Topaz's Play or Park - We could have created another loyalty programme, but a loyalty GAME that customers wanted to play…. ‘that's better’.

Target McConnells and PHD Ireland

Introduction & Background

In 2013, Topaz - Ireland’s largest fuels/convenience retailer – faced a very challenging commercial reality with a number of distinct challenges:

- The brand was experiencing declining market share.

- The overall Fuels market was predicted to decline by 6%.

- Research showed that 72% of customers claimed to “either know the exact price of fuel or have a good idea of the price” and 36% claimed to choose their stations solely based on the cheapest price [1]. As such, customers consider fuel to be a grudge purchase and are extremely price-sensitive and their brand choice is almost exclusively based on price. Furthermore, this market is strongly characterised by very tight margins.

- Topaz was priced at a slight premium due to their superior Fuel Additive that delivers enhanced fuel efficiencies. This resulted in their main competitor, Applegreen, being perceived as a cheaper choice, especially in the two main markets - Dublin and Cork.

Based on the above market conditions, the strategic imperative was clear. Topaz had to create a very compelling reason for consumers to choose their brand.

- Topaz had little data on their customers, despite the high footfall through their 330 sites each week. This lack of data meant that the brand had no visibility as to who their customers were, what they were buying and how often they did so.

To address all of the above, the strategic decision was made to focus the entire business on getting closer to their customers with the sole objective of building sustainable, long-term profitable relationships with them, through the creation of a highly innovative, unique and category-changing Loyalty Strategy.

In February 2013, ‘PLAY or PARK’, the Topaz Loyalty Game was launched and became the first ever Loyalty Programme in Europe to use an on-going game as its central mechanic.

[1] Behaviour & Attitudes (November 2013)

Marketing Objectives

Given the strategic importance of ‘PLAY or PARK’, very ambitious and aggressive targets were set for Year 1:

COMMERCIAL OBJECTIVES:

- Retain #1 position in the market.

- Arrest decline in (1) market share (2) fuel volume and (3) sales.

- Arrest decline in Diesel volume by 0.5%

- Arrest decline in Unleaded volume by 0.5%

- Increase YOY Fuel Card volumes by 1%

- Increase YOY Non-Fuel/shop turnover by 1%

MARKETING OBJECTIVES:

- To establish a tangible and compelling point of difference for Topaz amongst its competitive set in order to retain their customers.

- To strengthen brand equity by creating a truly unique, innovative version of loyalty that is more meaningful for customers and one that they would actively participate in.

- To acquire valuable customer data on a mass scale to provide the business with on-going visibility of its customers, their behaviour and purchases in order to communicate with them in the most relevant manner and also to drive preferential behavioural change.

CUSTOMER ENGAGEMENT OBJECTIVES:

In achieving the above Commercial and Marketing objectives, mass consumer engagement and ongoing participation became mandatory and as such, the following objectives were set for Year 1.

- Recruit 200,000 fully registered members.

- Deliver high levels of customer participation:

- 400,000 PLAYS

- 30% Topaz Treat redemption on a monthly-basis

- 5% uplift in average-transaction-value from loyalty members

- Establish a meaningful, regular dialogue with customers via a highly personalised experience each month.

The Task

The ambition was extremely challenging - create a highly innovative, category-changing Loyalty Programme that has the ability to actively engage consumers on a regular basis and utimately has the potential to drive preferential behavioural change (ie: purchase behaviour). And by doing so, reverse the decline in market share, fuel volume and drive loyalty.

However, making this ambition a reality presented an array of very significant obstacles:

1. PRICE PREMUIM WITH NO PERCEIVED PRODUCT DIFFERENTIATION

There is little perceived product differentiation among the various brands operating within this category. Despite this, Topaz continually invest in their products to ensure an enhanced, superior performance of their fuels which in turn delivers greater efficiencies for their customers (eg: a fuel additive that delivers up to 24km more per tank). Such an approach results in Topaz fuels being retailed at a slight premium when compared to the market, in particular, its closest competitor, Applegreen. This inevitably compounds the task of defending a market leading position in a highly priced-driven/sensitive market.

