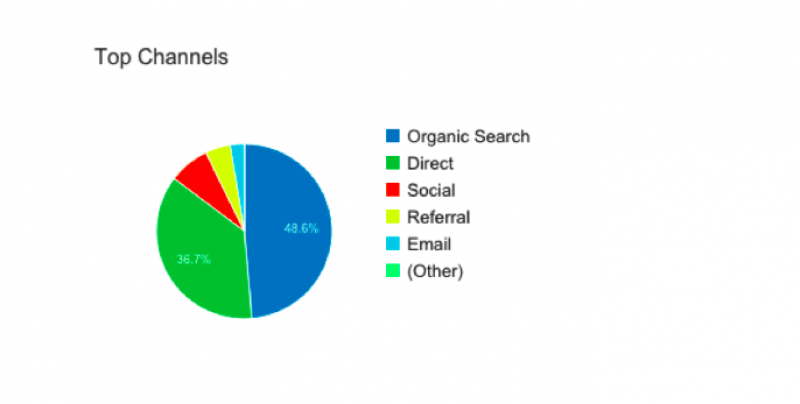

Fig. 1: The Cider Category in Ireland 2014 – 2015. Source Nielsen & TNS.

To meet these business objectives, the marketing objective was clear. We needed to break the Bulmers habit and more importantly recruit new consumers to the Heineken portfolio. Success would be measured against these objectives:

- Challenge Bulmers in value and volume share to become a strong and credible No.2 in the category.

- Recruit new consumers to our portfolio; get them to fall in love with our brand.

Communications Objectives:

The communication objectives were simple. Launching a brand new cider that had ambitions to take on the ‘Guinness of cider’, we needed to drive awareness and trial fast. Sampling was at the heart of our brief, as we knew from research that once consumers tried our product, they would like it.

1. Awareness to Trial:

Our task was to drive top of mind awareness amongst the key target audience that research had identified. A young, 25-34, urban population, young professionals who value new experiences. We needed to get them to notice Orchard Thieves, and understand that it is a great-tasting, refreshing new cider, ultimately overcoming their belief that Bulmers is the only cider in the market.

Key Equity Measure:

- 50% Awareness by 2015 Year End.

2. Trial to Usage:

Our second task was to drive our consumers to move from merely trying Orchard Thieves, to adopting it. And perhaps most crucially, to get them to believe that that there is more to cider than Bulmers, and that it can be enjoyed outside of low energy, summertime only drinking occasions.

Key Equity Measures:

- Grow trial from 0% to 25%.

- Get 300,000 samples across pints and bottles and cans in hands by end Dec, and ensure repeat purchase and adoption into their repertoire.

- Usage at 12% - frequency at 2 units per week.

The Task

Heineken Ireland is a beer company. We love beer.

Back in April 2014, Heineken Ireland was a company in the middle of the perfect storm. Heineken Ireland had to do something highly disruptive to future-proof its business.

Cider is adjacent to beer, commands 13% of the total category, and reaches people beer can’t. New millennials have a sweeter palate, so cider offers an option that beer doesn’t. It also offered Heineken Ireland the opportunity to broaden its portfolio and meet changing consumer needs, and not rely as heavily on the leading Heineken brand.

But Bulmers has dominated the Irish Cider Category for over 3 decades. It held a whopping 80% share overall, and in the on trade (licensed premises), which is 67% of the total market in Ireland, their share rises to 96%. (For more details on Bulmer’s dominance over other cider brands, see appendices.)

Fig. 2: Bulmers Penetration in Ireland 2014 – 2015. Source Nielsen.

A few challengers have come and gone over the last twenty years, including Kopparberg, Stella Cidre, Hudson Blue and Cashels, but no brand has stuck or challenged Bulmers’ undeniable dominance. Bulmers was also acknowledged as a best-in-class example of marketing and creative effectiveness, having previously won the ADFX Grand Prix in 2000 and 2006, and the Silver UK IPA Award in 2007.

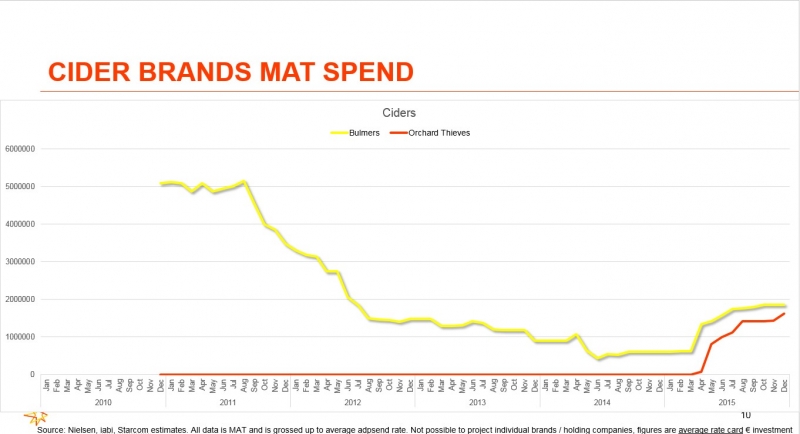

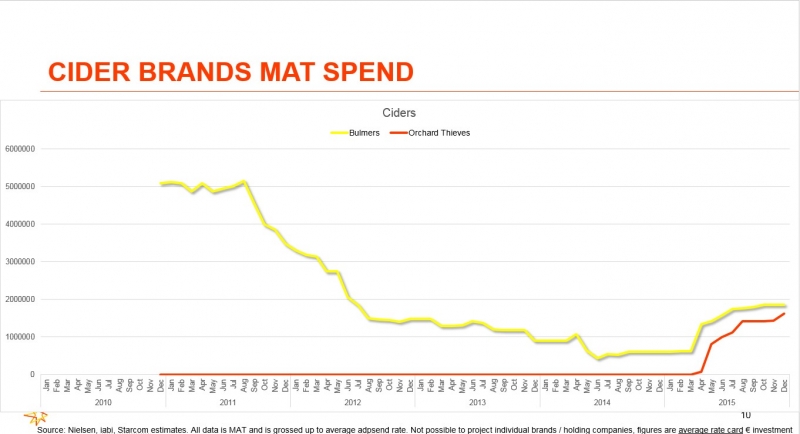

However, Bulmers had seen some slippage in investment in Ireland over the previous few years, and consumers were describing it as somewhat faded. Bulmers’ media spend had been plummeting since 2009. Trade partners were challenging the staidness of the category and there was a sense that cider was not a ”hot” category. We needed to create a brand that overcame all of these challenges and disrupted the category.

The global Heineken cider brands Strongbow and Bulmers (available in the UK, not to be confused with Irish Bulmers) could not be used in Ireland and equally these were not ideal in terms of positioning. So this was a unique opportunity to create a new brand that offered a fresh take on cider and a new consumer experience for the Irish drinkers. We wanted to “seize our moment” to create a brand that was less about apples and orchards and more about a contemporary urban take on cider, which lived in our Irish consumers’ world right here, right now, and allowed them to socialise in a new way.

Fig. 3: The Dominance of Bulmers 2014 - 2015. Source Nielsen.

The Strategy

Our objectives were clear and crisp, but the task was huge. Thieve share and drive trial at huge scale to ultimately convert cider drinkers.

As we worked on crafting our concept, we knew we had to get the proposition absolutely spot on, we needed to launch fast and with a bang. We could not fail.

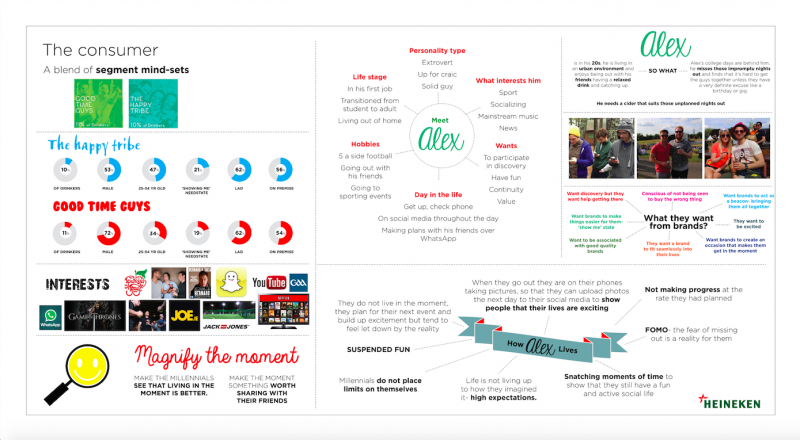

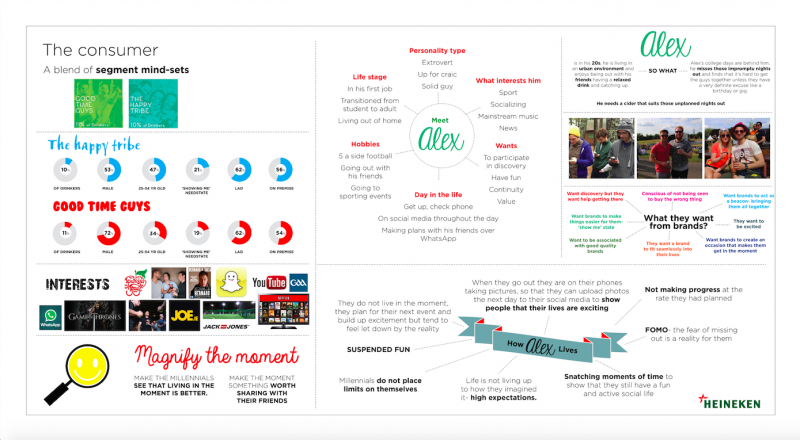

This meant our idea had to work beyond communications; we needed a brand mantra to live, breathe and bleed by. This mantra was sourced in the intersection of the brand, our consumer’s life and key category knowledge. Orchard Thieves cider was designed and developed with a specific consumer in mind. Our advertising needed to do the same. Meet Alex - our he/she consumer who lives for new experiences and unexpected adventures.

Fig. 4: Alex Pen Portrait. Source: MCCP & Bricolage.

ALEX & LIFE

Alex is typical of millennials who have moved into a new phase in life, they are first jobbers/young professionals or creative giggers who are torn between the structured demands of work and life, constantly seeking out moments that allow them to be spontaneous and embrace possibilities so that they are really living life. We distilled this into one main “life” insight: “I want to cut loose from the hype to enjoy unplanned social adventures with my friends, so that we can be our true selves.”

ALEX & CIDER

Understanding the category was fundamental. It was apparent that for Alex, cider is a happy drink - refreshing, easy drinking, accessible and has unisex appeal, so enhances the social occasion. The most significant insight to our creative journey was that: Cider drinkers are more open to new experiences than regular LAD (Long Alcoholic Drinks) drinkers.

Fig. 5: Cider drinkers are more open to new experiences than regular LAD. Source: TNS U&A April 2014

Identifying this low hanging fruit, it was important that we met our potential cider-drinkers’ desire for newness, spontaneity, group occasions and sociability. Our challenge became apparent: offer cider drinkers a real, different alternative.

ALEX & ORCHARD THIEVES

We were always sure of one thing: this product was developed with our audience in mind. It was crafted to appeal to their sweet palates with many iterations of “apple-y-ness” and “sweetness” levels tested with our R&D team, until we had crafted the now famous “fresh and apple-y” take on cider – which tested really positively with 1,000 Irish consumers in our concept product test. We envisaged Orchard Thieves as being a modern mainstream cider in Alex’s world, with a bit of boldness and a fresh taste made for real enjoyment. We then developed our “Brand in a Bottle” which acted as a guide for the brand.