2. LACK OF CONSUMER LOYALTY

Consumer loyalty as traditionally thought of does not exist in this category. As shown above (section 2 – Introduction & Background), research showed that 72% of customers claimed to “either know the exact price of fuel or have a good idea of the price” and 36% claimed to choose their stations solely based on the cheapest price. As such, there is one dominant type of loyalty that exists in this category – Price Loyalty. And to a lesser extent, assuming a minimal or neutral price difference, Convenience Loyalty (ie: choosing a petrol station based on geographical proximity/convenience) may also exist. This made the task of creating a deeper, more meaningful connection with consumers all the more challenging.

3. CONSUMER OVERLOAD WITH LOYALTY PROGRAMMES IN THE IRISH MARKET

One of the biggest challenges was the proliferation of Loyalty Programmes in the Irish Market and the fact that customers only actively participate in half of the programmes that they belong to - therefore having little or no impact on their affinity with the brand or future purchasing behaviours. To compound this challenge further, Topaz did not have the benefit of ‘first mover advantage’ in this category as Applegreen, Topaz’s largest competitor, had launched their loyalty programme 14 months prior to the launch of Topaz’s ‘PLAY or PARK’. During this time, approximately 100,000 customers had joined their rewards programme that mirrored the standard 'purchases = points = prizes' model.