Fig. 6: Brand in a Bottle

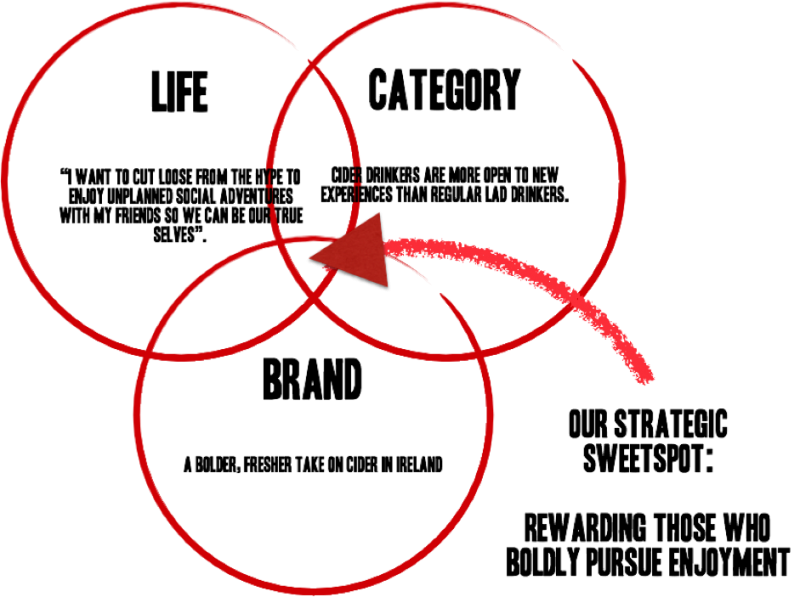

Out of this, we crafted our proposition: A bolder, fresher take on cider in Ireland.

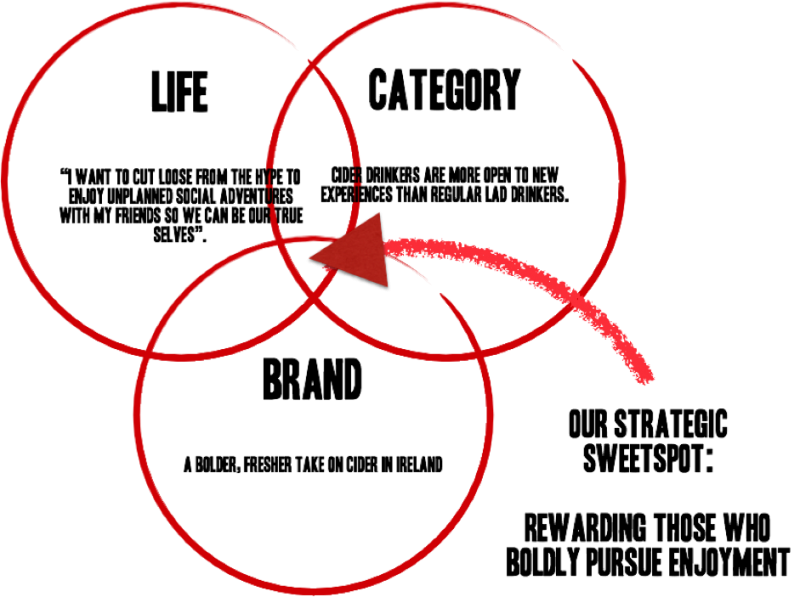

Role of Advertising: Our Brand Mantra

The overlap of Alex’s life, the brand proposition and category knowledge created a sweet spot from which we developed our role of advertising that became our mantra: Rewarding those who boldly pursue enjoyment. It was clear that the opportunities for enjoyment in our consumer’s life are shrinking – filled with too many ‘have to do’s versus ‘love to do’s. We wanted to ensure our brand rewarded those who grabbed opportunities for enjoyment; those fun times with friends.

From here, this became our North Star for everything. This is what we firmly felt the brand needed to deliver on in every aspect of its communications and beyond to achieve real success - and fast.

Fig. 7: Our Communications Model: The Intersection of the context of Life, Category and Brand that led to our brand mantra: Rewarding those who boldly pursue enjoyment.

The Idea

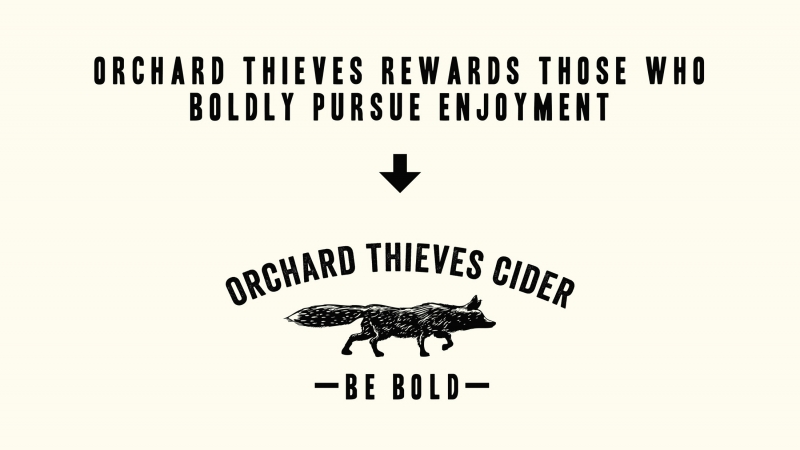

Having identified our strategic sweet spot and developed our brand mantra “rewarding those who boldly pursue enjoyment,” it was time to take that creative leap. We launched the brand with the simple expression, BE BOLD.

Fig. 8: From Brand Mantra to Creative Expression

Our Idea

Be Bold is a rallying call to likeminded ‘thieves’ to pursue enjoyment at every opportunity. It means not waiting for adventure to come but seeking it out, grabbing it, making the most of it. Be Bold is about being willing to take risks, break the rules of convention, when it comes to good times with friends. It’s about being alive and alert, spontaneous and up for it when it comes to grabbing every opportunity for social adventure.

To help shape our executional approach and bring to life the idea, we wrote a brand manifesto.

Fig. 9: Brand Mantra

Our Icon

Although we thieved the name and the fox emblem from an unused Heineken brand in New Zealand, we created everything else from scratch. It was important that our fox was more than an emblem on the pack. He became the brand icon and had meaning. He is always alive and alert and awake to possibilities. He is the link between the orchard and the city. Our fox by his very nature is bold, and always seeks out and points the way to enjoyment for our audience. They would follow the fox.

Our Communications

Be Bold was our creative idea and we wanted to live up to BE BOLD in everything we did, so we adopted the same mantra when it came to executing the idea. More importantly, trial needed to be at the centre of everything we did.

ROLE OF CHANNELS: CONNECTIONS STRATEGY

Our Orchard Thieves drinker, Alex, is aged 25-34. Their life is their social life; they love new things, new places, and new fashions. They are a generation that doesn’t differentiate media channels and they’ve grown up with social at the centre of their media life. Mobility is the heartbeat of their lives; they consider themselves self-expressionists and visual storytellers, craving urban adventures, and time together with the gang.

They are notoriously difficult to connect with, so we got under their skin. Through consumer workshops and non-linear co-creation sessions, we established the key connection moments for the target audience, identifying three key connection moments throughout the week, which in turn allowed us to build out a robust media strategy to leverage these moments, and connect with our consumers on all touch points.

- GOING HOME: ‘As soon as I finish work I can’t wait to reconnect with my gang and get ready for an adventure.’

- REVVING UP: ‘That time before the night really kicks off is awesome. The gang is together, we’re all really ourselves and full of energy for the night ahead.’

- SHARED SOCIAL ADVENTURES: ‘Weekends are for living, epic adventures and making the most of my time with friends.’

Timing our launch was also key. The prospect of a cold cider on a summer’s day would be a heavy sales driver. The May bank holiday weekend provided the ideal launch time.

THE EXECUTION

All good stories have a beginning, middle and end, and it was no different when it came to creating our communications for Orchard Thieves. Our story unfolded in three acts. Each act had a different focus. Act 1 was about seeding our brand and brand idea. Act 2 was the central act and it was about driving trial and awareness of our brand. Finally, Act 3 was all about trial and engagement.

ACT 1: SEED

Conscious that we were launching in one of the busiest periods for alcohol brands around the May bank holiday, we had to do things differently. Before officially launching on 1st May, our iconic fox emblem began interrupting national TV and VOD channels as part of a non-branded teaser campaign. We thieved ads from Meteor and Hailo, with our fox hijacking their commercials, in the four days leading up to the official launch. We also disrupted national TV stations, with the fox taking over the evening broadcast idents on TV3.

Fig. 10: Thieved Ads from Hailo and Meteor

From TV to the streets, we took our fox on tour, disrupting nights out and conversations with on-street projections and graffiti branding city walls across Ireland - announcing our arrival and encouraging Irish consumers to #BeBold. Anyone who followed the fox on our social channels was rewarded for their curiosity with merchandise and an invite to a secret launch event.

Fig. 11: Ambient

ACT 2: TRIAL & AWARENESS

After the four-day teaser, our official launch kicked off. Targeted to key urban areas, the official launch was signalled across the May bank holiday weekend, with heavyweight TV and outdoor support rolled out across the country.

OOH

Large formats were primarily used to build brand awareness along key arterial routes, with small formats and digital screens used to drive frequency in high footfall areas. Our outdoor was dominated by our fox, through him we displayed our golden, crisp cider to help communicate our brand intrinsics of refreshment and our unique light, golden liquid.

Fig. 12: Outdoor

To further communicate the brand intrinsics of Orchard Thieves, we created our own digital OOH (out of home) network. In a media first, we transformed a static 48 Sheet poster into a large format digital screen showcasing both the fox and beautiful, cider liquid footage. We also installed 75” digital screens at select Adshels to connect with our consumers. NFC/QR code units were built into each shelter, directing consumers to www.denofthieves.ie to ‘thieve a pint’ in a nearby bar.

Outdoor alone reached 80% of target audience across the launch cycle (cycle 10) with a high frequency (OTS) of 30, helping establish the brand and keep it front of mind across this key drinking period.

TV & SOCIAL

Heavyweight TV and social media support was used to bolster the outdoor activity, with social activity specifically optimised to short form (10” or less) video to drive relevancy with our on-the-go audience. The narrative of our TV ad brought to life the meaning behind Be Bold by showing two groups of friends being that bit Bolder, and as a result, enjoying exciting urban adventures. One group of friends crashes an awesome house party, while another group of friends bypass the massive queue into a club and find an even better night in a hidden venue. All of this was seen to the soundtrack of the fox’s adventure, an ancient fable of the sly fox outwitting the farmer, spoken by Michael Gambon. While our TV helped bring to life the BE BOLD idea, we also used it as an opportunity to encourage our audience at home to be bold too, by allowing them to thieve pints of Orchard Thieves through our mobile site DenOfThieves.ie

Fig. 13: Brand Film TVC

MOBILE: Keeping trial at the core of everything – denofthieves.ie

We designed Denofthieves.ie to instantly reward our audience with a free pint of Orchard Thieves. The Den featured three games built around our fox fable narrative; The Bold Adventure, The Bold Challenge, and The Bold Chase. Completing one game unlocked the next; this encouraged repeat visits and more pint redemptions. Once completed, we rewarded players with a free pint and the chance to gift a pint to a friend via an innovative social media tool that allowed users to share a pint with a Facebook friend.

Fig. 14: Device responsive Denofthieves.ie

What was special about our site was that we designed a GPS enabled wallet to hold your thieved pints. People could use this wallet straight from their mobile browser, which allowed them to redeem their pints in the nearest participating pub to them. The wallet allowed people to store their thieved pints until they were ready to redeem them in the pub.

But this was not just a media campaign, it was a full through the line campaign. We worked with the Trade to ensure our Be Bold mantra lived through our path to purchase in our channels, i.e. in the local off-licence and in the pub.

Off Trade (Off-Licences)

Shoppers were greeted with visibility in the alcohol aisles, which took on the look and feel from our above the line print, and carried our key message of ‘Be Bold’. We used both manned and unmanned sampling in-store to encourage people to trial Orchard Thieves, using small 15cl cans to make it easier to distribute our Bold Taste. And we drove distribution to 75% of all stores in 10 days, making it the boldest launch in Heineken Ireland history, and commented upon positively by Musgraves as being the best FMCG launch of 2015.

Fig. 15: Off Trade Visibility

On trade (Licensed premises)

In the on trade it was all about visibility, availability and sampling. We had a gang of ‘Thieves’ who acted as brand ambassadors and engaged consumers in fun games to prompt them to Be Bold for the chance to be rewarded with free merchandise and pints. And pubs all around Ireland got in on the act, posting impromptu parades of fox merchandise and visibility on their Facebook and Twitter pages; encouraging more sharing and boldness. Our original target number of draught outlets was achieved in over 3 months and publicans were coming to us looking for it to be listed.

Fig. 16: On Trade Visibility Focal Screens

Act 3: Trial and Engagement

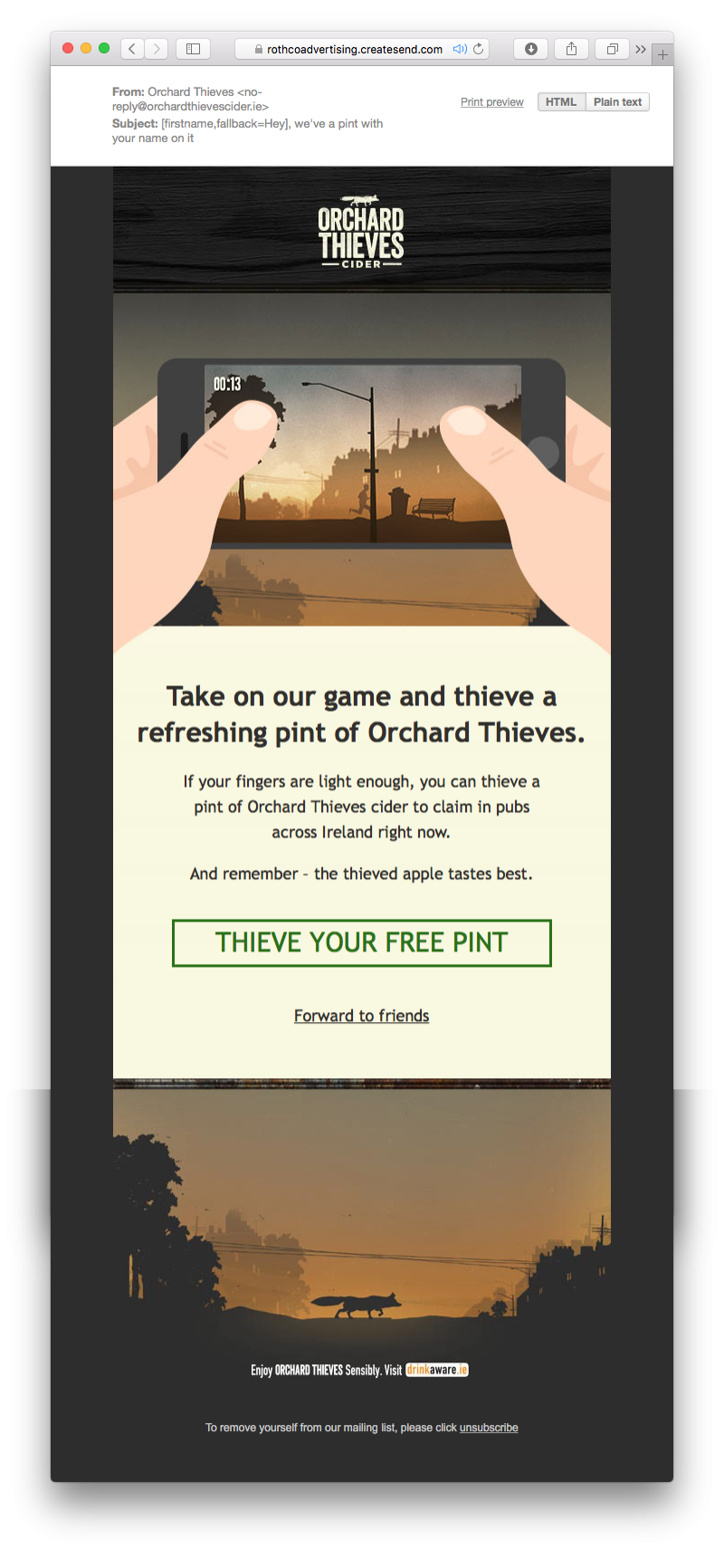

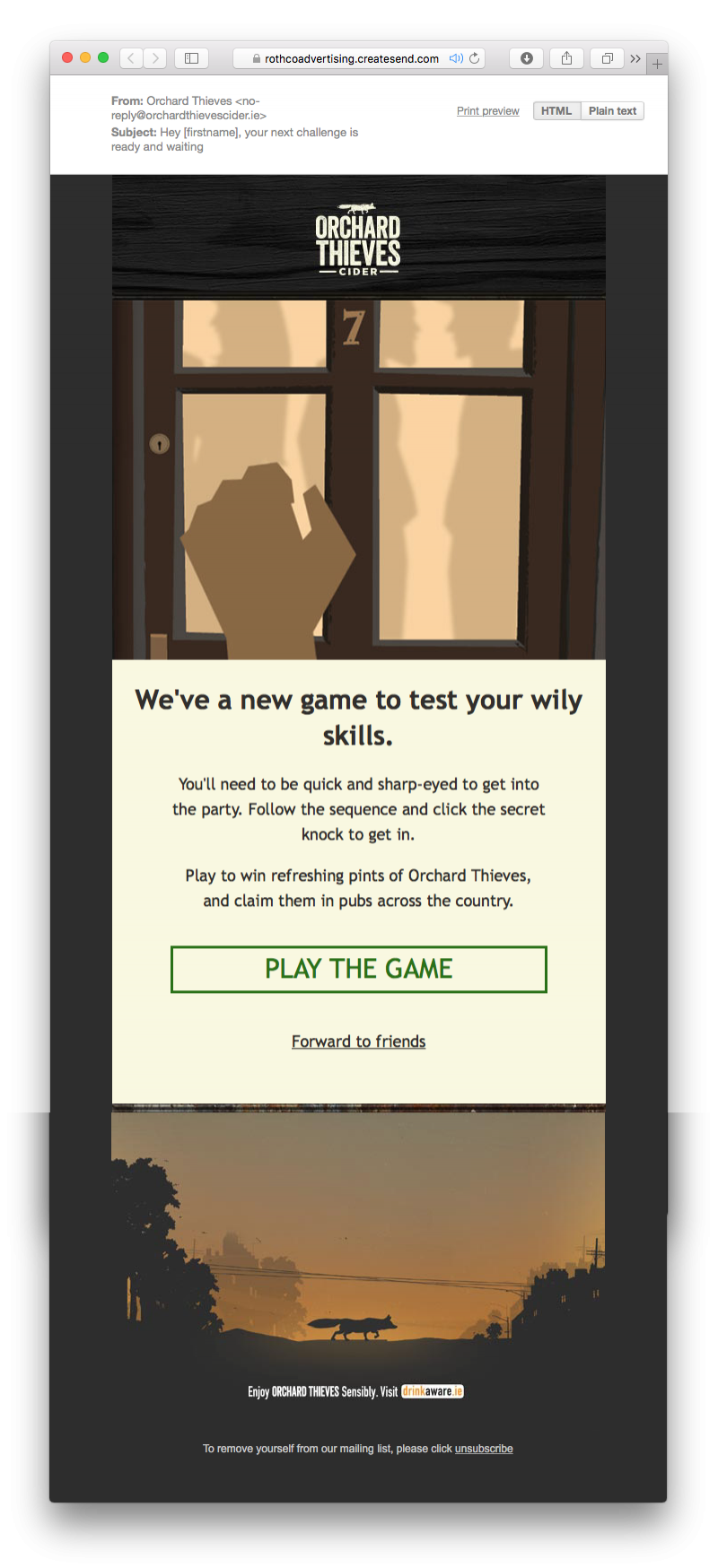

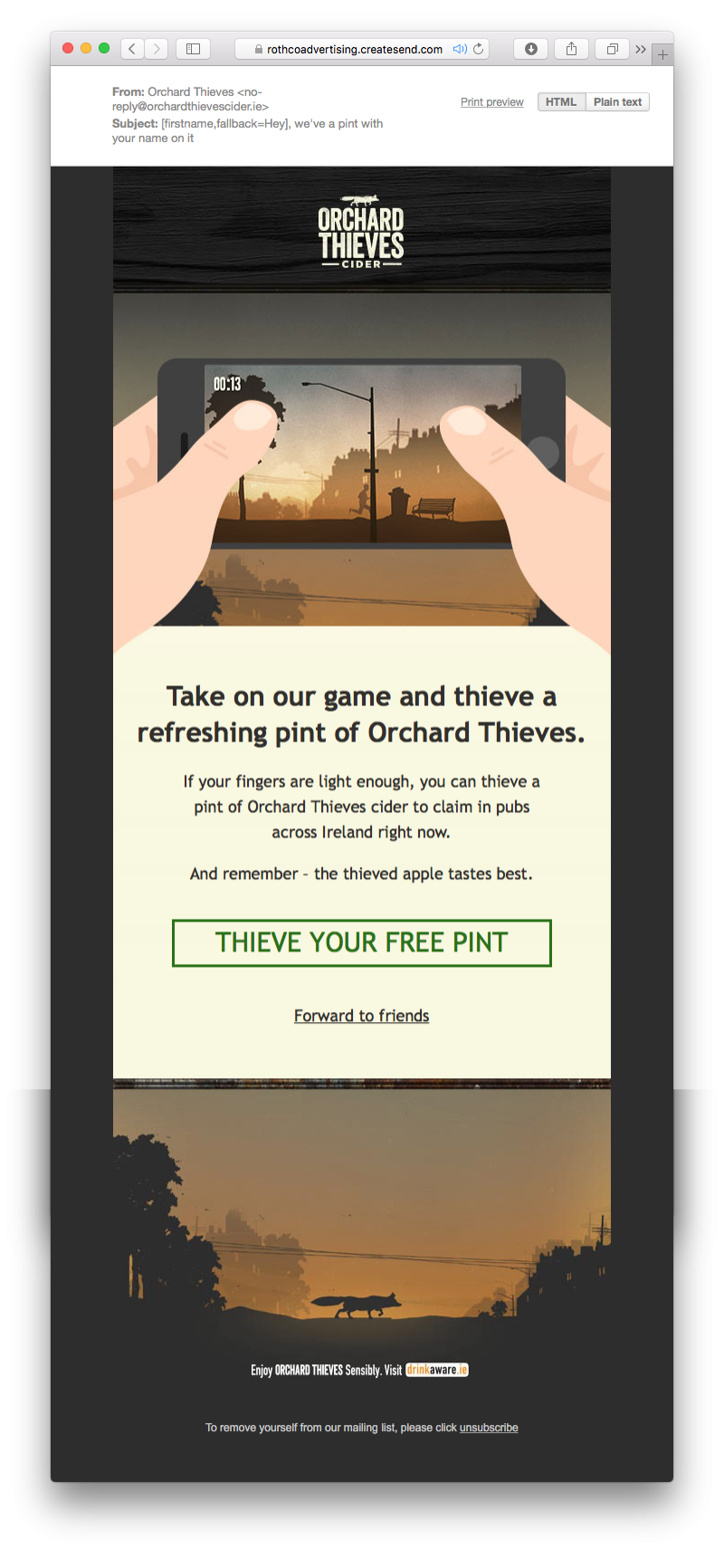

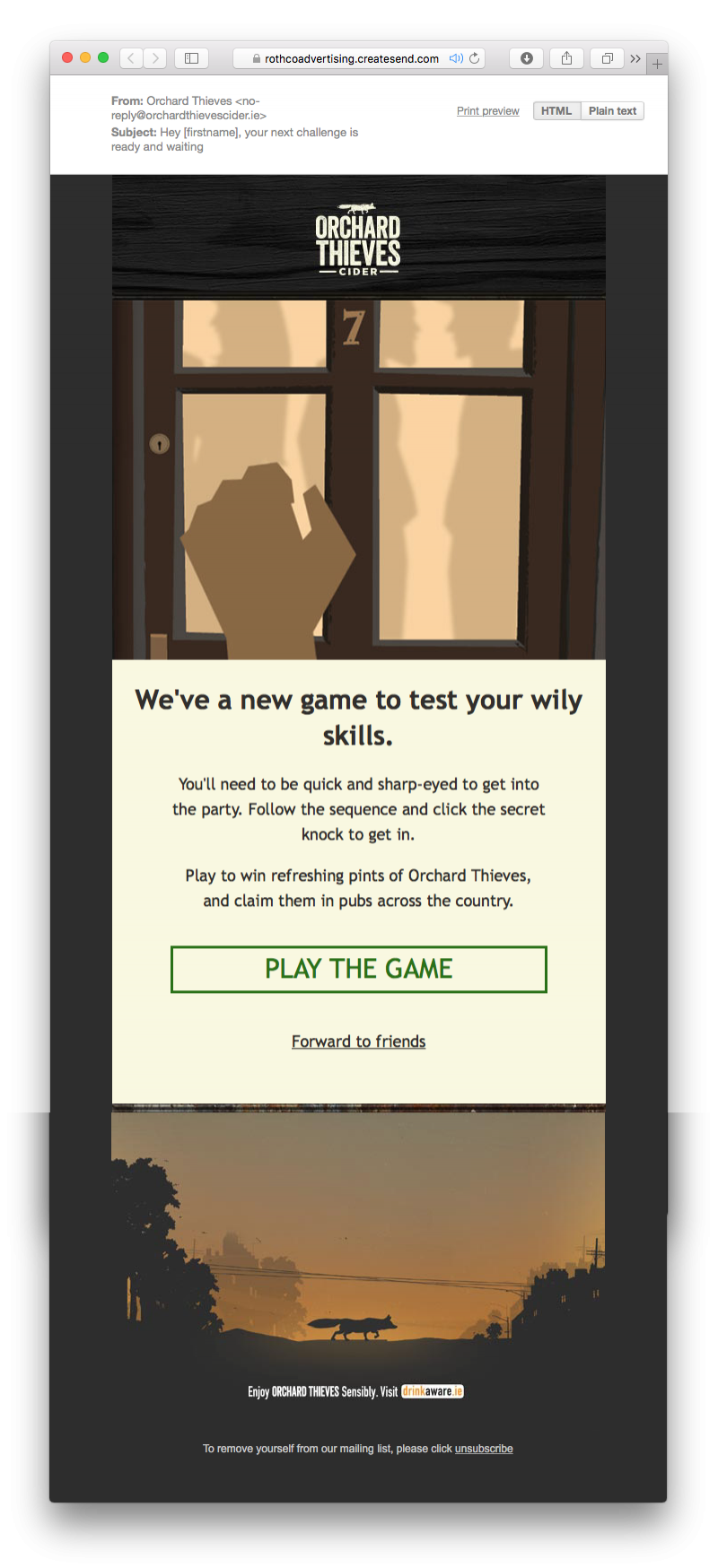

In order to keep momentum going through the summer, and tapping into the digital-first nature of our target consumer, we rolled out a media first, encouraging our audience to steal the props from our TV commercial. Bespoke VOD was used to announce when desirable props from our TV ad like the pool table, DJ decks and electric guitar were up for grabs. Those who were quick enough were in with a chance of grabbing some cool loot by visiting DenOfThieves.ie and trying to thieve them. As the props were successfully pinched over the course of our campaign, they also literally disappeared from our broadcasted commercial. To partake in this game, consumers had to become members of the den, building our database along the way. This allowed us to kick-start our CRM initiative, engaging users through email with upcoming opportunities to thieve pints and prizes.