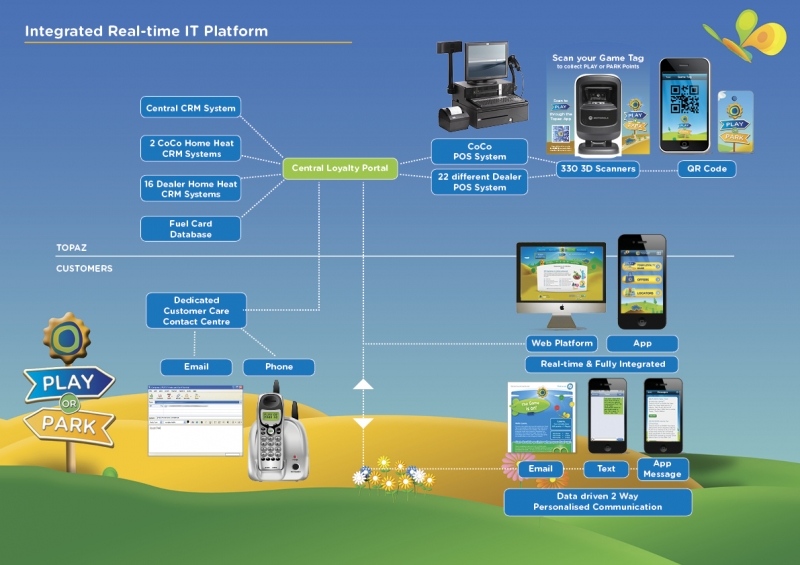

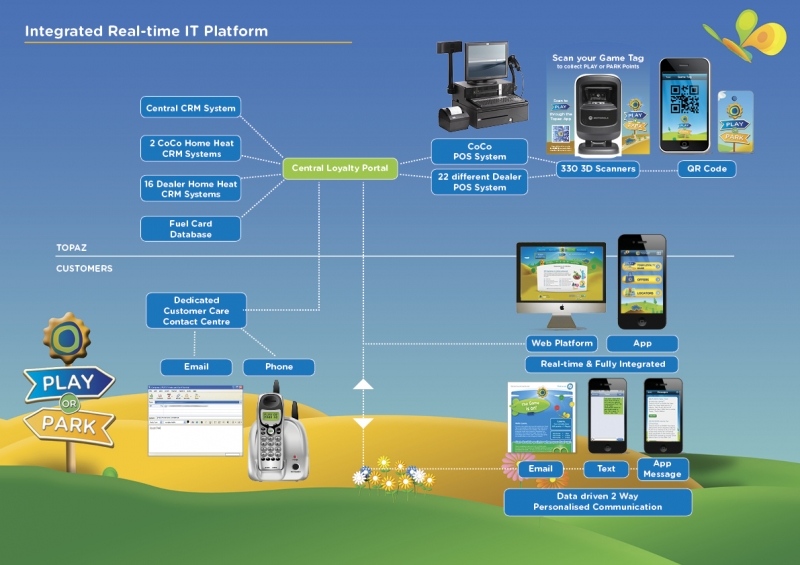

4. COMPLEXITY OF INTEGRATING MUTIPLE BUSINESSES

Among the 330 individual fourcourts, there is a mix of company-owned and individual dealer-owned sites. This presented an array of challenges from a financial, implementation and internal adoption perspective. In addition, Topaz Home Heat business also needed to be included as part of this programme.

The Strategy

To address the above challenges and make the ambition of presenting consumers with a truly category-changing proposition, Topaz undertook extensive research to fully understand why customers do and do not engage with loyalty programmes.

The feedback from the initial phase of research provided very concise direction – the programme (1) must present customers with something of genuine value and (2) give them relevant and tangible rewards each month.

Three Loyalty models were developed – two being more in line with traditional approaches but the third model having a game at its core.

This research presented the key insight that became the strategic rationale for the Loyalty Programme; ‘Customers wanted permission to PLAY’.

- Play is a transformative act that moves customers from passive recipients to being participants, stakeholders, players.

- Gaming wasn’t new – but the gamification of relationships was.

- Play is fun. In this market, at this time, fun is currency! And ‘fun’ is proven to be a most effective means to changing behaviour (ref: VW’s Fun Theory).

By having a game as the programme’s central mechanic, it ensured ‘PLAY or PARK’ was more playful, more rewarding and in turn, ensured Topaz’s rendition of loyalty was more engaging, more participative and more distinctive. And thereby creating a compelling reason for consumers to choose Topaz above its competitors.

WE COULD HAVE CREATED ANOTHER LOYALTY PROGRAMME, BUT A LOYALTY GAME THAT CUSTOMERS WANTED TO PLAY…. ‘THAT’S BETTER’.

This approach also strongly leveraged the emerging consumer behaviour whereby consumers were favouring brands who incorporated an element of gamification into their strategies such as Heineken and Nike+ (Nike Fuelband).