Paid search was an important element of our activations too. We ran innovative countdown timers to when the competition began. Once the competition began, it then switched to a countdown to the end deadline, creating a sense of urgency and a fear of missing out in our audience. Overall paid search delivered 17,612 clicks to denofthieves.ie. Across the 4 mastheads, we delivered 7.5 million impressions and an average interaction rate of 10.1%. It also delivered 4,894 clicks to denofthieves.ie, delivering a CTR of 0.65%, which is over 6 times the industry average. Across VOD, we delivered 550k impressions and 8848 clicks to DenOfThieves.ie. This is a CTR of 1.6%, which is well above the industry average of 1%.

Fig. 17: CRM

Fig. 18: Thievable Props from the TVC

The Results

Orchard Thieves smashed the annual volume targets within its first 4 months in market.

Our total year-end volume was almost twice that of our business case. The global definition of game changer (Global Heineken Success Model) success is 1% share in one year. We gained 6.5% share points and sold over two million pints and 3 million bottles and cans of Orchard Thieves by the end of December (240 days in). Our marketing investment has generated strong revenues and a new “arm” for our company. Heineken Ireland is now a beer and a cider business.

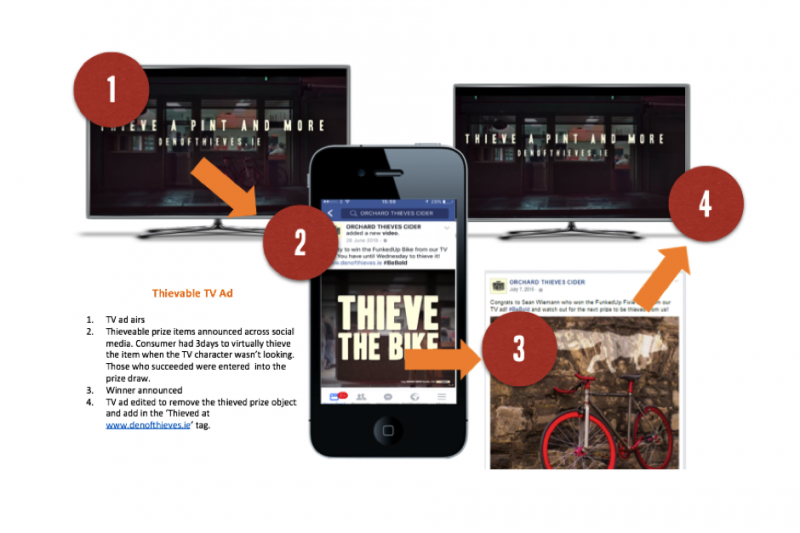

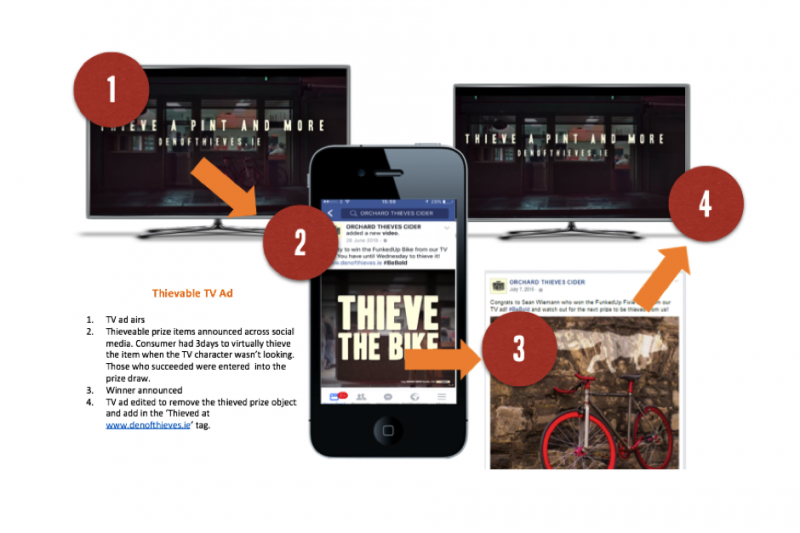

Marketing Objectives:

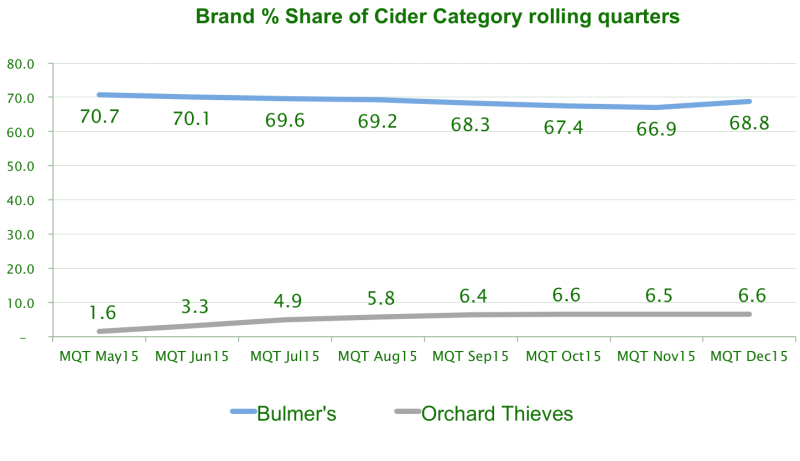

We successfully challenged Bulmers in value and volume share, and quickly became a strong and credible No.2 in the cider category in Ireland. For total brand performance scores, see appendices.

Fig. 20: Marketing Objectives v’s achieved

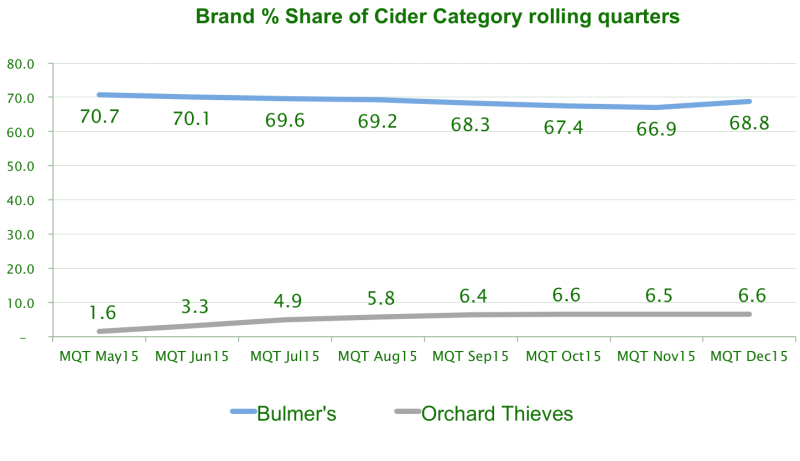

Fig. 21: Market Share Bulmers v’ Orchard Thieves. Source Nielsen

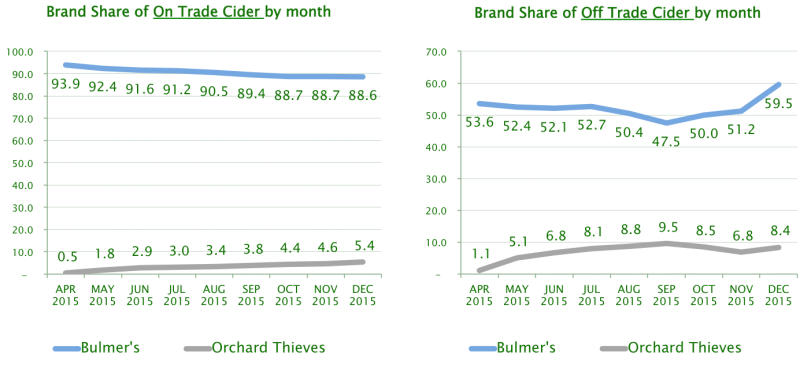

OT share of On Trade Cider FY 2015 of 2.6%, while Off Trade achieved FY share of 5.7%.