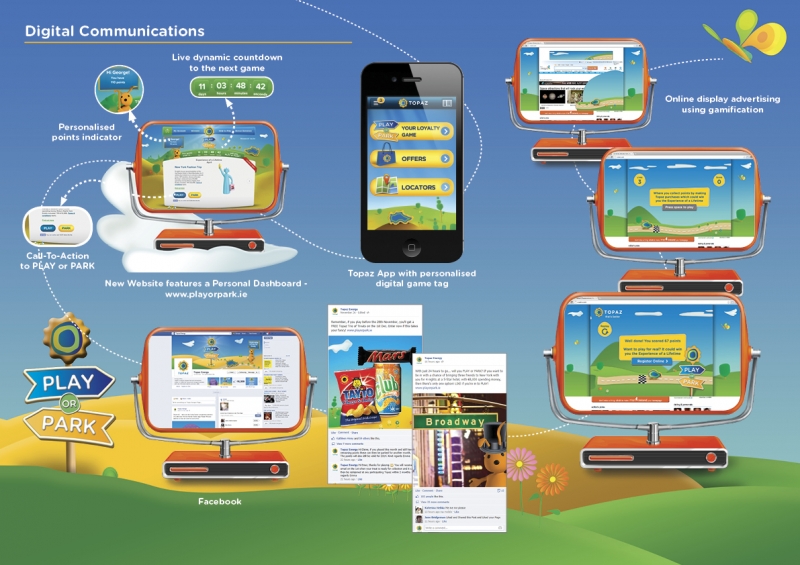

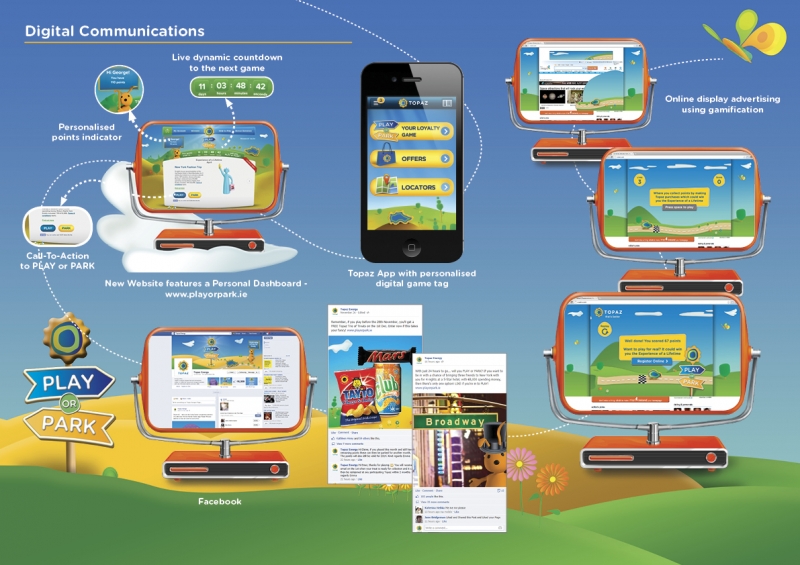

The ambition with ‘PLAY or PARK’ was to create a mass participative platform for the brand to regularly engage its customers and so, each month registered customers receive a suite of highly personalised communications that are carefully choreographed around each monthly game to maximise excitement and participation.

Also, of paramount importance, was the ease with which customers could PLAY. Each customer was invited to PLAY via a FREE text, the ‘PLAY or PARK’ App or their personalised web page on ‘PlayorPark.ie.

Such multiple touch-points and real-time integration between the game tag, app, website and forecourt means that customers can PLAY 24/7, creating a seamless customer experience that fosters deep, regular engagement and makes rewards feel tangible.

The Idea

Free Treats and the chance to win big prizes was a lovely way for Topaz to say thank you to their customers. But in keeping with the brand’s overall promise of ‘That’s better’, we needed to do it in a way that felt more playful, more exciting and more fun.

PLAY or PARK is an identity very deliberate in design.

- First and foremost, it works extremely hard to drive clear comprehension for what is the central mechanic of the programme.

- Secondly, it instantly establishes the core decision that the customer needs to make each month in order to participate. Thereby also serving as a strong call-to-action for customers.

- Thirdly, from a language perspective, ‘PLAY’ champions the fun aspect of the programme and reinforces the existing brand values, while ‘PARK’ offers a very brand-centric expression of ‘do nothing’.

The single minded proposition of ‘filling up has never been so much fun’ was consistently brought to life across all touch-points via copy, visual imagery and the technology employed to create real-time interaction. Furthermore, the proposition was rooted in the genuine customer experience of ‘PLAY or PARK’.

At every opportunity, customers were invited to engage with the programme. For example, Shazam was used as the call-to-action on the launch TVC whereby customers used the Shazam app to be brought from the TVC to the App store to download the ‘PLAY or PARK’ App. Topaz were the second company in Ireland to use Shazam in their TV campaign but the first to use it as part of their Loyalty Programme.

The creative approach needed to leverage the already established ‘Topaz’ look and feel. However, this was fully extended across all consumer touch-points to include the ‘PLAY or PARK’ App, website, emails, and on-site POS. Additional characters were introduced to interact with screens and icons, staff training videos and in-store POS.

The visual expression of this is a figurative journey motif, truly bringing to life the choice the customer has to make each month and firmly rooting it within the existing Topaz World.

The Experiences-of-a-Lifetime and Topaz Treats imagery was rendered in Topaz’s trademark illustrative style, allowing us to incorporate them seamlessly into the Topaz world. This visual synergy reinforced the notion that PLAY or PARK was a programme that is strongly borne of the parent brand.

Use of channels

PLAY or PARK employed a truly integrated approach whereby the strengths of each individual media/channel were fully utilised to manage the customer from awareness to activation.

The initial launch phase was primarily tasked with establishing strong ‘front-of-mind’ awareness and to drive engagement. The PLAY or PARK TV campaign ran across six weeks with heavy weight periods applied across national and multi-channel platforms. The innovative use of Shazam in the TV commercial allowed consumers to interact with the TVC and this ultimately brought viewers directly to the Topaz App in the App Store.

In addition, high profile digital placements were used to generate impact and deliver high reach among the target audience. The high profile digital campaign included full page take-overs and half page formats. These formats were specifically employed to bring the ‘PLAY or PARK’ experience to life for consumers, delivering real-time engagement and stimulating high volume onsite visits.

Radio and Digital were fully used to drive recruitment (e.g. registrations). The strategy on radio was two-pronged where focus was placed on creating mass awareness of the ‘PLAY or PARK’ proposition whilst actively driving App downloads. Radio was aired during key drive time segments to ensure large scale reach, high messaging frequency with a strong relevant context.

Mobile advertising (both search and display) was deployed in a direct response mode to also actively drive App downloads. Paid search was also used as a support channel.

For the initial launch phase, Branded Content was developed for social channels and the PlayorPark.ie website. All content (including ‘how to PLAY’ infomercials) were developed to drive comprehension of how ‘PLAY or PARK’ works.

Finally, a most crucial channel for the success of ‘PLAY or PARK’ was the company’s 330 forecourts. Given the grudge nature of each purchase, Topaz clearly identified this channel as the key recruitment channel. Furthermore, it presented another key opportunity to drive comprehension via staff interaction with customers – at the all important point-of-purchase.