Fig. 22: OnTrade & OffTrade Market Share Bulmers v’ Orchard Thieves. Source Nielsen

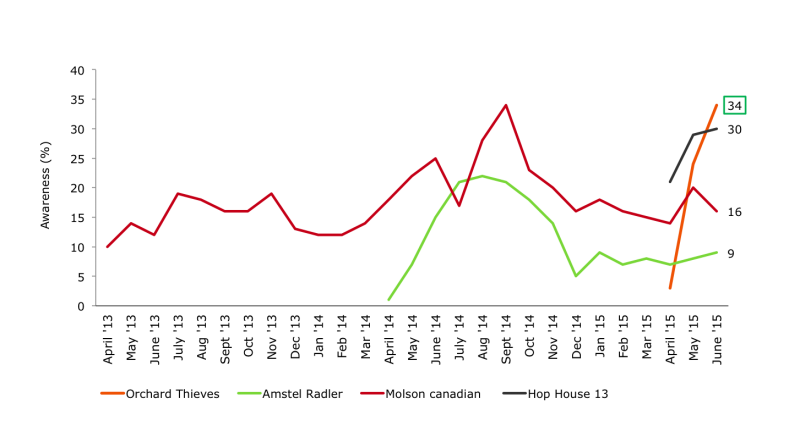

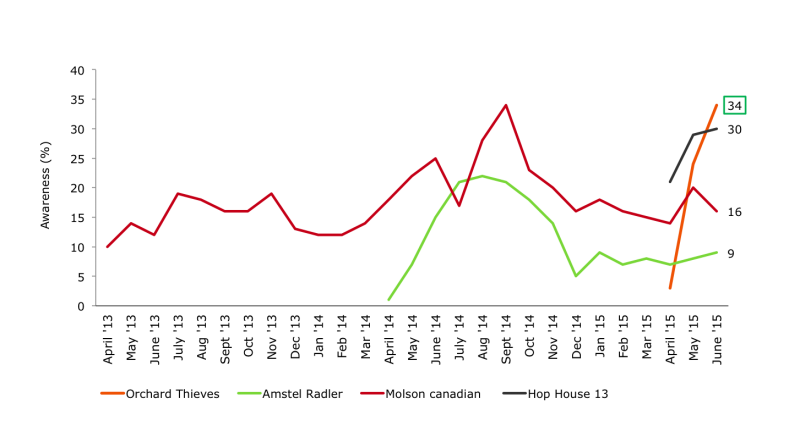

Communications Objectives

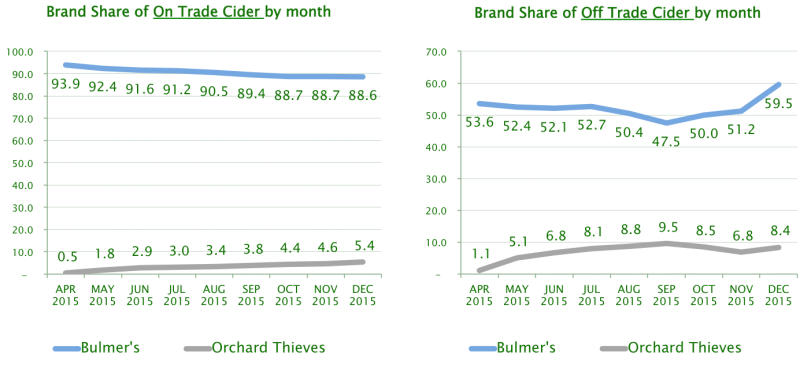

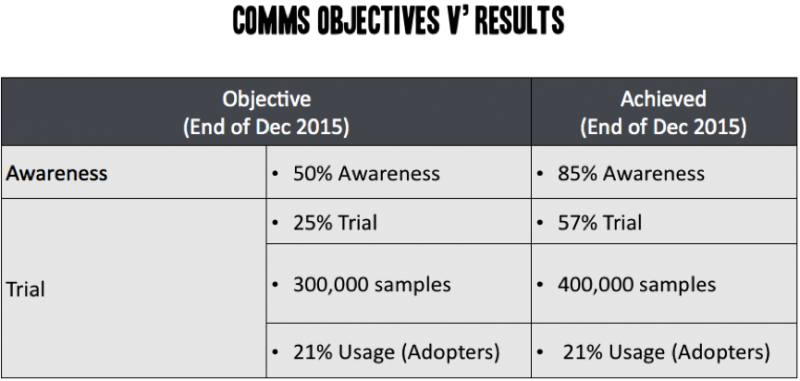

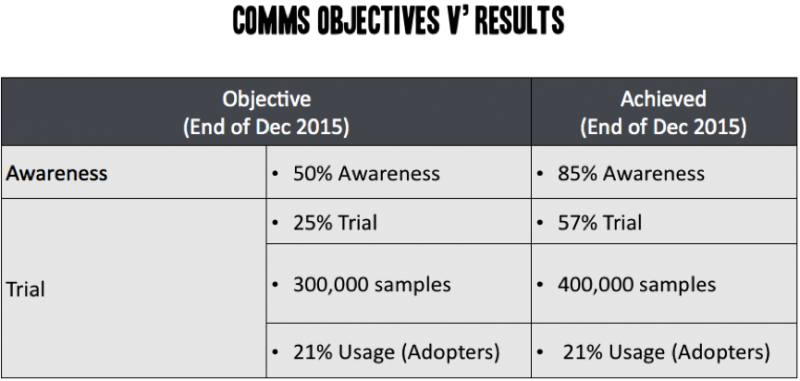

The launch of Orchard Thieves in 2015 has been an exceptional success in terms of driving awareness and usage conversion. Within the space of 6 months after its launch, it had achieved 85% awareness and 57% trial with 21% going on to add it to their brand repertoire.

Fig. 23: Communications Objectives v’s achieved

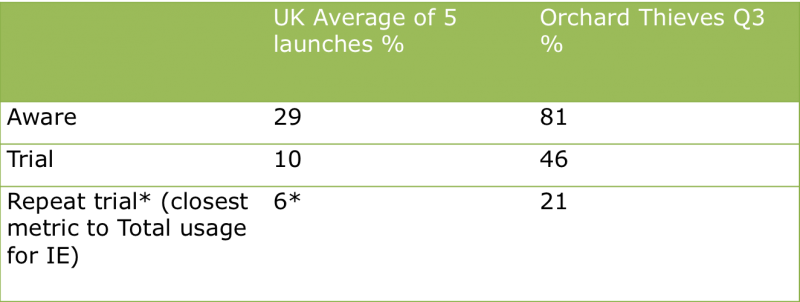

Comparing this to a range of product variant launches in the UK within the cider category, TNS commented that they typically see just under 30% awareness at this phase in the lifecycle, with 10% trial and just 6% converting to occasional usage. Even taking into consideration that the Irish cider market has traditionally been a one horse race, unlike the UK, it’s taken an exciting and compelling new brand proposition, supported by a hugely impactful launch campaign, to really make headway in building awareness and taking share – which Orchard Thieves has done. Fig. 24 measures results from Q3 rather than Q4 2015, hence the difference to the figures above.

Fig. 24: Average funnel results across the launch 5 variants v’ the Orchard Thieves funnel at Q3 ’15. Source TNS ONEquity

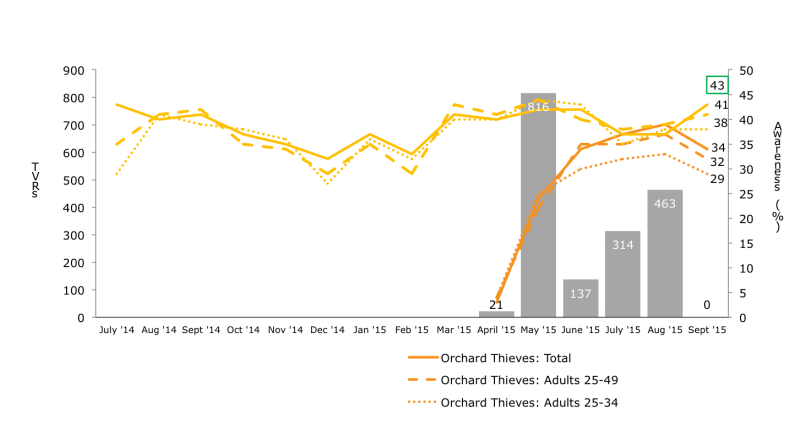

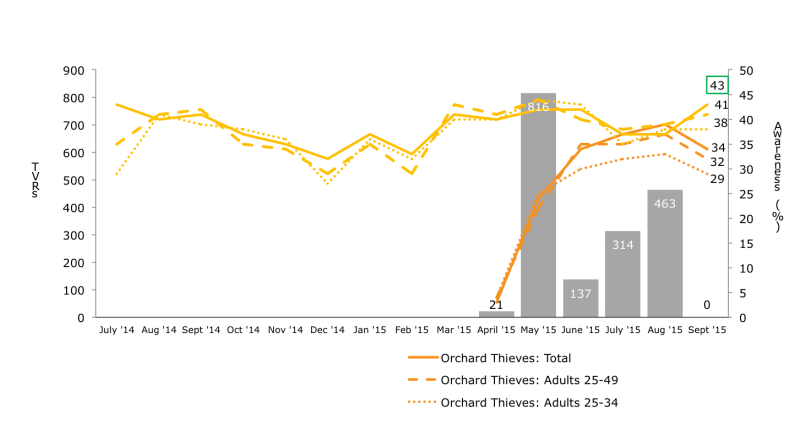

3 months in, Orchard Thieves had already achieved the same levels of ad awareness as Bulmers.

Fig. 25: Bulmers VS Orchard Thieves Ad Awareness EOQ3. Source TNS ONEquity

Post-campaign cross media evaluation shows strong top quartile ad recognition and recall of key messages (new cider, taste, be bold and our fox), despite Bulmers increasing their spend and launching a new campaign adjacent to our activity. (See appendices for further details)

Fig. 26: Huge hike in advertising spend adjacent to Orchard Thieves launch. Source Starcom/Nielsen.

The true scale of Orchard Thieves’ impact over such a short period of time is apparent when compared to other major brand launches over the past two years.

Fig. 27: Strong Ad Awareness Among Similar Size Launch Campaigns. Source TNS ONEquity

Orchard Thieves Cider is now being seen as a global brand for the Heineken company, with Heineken planning to launch it in Netherlands, South Africa and potentially some other European markets, with all Irish-produced assets.

In its short lifespan to date, Orchard Thieves has already been shortlisted / won the following awards;

- Media Awards: Won the Grand Prix and also Gold in Creativity in Media, Gold in Out of Home, Silver in Best Use of Interactive / Digital Media.

- Outdoor Advertising Awards: Won Best Newcomer.

- Digital Media Awards: Shortlisted for Best Integrated Media and won Silver in Best Integrated Digital.

- All Ireland Marketing Awards: Shortlisted for Marketer of the Year Campaign. Result TBC.

- Checkout Magazine Awards: Best FMCG Launch.

- Sharks: Won Bronze in Editing and a Bronze in Integrated.

On social (Facebook and Twitter), we’ve built a community of just under 60k fans and followers. Denofthieves.ie was thieved dry by the end of September and helped us build a CRM database of over 30k unique registered consumers whom we can continue to engage with. This is double the Heineken average, and of extreme importance to our future communications as the dark market looms – putting restrictions on when and where we can communicate with our audience.

The Impact

A Growing Category & Ongoing Engagement through Digital.