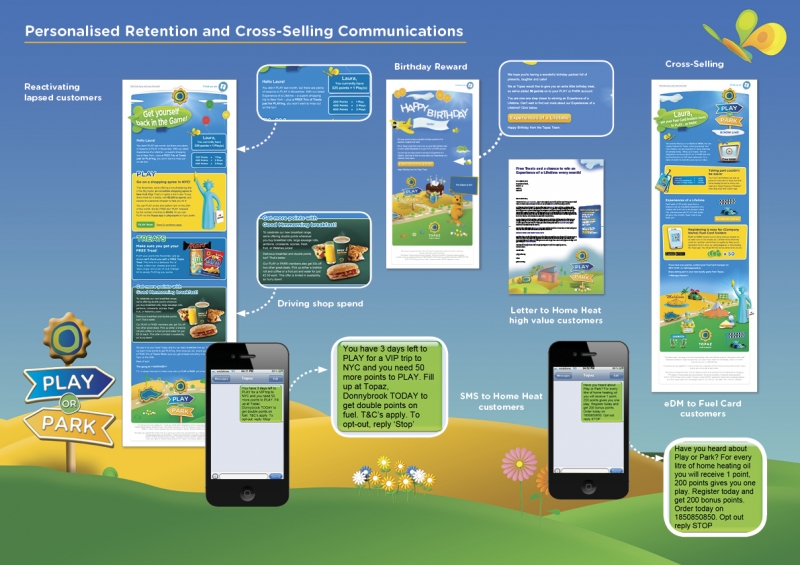

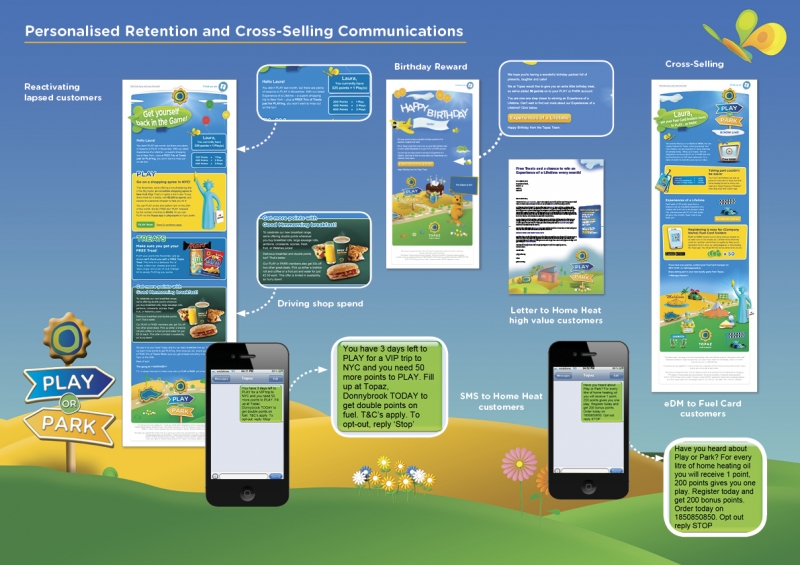

Once fully registered, the more direct, personal channels were utilised (email, in-App and SMS) to drive on-going participation. Using the data provided, consumers enjoyed a highly personalised experience with bespoke monthly communications tailored around their individual behaviours/purchases, each displaying their total points and available ‘Plays’.

Each month, consumers received a series of three very carefully choreographed communications, each designed to bring the individual consumer through the entire ‘PLAY or PARK’ game experience:

- 1st of the month: This communication is designed primarily to inform the customer that his/her Topaz Treat is waiting for them in-store. The secondary message is announcing that this month’s game has started and incorporates a prompt to ‘Play’

- 20th of the month: This communication is very much focussed on the prompt to ‘Play’ this month’s game, clearly displaying how many points and corresponding ‘Plays’ the individual customer has. In this instance, the Topaz treat is the secondary message.

- 25th of the month: This communication serves as a final prompt to ‘PLAY’ the monthly game, again clearly displaying how many points and corresponding ‘Plays’ the individual customer has. In addition, it champions the time remaining until the games closes. Secondary messages include the following month’s Experience of a Lifetime in the case whereby the consumer wants to ‘PARK’ his/her points. Also, the previous month’s winner is featured.

Within the above three monthly communications, each are tailored using the individual customer data to ensure the most appropritate prompt for the individual consumers (eg: those with over 200pts = ‘Play’ this month or those with less than 200pts = fill up before the dealine, collect points and then ‘Play’ this month). The data is segmented by metrcis such as value, gaming history, purchase and transactional behaviours.

All the above three communications would only be sent via the customers self-nominated preferred channels (email, in-App and SMS), thereby completing the integrated loyalty experience.

From an on-going perspective, both social channels and the brand’s forecourt sites became the lead channels to maintain awareness and drive continuous engagement in ‘PLAY or PARK’s monthly games. Each monthly ‘Experience of a Lifetime’ was championed on the forecourt, with strong prompts to ‘PLAY’. Social channels were also used to stimulate excitement, conversation and ultimately participation for each monthly game via timely and playful posts promoting the up and coming Experience of a Lifetime and relevant treats – and, previous winners were also championed in these channels.

The Results

Within its first year, PLAY or PARK has delivered exceptionally across all objectives and in all cases the targets were exceeded.

COMMERCIAL OBJECTIVES:

- Topaz retained #1 market position and increased fuel market share by +1.2% (outperforming the market by 6.5%). [2]

- Increased market share, fuel volume and sales. [2]

- +15% increase in YOY Diesel volume (and against a target of arresting volume decline by 0.5%). It is worth noting that this result is considerably stronger than the market increase of +5%.

- +1% increase in YOY Unleaded volume (against a target of arresting volume decline by 0.5%). It is worth noting that this result is an exceptional acheivement as the overall market decreased by -6% during the campaign period.

- +10% increase in YOY Fuel Card Volumes (against a target of +1%).

- +4% increase in YOY Non-Fuel/shop turnover (against a target of +1%).

- The ability for ‘PLAY or PARK’ to target and drive specific sales lines/products was clearly demonstrated during the Double Points promotion on Breakfast products. This promotion resulted in a +25% increase in sales on breakfast products during the 4-week promotional period. [2]

MARKETING OBJECTIVES:

- Independent research has clearly shown that ‘PLAY or PARK’ has without doubt created a tangible and compelling point of difference for Topaz among consumers against the competitive set.

- In November 2013, it states that 23% of customers have now “switched to Topaz” due to ‘PLAY or PARK’ [1]

- Even more impressive is that 26% of customers now “only choose to fill up in Topaz” due to ‘PLAY or PARK’. [1]

The commercial value of both the above results is significant. And such achievements are made all the more remarkable, when one considers the category in which the brand operates – where fuel is considered by consumers to be very much a grudge purchase, brand choice is almost exclusively based on price…. And Topaz’s fuels are priced at a slight premium.

- There were unprecedented increases in the key brand equity scores with the NPS increasing by +7% (to 45%). In addition, there were further strengthening of the brand’s #1 position in the forecourt/convenience sector for the ‘Leadership’ Brand KPI by +10%. (+20% vs closest competitor). [1]

- This database of actively engaged customers now affords Topaz full visibility of customers and their transactional behaviour. Such visibility enables Topaz to clearly segment their customer base and drive specific, preferential behavioural change for each customer group (e.g. increase share of tank or drive non-fuel purchases among customers only purchasing fuel). This inevitably will optimise the lifetime value of each individual customer. Already in Year 1, we have seen the positive commercial impact of such an approach (+4% increase in YOY Non-Fuel/shop turnover). [2]

CUSTOMER ENGAGEMENT OBJECTIVES:

From a customer engagement and participation perspective, the numbers tell a very compelling story. The ambition to create a mass participative platform for the brand to regularly engage its customers has clearly been delivered on. [3]

Within the first 11 months, ‘PLAY or PARK’ has delivered the following:

- Recruited 215,000 members in only 11 months (8% ahead of target with 1 month to go!)

- Drove high levels of customer participation and a greater share of wallet.

- Over 580,000 PLAYS since launch. (45% ahead of target)

- 250,000 FREE Topaz Treats issued with a 56% redemption rate, way ahead of the category norm and 26% ahead of target

- 18% increase in fuel ATV for loyalty members. (against target of 5%)

- The monthly communications provide a dynamic and highly relevant platform to ‘PLAYfully’ engage with customers, with participation rates far exceeded market norms.

- 45% monthly email open-rate (v’s industry av. of 30% for Loyalty Programmes).

- Active participation in social media, resulted in a ten-fold increase in Facebook likes and average post reach of 30% (over 50% at launch). Facebook average = 16%

- No. 1 App download during launch with 45,307 downloads

- 30,924 site visits from launch digital display

Finally, the unique achievements of ‘PLAY or PARK’ are especially impressive when viewed in relation to its impact on the Irish Loyalty Market and its main competitor.

- In its first year ‘PLAY or PARK’ has beaten well established Loyalty Programmes on the Customer Participation Metric - the key metric to success for Loyalty Programmes [4] including Applegreen, Easons and Brown Thomas. Most impressively, Topaz is tracking 12% ahead of Applegreen.