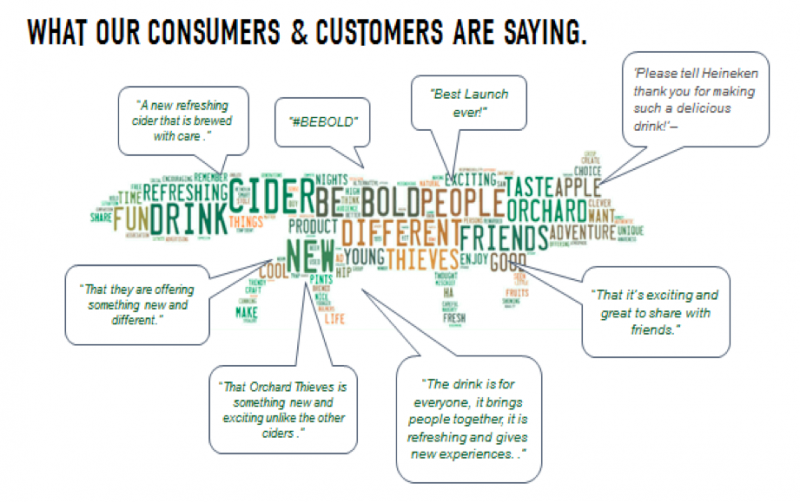

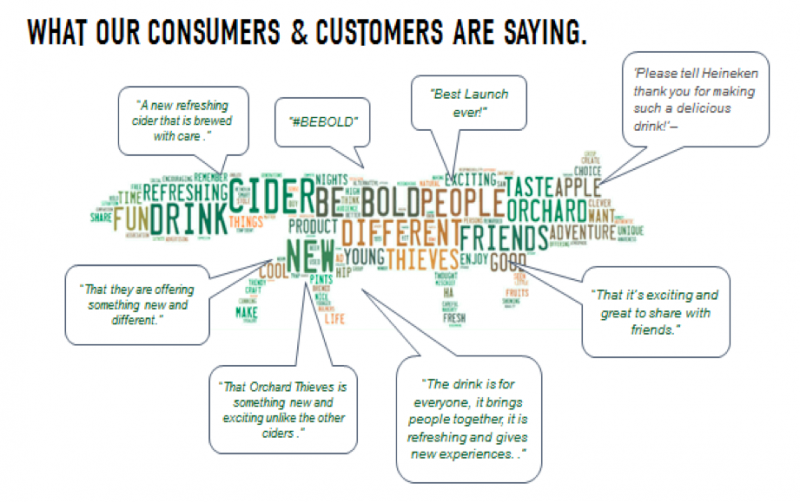

The disruptive and game-changing nature of the brand idea and placing trial at the core of our creative approach proved to have national appeal and successfully recruited new audiences to Orchard Thieves. In its first year, Orchard Thieves has already built up a strong emotional connection (measured through closeness) and is perceived as being innovative, daring and for people who are up for new experiences.

Fig. 28: Positive Consumer Response. Source Metrixlab Storytelling Tracker

Conversion from trial to usage was high. Consumers are continuously choosing to drink Orchard Thieves over Bulmers. Looking at brand funnels for Orchard Thieves and Bulmers over Q2 ‘15 to Q1 ’16 among All Adults, Bulmers are losing share of Main brand usage.

We are driving category value and recruitment is at a 33% repeat rate and growing; 48% switching from Bulmers.

The multimedia launch campaign succeeded in cutting through and disrupting people. The combination of TV and OOH worked particularly well, while the YouTube mastheads brought in a new audience (11% incremental reach). The ads were liked, relevant and prompted a strong desire to buy. The TVCs inspired a sense of adventure, and the Fox is already well established as a brand icon and conduit to adventure, being bold, and doing things differently. The brand is seen as contemporary, urban and sociable.

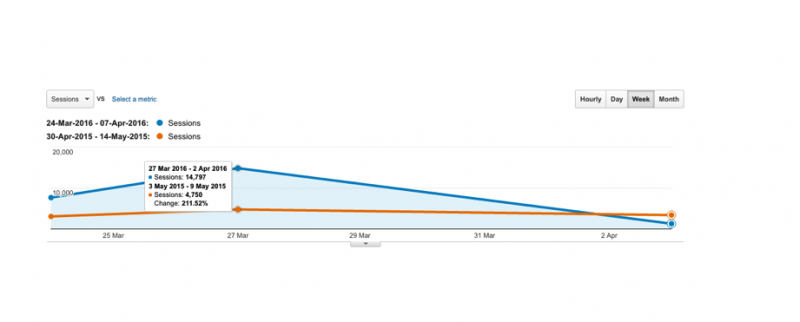

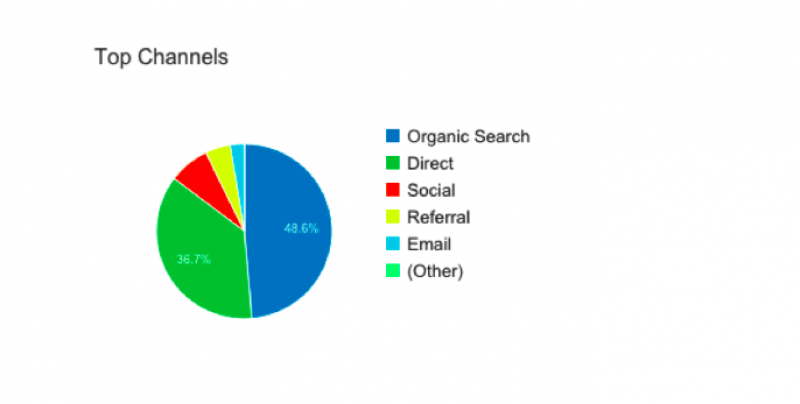

Usually, brand websites push people to visit through paid media support and the main channels of acquisition are social and referral. Our top 3 traffic referrals were search and direct. What’s exciting about this is that it tells us that people recalled our work and actively searched for the website or directly inputted the URL into their browser after seeing the TV.

Fig. 31: Denofthieves.ie Google Analytics, Acquisition Report.

Our Second Album: 2016 Activity

It was important that our communications built a strong foundation for the brand to evolve from and sustain momentum beyond the launch period. In 2016, engagement with the brand has already reached new heights, proving the effect of our launch is continuing.

The Bold Hour

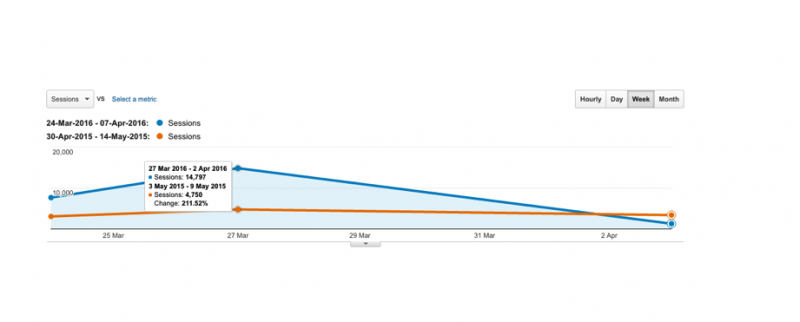

Our first burst of activity post launch was to spark for our audience the opportunity to Be Bold. In March 2016, we lost an hour of our weekend when the clocks moved forward, and Orchard Thieves decided to steal it back. We gave it to our audience when they least expected it but most needed it, in the form of The Bold Hour. A branded event was held simultaneously in Dublin, Cork and Galway. All they had to do was sign up at DenOfThieves.ie or respond to their email invite. Within this 2-week period of activity, we doubled our traffic levels and tripled our sign-ups to denofthieves.ie compared to the first 2 weeks of our first year. This is a sign of great things to come and of how momentum is still building.

Fig. 32: Traffic doubled in 2016 V’ 2015 launch period.

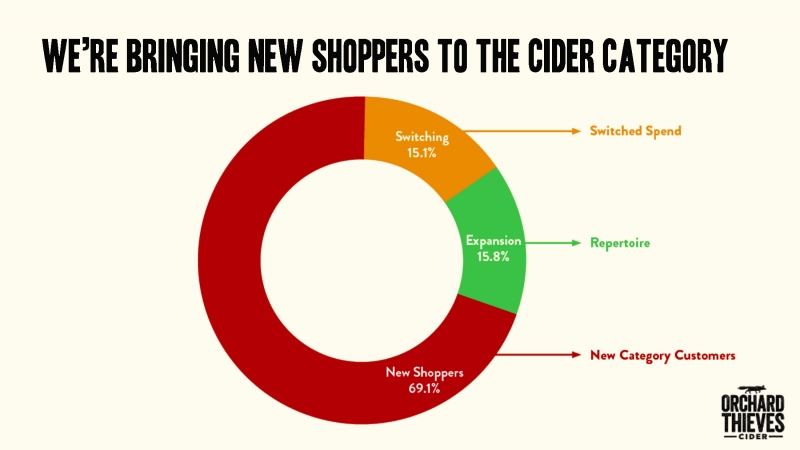

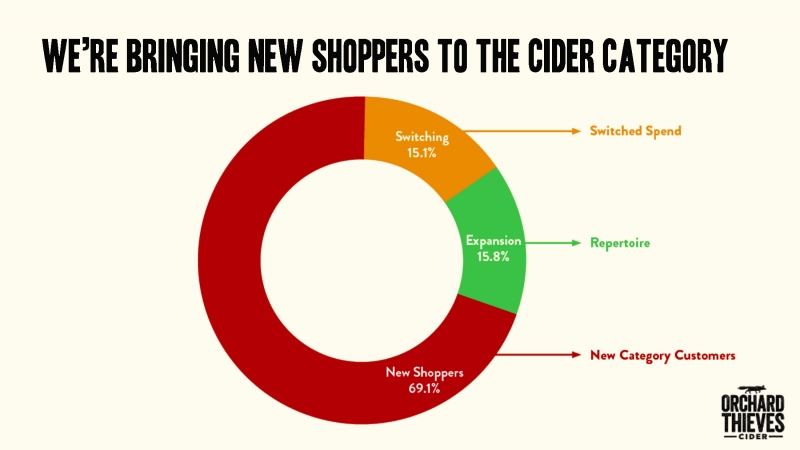

On top of all that, we successfully grew the cider category.

Fig. 33: New Shoppers to the Category. Source Dunhumby & EYC Data 2015

Summary

From the beginning, this brief was more about a behaviour than a message.

For our audience, the opportunities for enjoyment are shrinking. Their lives are filled with ‘have to do’s versus ‘love to do’s. We knew that if we could be the brand that rewarded them for grabbing more of those opportunities for fun and enjoyment, we could be a brand that belonged in their world.

This is the story of how great consumer insight and game changing marketing executions have disrupted the category and market to create success.

Taking inspiration from our name, we let our fox out… and he went on the prowl, thieving space on-shelf and in bars quickly, to get pints in hands. As a result, we successfully took a big bite out of Bulmers, and recruited over 6.5% of the cider market to our cider brand Orchard Thieves in half the expected time, driving significant revenue in the Heineken business.

And what’s most exciting is that this is just the first chapter of our Orchard Thieves story.

**Public version of this case study re-edited 26 Sept 2016**

For decades, being a cider drinker in Ireland meant being a Bulmers* drinker. Up until May 2015, it’s fair to say that cider tasted like Bulmers in this country, and consumers had little or no choice.

This is the story of how the newly created Orchard Thieves Cider launched into the marketplace, won the hearts and minds of cider drinkers nationally, and took a big bite out of Bulmers’ apple in its first year.

The Irish cider market was worth €366 million at the start of 2015. Bulmers was the biggest player in the category with approx. 80% market share (and this rose to 96% in the on trade). This presented an interesting but challenging opportunity for Heineken Ireland; to attempt to re-excite a monopolised cider category and break the Bulmers habit.

Orchard Thieves Cider launched in May following an accelerated nine months pre-launch development programme. It was decided early on in the process that this wasn’t going to be a me-too brand, and if we were going to be successful and expand the category, we needed to do it on our own terms.

A bold approach was employed across all elements of the launch. From the strategy to the planning and execution of this new-to-market brand, this was a brand that was designed to be noticed and - more importantly - adopted by our audience.

The results of our ambitious approach didn’t disappoint, with 85% awareness and over 57% trial as measured by TNS. Market share rose to 6.5% by end of December 2015, and as of the end of February, Orchard Thieves Cider has thieved 7.1% share of cider, rising to 14% in supermarkets.

This is our story.

*Bulmers in Ireland is also known as Magners in the UK and has been considered a premium cider since 1997.

Business Objective:

Heineken Ireland has an ambition to be innovative. With increased pressure on its lager business from a declining market (beer consumption down from 118 litres per capita to 89 litres over previous 10 years) and the rise of craft beers, opportunities needed to be sought in adjacent categories. The launch of Orchard Thieves cider crucially needed to reach people we could not reach with beer, and drive recruitment. From the business’s perspective, success would be:

- Achieve 2% cider share in Year 1; 10% by year 5.

Marketing Objectives:

Fig. 1: The Cider Category in Ireland 2014 – 2015. Source Nielsen & TNS.

To meet these business objectives, the marketing objective was clear. We needed to break the Bulmers habit and more importantly recruit new consumers to the Heineken portfolio. Success would be measured against these objectives:

- Challenge Bulmers in value and volume share to become a strong and credible No.2 in the category.

- Recruit new consumers to our portfolio; get them to fall in love with our brand.

Communications Objectives:

The communication objectives were simple. Launching a brand new cider that had ambitions to take on the ‘Guinness of cider’, we needed to drive awareness and trial fast. Sampling was at the heart of our brief, as we knew from research that once consumers tried our product, they would like it.

1. Awareness to Trial:

Our task was to drive top of mind awareness amongst the key target audience that research had identified. A young, 25-34, urban population, young professionals who value new experiences. We needed to get them to notice Orchard Thieves, and understand that it is a great-tasting, refreshing new cider, ultimately overcoming their belief that Bulmers is the only cider in the market.

Key Equity Measure:

- 50% Awareness by 2015 Year End.

2. Trial to Usage:

Our second task was to drive our consumers to move from merely trying Orchard Thieves, to adopting it. And perhaps most crucially, to get them to believe that that there is more to cider than Bulmers, and that it can be enjoyed outside of low energy, summertime only drinking occasions.

Key Equity Measures:

- Grow trial from 0% to 25%.

- Get 300,000 samples across pints and bottles and cans in hands by end Dec, and ensure repeat purchase and adoption into their repertoire.

- Usage at 12% - frequency at 2 units per week.

Heineken Ireland is a beer company. We love beer.

Back in April 2014, Heineken Ireland was a company in the middle of the perfect storm. Heineken Ireland had to do something highly disruptive to future-proof its business.

Cider is adjacent to beer, commands 13% of the total category, and reaches people beer can’t. New millennials have a sweeter palate, so cider offers an option that beer doesn’t. It also offered Heineken Ireland the opportunity to broaden its portfolio and meet changing consumer needs, and not rely as heavily on the leading Heineken brand.

But Bulmers has dominated the Irish Cider Category for over 3 decades. It held a whopping 80% share overall, and in the on trade (licensed premises), which is 67% of the total market in Ireland, their share rises to 96%. (For more details on Bulmer’s dominance over other cider brands, see appendices.)

Fig. 2: Bulmers Penetration in Ireland 2014 – 2015. Source Nielsen.

A few challengers have come and gone over the last twenty years, including Kopparberg, Stella Cidre, Hudson Blue and Cashels, but no brand has stuck or challenged Bulmers’ undeniable dominance. Bulmers was also acknowledged as a best-in-class example of marketing and creative effectiveness, having previously won the ADFX Grand Prix in 2000 and 2006, and the Silver UK IPA Award in 2007.

However, Bulmers had seen some slippage in investment in Ireland over the previous few years, and consumers were describing it as somewhat faded. Bulmers’ media spend had been plummeting since 2009. Trade partners were challenging the staidness of the category and there was a sense that cider was not a ”hot” category. We needed to create a brand that overcame all of these challenges and disrupted the category.

The global Heineken cider brands Strongbow and Bulmers (available in the UK, not to be confused with Irish Bulmers) could not be used in Ireland and equally these were not ideal in terms of positioning. So this was a unique opportunity to create a new brand that offered a fresh take on cider and a new consumer experience for the Irish drinkers. We wanted to “seize our moment” to create a brand that was less about apples and orchards and more about a contemporary urban take on cider, which lived in our Irish consumers’ world right here, right now, and allowed them to socialise in a new way.

Fig. 3: The Dominance of Bulmers 2014 - 2015. Source Nielsen.

Our objectives were clear and crisp, but the task was huge. Thieve share and drive trial at huge scale to ultimately convert cider drinkers.

As we worked on crafting our concept, we knew we had to get the proposition absolutely spot on, we needed to launch fast and with a bang. We could not fail.

This meant our idea had to work beyond communications; we needed a brand mantra to live, breathe and bleed by. This mantra was sourced in the intersection of the brand, our consumer’s life and key category knowledge. Orchard Thieves cider was designed and developed with a specific consumer in mind. Our advertising needed to do the same. Meet Alex - our he/she consumer who lives for new experiences and unexpected adventures.

Fig. 4: Alex Pen Portrait. Source: MCCP & Bricolage.

ALEX & LIFE

Alex is typical of millennials who have moved into a new phase in life, they are first jobbers/young professionals or creative giggers who are torn between the structured demands of work and life, constantly seeking out moments that allow them to be spontaneous and embrace possibilities so that they are really living life. We distilled this into one main “life” insight: “I want to cut loose from the hype to enjoy unplanned social adventures with my friends, so that we can be our true selves.”

ALEX & CIDER

Understanding the category was fundamental. It was apparent that for Alex, cider is a happy drink - refreshing, easy drinking, accessible and has unisex appeal, so enhances the social occasion. The most significant insight to our creative journey was that: Cider drinkers are more open to new experiences than regular LAD (Long Alcoholic Drinks) drinkers.

Fig. 5: Cider drinkers are more open to new experiences than regular LAD. Source: TNS U&A April 2014

Identifying this low hanging fruit, it was important that we met our potential cider-drinkers’ desire for newness, spontaneity, group occasions and sociability. Our challenge became apparent: offer cider drinkers a real, different alternative.

ALEX & ORCHARD THIEVES

We were always sure of one thing: this product was developed with our audience in mind. It was crafted to appeal to their sweet palates with many iterations of “apple-y-ness” and “sweetness” levels tested with our R&D team, until we had crafted the now famous “fresh and apple-y” take on cider – which tested really positively with 1,000 Irish consumers in our concept product test. We envisaged Orchard Thieves as being a modern mainstream cider in Alex’s world, with a bit of boldness and a fresh taste made for real enjoyment. We then developed our “Brand in a Bottle” which acted as a guide for the brand.

Fig. 6: Brand in a Bottle

Out of this, we crafted our proposition: A bolder, fresher take on cider in Ireland.

Role of Advertising: Our Brand Mantra

The overlap of Alex’s life, the brand proposition and category knowledge created a sweet spot from which we developed our role of advertising that became our mantra: Rewarding those who boldly pursue enjoyment. It was clear that the opportunities for enjoyment in our consumer’s life are shrinking – filled with too many ‘have to do’s versus ‘love to do’s. We wanted to ensure our brand rewarded those who grabbed opportunities for enjoyment; those fun times with friends.

From here, this became our North Star for everything. This is what we firmly felt the brand needed to deliver on in every aspect of its communications and beyond to achieve real success - and fast.

Fig. 7: Our Communications Model: The Intersection of the context of Life, Category and Brand that led to our brand mantra: Rewarding those who boldly pursue enjoyment.

Having identified our strategic sweet spot and developed our brand mantra “rewarding those who boldly pursue enjoyment,” it was time to take that creative leap. We launched the brand with the simple expression, BE BOLD.

Fig. 8: From Brand Mantra to Creative Expression

Our Idea

Be Bold is a rallying call to likeminded ‘thieves’ to pursue enjoyment at every opportunity. It means not waiting for adventure to come but seeking it out, grabbing it, making the most of it. Be Bold is about being willing to take risks, break the rules of convention, when it comes to good times with friends. It’s about being alive and alert, spontaneous and up for it when it comes to grabbing every opportunity for social adventure.

To help shape our executional approach and bring to life the idea, we wrote a brand manifesto.

Fig. 9: Brand Mantra

Our Icon

Although we thieved the name and the fox emblem from an unused Heineken brand in New Zealand, we created everything else from scratch. It was important that our fox was more than an emblem on the pack. He became the brand icon and had meaning. He is always alive and alert and awake to possibilities. He is the link between the orchard and the city. Our fox by his very nature is bold, and always seeks out and points the way to enjoyment for our audience. They would follow the fox.

Our Communications

Be Bold was our creative idea and we wanted to live up to BE BOLD in everything we did, so we adopted the same mantra when it came to executing the idea. More importantly, trial needed to be at the centre of everything we did.

ROLE OF CHANNELS: CONNECTIONS STRATEGY

Our Orchard Thieves drinker, Alex, is aged 25-34. Their life is their social life; they love new things, new places, and new fashions. They are a generation that doesn’t differentiate media channels and they’ve grown up with social at the centre of their media life. Mobility is the heartbeat of their lives; they consider themselves self-expressionists and visual storytellers, craving urban adventures, and time together with the gang.

They are notoriously difficult to connect with, so we got under their skin. Through consumer workshops and non-linear co-creation sessions, we established the key connection moments for the target audience, identifying three key connection moments throughout the week, which in turn allowed us to build out a robust media strategy to leverage these moments, and connect with our consumers on all touch points.

- GOING HOME: ‘As soon as I finish work I can’t wait to reconnect with my gang and get ready for an adventure.’

- REVVING UP: ‘That time before the night really kicks off is awesome. The gang is together, we’re all really ourselves and full of energy for the night ahead.’

- SHARED SOCIAL ADVENTURES: ‘Weekends are for living, epic adventures and making the most of my time with friends.’

Timing our launch was also key. The prospect of a cold cider on a summer’s day would be a heavy sales driver. The May bank holiday weekend provided the ideal launch time.

THE EXECUTION

All good stories have a beginning, middle and end, and it was no different when it came to creating our communications for Orchard Thieves. Our story unfolded in three acts. Each act had a different focus. Act 1 was about seeding our brand and brand idea. Act 2 was the central act and it was about driving trial and awareness of our brand. Finally, Act 3 was all about trial and engagement.

ACT 1: SEED

Conscious that we were launching in one of the busiest periods for alcohol brands around the May bank holiday, we had to do things differently. Before officially launching on 1st May, our iconic fox emblem began interrupting national TV and VOD channels as part of a non-branded teaser campaign. We thieved ads from Meteor and Hailo, with our fox hijacking their commercials, in the four days leading up to the official launch. We also disrupted national TV stations, with the fox taking over the evening broadcast idents on TV3.

Fig. 10: Thieved Ads from Hailo and Meteor

From TV to the streets, we took our fox on tour, disrupting nights out and conversations with on-street projections and graffiti branding city walls across Ireland - announcing our arrival and encouraging Irish consumers to #BeBold. Anyone who followed the fox on our social channels was rewarded for their curiosity with merchandise and an invite to a secret launch event.

Fig. 11: Ambient

ACT 2: TRIAL & AWARENESS

After the four-day teaser, our official launch kicked off. Targeted to key urban areas, the official launch was signalled across the May bank holiday weekend, with heavyweight TV and outdoor support rolled out across the country.

OOH

Large formats were primarily used to build brand awareness along key arterial routes, with small formats and digital screens used to drive frequency in high footfall areas. Our outdoor was dominated by our fox, through him we displayed our golden, crisp cider to help communicate our brand intrinsics of refreshment and our unique light, golden liquid.

Fig. 12: Outdoor

To further communicate the brand intrinsics of Orchard Thieves, we created our own digital OOH (out of home) network. In a media first, we transformed a static 48 Sheet poster into a large format digital screen showcasing both the fox and beautiful, cider liquid footage. We also installed 75” digital screens at select Adshels to connect with our consumers. NFC/QR code units were built into each shelter, directing consumers to www.denofthieves.ie to ‘thieve a pint’ in a nearby bar.

Outdoor alone reached 80% of target audience across the launch cycle (cycle 10) with a high frequency (OTS) of 30, helping establish the brand and keep it front of mind across this key drinking period.

TV & SOCIAL

Heavyweight TV and social media support was used to bolster the outdoor activity, with social activity specifically optimised to short form (10” or less) video to drive relevancy with our on-the-go audience. The narrative of our TV ad brought to life the meaning behind Be Bold by showing two groups of friends being that bit Bolder, and as a result, enjoying exciting urban adventures. One group of friends crashes an awesome house party, while another group of friends bypass the massive queue into a club and find an even better night in a hidden venue. All of this was seen to the soundtrack of the fox’s adventure, an ancient fable of the sly fox outwitting the farmer, spoken by Michael Gambon. While our TV helped bring to life the BE BOLD idea, we also used it as an opportunity to encourage our audience at home to be bold too, by allowing them to thieve pints of Orchard Thieves through our mobile site DenOfThieves.ie

Fig. 13: Brand Film TVC

MOBILE: Keeping trial at the core of everything – denofthieves.ie

We designed Denofthieves.ie to instantly reward our audience with a free pint of Orchard Thieves. The Den featured three games built around our fox fable narrative; The Bold Adventure, The Bold Challenge, and The Bold Chase. Completing one game unlocked the next; this encouraged repeat visits and more pint redemptions. Once completed, we rewarded players with a free pint and the chance to gift a pint to a friend via an innovative social media tool that allowed users to share a pint with a Facebook friend.

Fig. 14: Device responsive Denofthieves.ie

What was special about our site was that we designed a GPS enabled wallet to hold your thieved pints. People could use this wallet straight from their mobile browser, which allowed them to redeem their pints in the nearest participating pub to them. The wallet allowed people to store their thieved pints until they were ready to redeem them in the pub.

But this was not just a media campaign, it was a full through the line campaign. We worked with the Trade to ensure our Be Bold mantra lived through our path to purchase in our channels, i.e. in the local off-licence and in the pub.

Off Trade (Off-Licences)

Shoppers were greeted with visibility in the alcohol aisles, which took on the look and feel from our above the line print, and carried our key message of ‘Be Bold’. We used both manned and unmanned sampling in-store to encourage people to trial Orchard Thieves, using small 15cl cans to make it easier to distribute our Bold Taste. And we drove distribution to 75% of all stores in 10 days, making it the boldest launch in Heineken Ireland history, and commented upon positively by Musgraves as being the best FMCG launch of 2015.

Fig. 15: Off Trade Visibility

On trade (Licensed premises)

In the on trade it was all about visibility, availability and sampling. We had a gang of ‘Thieves’ who acted as brand ambassadors and engaged consumers in fun games to prompt them to Be Bold for the chance to be rewarded with free merchandise and pints. And pubs all around Ireland got in on the act, posting impromptu parades of fox merchandise and visibility on their Facebook and Twitter pages; encouraging more sharing and boldness. Our original target number of draught outlets was achieved in over 3 months and publicans were coming to us looking for it to be listed.

Fig. 16: On Trade Visibility Focal Screens

Act 3: Trial and Engagement

In order to keep momentum going through the summer, and tapping into the digital-first nature of our target consumer, we rolled out a media first, encouraging our audience to steal the props from our TV commercial. Bespoke VOD was used to announce when desirable props from our TV ad like the pool table, DJ decks and electric guitar were up for grabs. Those who were quick enough were in with a chance of grabbing some cool loot by visiting DenOfThieves.ie and trying to thieve them. As the props were successfully pinched over the course of our campaign, they also literally disappeared from our broadcasted commercial. To partake in this game, consumers had to become members of the den, building our database along the way. This allowed us to kick-start our CRM initiative, engaging users through email with upcoming opportunities to thieve pints and prizes.

Paid search was an important element of our activations too. We ran innovative countdown timers to when the competition began. Once the competition began, it then switched to a countdown to the end deadline, creating a sense of urgency and a fear of missing out in our audience. Overall paid search delivered 17,612 clicks to denofthieves.ie. Across the 4 mastheads, we delivered 7.5 million impressions and an average interaction rate of 10.1%. It also delivered 4,894 clicks to denofthieves.ie, delivering a CTR of 0.65%, which is over 6 times the industry average. Across VOD, we delivered 550k impressions and 8848 clicks to DenOfThieves.ie. This is a CTR of 1.6%, which is well above the industry average of 1%.

Fig. 17: CRM

Fig. 18: Thievable Props from the TVC

Orchard Thieves smashed the annual volume targets within its first 4 months in market.

Our total year-end volume was almost twice that of our business case. The global definition of game changer (Global Heineken Success Model) success is 1% share in one year. We gained 6.5% share points and sold over two million pints and 3 million bottles and cans of Orchard Thieves by the end of December (240 days in). Our marketing investment has generated strong revenues and a new “arm” for our company. Heineken Ireland is now a beer and a cider business.

Marketing Objectives:

We successfully challenged Bulmers in value and volume share, and quickly became a strong and credible No.2 in the cider category in Ireland. For total brand performance scores, see appendices.

Fig. 20: Marketing Objectives v’s achieved

Fig. 21: Market Share Bulmers v’ Orchard Thieves. Source Nielsen

OT share of On Trade Cider FY 2015 of 2.6%, while Off Trade achieved FY share of 5.7%.

Fig. 22: OnTrade & OffTrade Market Share Bulmers v’ Orchard Thieves. Source Nielsen

Communications Objectives

The launch of Orchard Thieves in 2015 has been an exceptional success in terms of driving awareness and usage conversion. Within the space of 6 months after its launch, it had achieved 85% awareness and 57% trial with 21% going on to add it to their brand repertoire.

Fig. 23: Communications Objectives v’s achieved

Comparing this to a range of product variant launches in the UK within the cider category, TNS commented that they typically see just under 30% awareness at this phase in the lifecycle, with 10% trial and just 6% converting to occasional usage. Even taking into consideration that the Irish cider market has traditionally been a one horse race, unlike the UK, it’s taken an exciting and compelling new brand proposition, supported by a hugely impactful launch campaign, to really make headway in building awareness and taking share – which Orchard Thieves has done. Fig. 24 measures results from Q3 rather than Q4 2015, hence the difference to the figures above.

Fig. 24: Average funnel results across the launch 5 variants v’ the Orchard Thieves funnel at Q3 ’15. Source TNS ONEquity

3 months in, Orchard Thieves had already achieved the same levels of ad awareness as Bulmers.

Fig. 25: Bulmers VS Orchard Thieves Ad Awareness EOQ3. Source TNS ONEquity

Post-campaign cross media evaluation shows strong top quartile ad recognition and recall of key messages (new cider, taste, be bold and our fox), despite Bulmers increasing their spend and launching a new campaign adjacent to our activity. (See appendices for further details)

Fig. 26: Huge hike in advertising spend adjacent to Orchard Thieves launch. Source Starcom/Nielsen.

The true scale of Orchard Thieves’ impact over such a short period of time is apparent when compared to other major brand launches over the past two years.

Fig. 27: Strong Ad Awareness Among Similar Size Launch Campaigns. Source TNS ONEquity

Orchard Thieves Cider is now being seen as a global brand for the Heineken company, with Heineken planning to launch it in Netherlands, South Africa and potentially some other European markets, with all Irish-produced assets.

In its short lifespan to date, Orchard Thieves has already been shortlisted / won the following awards;

- Media Awards: Won the Grand Prix and also Gold in Creativity in Media, Gold in Out of Home, Silver in Best Use of Interactive / Digital Media.

- Outdoor Advertising Awards: Won Best Newcomer.

- Digital Media Awards: Shortlisted for Best Integrated Media and won Silver in Best Integrated Digital.

- All Ireland Marketing Awards: Shortlisted for Marketer of the Year Campaign. Result TBC.

- Checkout Magazine Awards: Best FMCG Launch.

- Sharks: Won Bronze in Editing and a Bronze in Integrated.

On social (Facebook and Twitter), we’ve built a community of just under 60k fans and followers. Denofthieves.ie was thieved dry by the end of September and helped us build a CRM database of over 30k unique registered consumers whom we can continue to engage with. This is double the Heineken average, and of extreme importance to our future communications as the dark market looms – putting restrictions on when and where we can communicate with our audience.

A Growing Category & Ongoing Engagement through Digital.

The disruptive and game-changing nature of the brand idea and placing trial at the core of our creative approach proved to have national appeal and successfully recruited new audiences to Orchard Thieves. In its first year, Orchard Thieves has already built up a strong emotional connection (measured through closeness) and is perceived as being innovative, daring and for people who are up for new experiences.

Fig. 28: Positive Consumer Response. Source Metrixlab Storytelling Tracker

Conversion from trial to usage was high. Consumers are continuously choosing to drink Orchard Thieves over Bulmers. Looking at brand funnels for Orchard Thieves and Bulmers over Q2 ‘15 to Q1 ’16 among All Adults, Bulmers are losing share of Main brand usage.

We are driving category value and recruitment is at a 33% repeat rate and growing; 48% switching from Bulmers.

The multimedia launch campaign succeeded in cutting through and disrupting people. The combination of TV and OOH worked particularly well, while the YouTube mastheads brought in a new audience (11% incremental reach). The ads were liked, relevant and prompted a strong desire to buy. The TVCs inspired a sense of adventure, and the Fox is already well established as a brand icon and conduit to adventure, being bold, and doing things differently. The brand is seen as contemporary, urban and sociable.

Usually, brand websites push people to visit through paid media support and the main channels of acquisition are social and referral. Our top 3 traffic referrals were search and direct. What’s exciting about this is that it tells us that people recalled our work and actively searched for the website or directly inputted the URL into their browser after seeing the TV.

Fig. 31: Denofthieves.ie Google Analytics, Acquisition Report.

Our Second Album: 2016 Activity

It was important that our communications built a strong foundation for the brand to evolve from and sustain momentum beyond the launch period. In 2016, engagement with the brand has already reached new heights, proving the effect of our launch is continuing.

The Bold Hour

Our first burst of activity post launch was to spark for our audience the opportunity to Be Bold. In March 2016, we lost an hour of our weekend when the clocks moved forward, and Orchard Thieves decided to steal it back. We gave it to our audience when they least expected it but most needed it, in the form of The Bold Hour. A branded event was held simultaneously in Dublin, Cork and Galway. All they had to do was sign up at DenOfThieves.ie or respond to their email invite. Within this 2-week period of activity, we doubled our traffic levels and tripled our sign-ups to denofthieves.ie compared to the first 2 weeks of our first year. This is a sign of great things to come and of how momentum is still building.

Fig. 32: Traffic doubled in 2016 V’ 2015 launch period.

On top of all that, we successfully grew the cider category.

Fig. 33: New Shoppers to the Category. Source Dunhumby & EYC Data 2015

From the beginning, this brief was more about a behaviour than a message.

For our audience, the opportunities for enjoyment are shrinking. Their lives are filled with ‘have to do’s versus ‘love to do’s. We knew that if we could be the brand that rewarded them for grabbing more of those opportunities for fun and enjoyment, we could be a brand that belonged in their world.

This is the story of how great consumer insight and game changing marketing executions have disrupted the category and market to create success.

Taking inspiration from our name, we let our fox out… and he went on the prowl, thieving space on-shelf and in bars quickly, to get pints in hands. As a result, we successfully took a big bite out of Bulmers, and recruited over 6.5% of the cider market to our cider brand Orchard Thieves in half the expected time, driving significant revenue in the Heineken business.

And what’s most exciting is that this is just the first chapter of our Orchard Thieves story.