NOTE REFERENCES/DATA SOURCES:

[1] Behaviour & Attitudes (November 2013)

[2] Topaz Sales data

[3] Covali Data

[4] Amarach The Loyalty Performance Index (2014)

The Impact

As outlined in the above section, ‘PLAY or PARK’ has had transformative effect on how Topaz customers think, feel and, most importantly act and how the business engages with customers.

POSITIVE IMPACT ON CUSTOMER ATTITUDES (‘THINK/FEEL’)

Since the launch of ‘PLAY or PARK’, there have been significant increases across the brand’s KPI’s including a +7% in NPS and +10% in ‘Leadership’. [1] In fact, Topaz is now ranked 1st across 9 (out of 12) brand KPI’s when compared to all competitors.

Possibly most telling is that Topaz is also now ranked 1st against the KPI ‘A brand I can trust’ (+8% ahead of nearest and main competitor, Applegreen).

POSITIVE IMPACT ON CUSTOMER BEHAVIOUR (‘ACT’)

Independent research carried out in November 2013 states that 23% of customers have now “switched to Topaz” due to ‘PLAY or PARK’. Even more impressive is that 26% of customers now “only choose to fill up in Topaz” due to ‘PLAY or PARK’. [1]

The above shifts in consumer attitudes and behaviours has resulted in consumers spending more in Topaz per visit (eg: +4% increase in YOY Non-Fuel/shop turnover).

In addition, consumers have demonstrated their receptiveness to loyalty promotions promotions via ‘PLAY or PARK’ (eg: during the Double Points promotion on Breakfast products. This promotion resulted in a +25% increase in sales on breakfast products during the 4-week promotional period).

In summary, Topaz customers are now (1) visiting Topaz more often, (2) spending more per visit and (3) actively engaging more regularly with Topaz as a result of ‘PLAY or PARK’.

As a final point, it is important to note that, despite launching 14 months after their nearest competitor, Applegreen, Topaz now has more than double the number of customers actively participating in their loyalty programme …. their ‘loyalty game’. [1]

New Learnings

‘PLAY’ will be to the 21st Century what work was to the Industrial age – our dominant way of knowing, doing and creating value”. Pat Kane, Author of ‘Play Ethic’.

The first fundamental learning from ‘PLAY or PARK’ is the transformative effect ‘fun’ can deliver in driving increased participation in loyalty. Again, there is a global trend where successful brands are beginning to bring an element of gamification into their strategies.

The second key learning from ‘PLAY or PARK’ is the need for real-time experiences as this reflects how consumers now live, consume products and messages and spend time with brands.

Summary

‘PLAY or PARK’ has delivered a considerably positive commercial effect for Topaz – within its first year!

Central to it’s success and more importantly, it’s future potential is a live, dynamic database that provides consumer insights and in turn, business intelligence which enables the business to drive incremental value from individual customers.

Furthermore, ‘PLAY or PARK’ has had a transformative effect on the brand’s relationship with its customers, moving them from indifference to preference.

It is an excellent example of what can be achieved with big, bold ambitions and a genuine desire to present customers with something new and something exciting.

Videos

Audio

In 2013, Topaz - Ireland’s largest fuels/convenience retailer – faced a very challenging commercial reality with a number of distinct challenges:

- The brand was experiencing declining market share.

- The overall Fuels market was predicted to decline by 6%.

- Research showed that 72% of customers claimed to “either know the exact price of fuel or have a good idea of the price” and 36% claimed to choose their stations solely based on the cheapest price [1]. As such, customers consider fuel to be a grudge purchase and are extremely price-sensitive and their brand choice is almost exclusively based on price. Furthermore, this market is strongly characterised by very tight margins.

- Topaz was priced at a slight premium due to their superior Fuel Additive that delivers enhanced fuel efficiencies. This resulted in their main competitor, Applegreen, being perceived as a cheaper choice, especially in the two main markets - Dublin and Cork.

Based on the above market conditions, the strategic imperative was clear. Topaz had to create a very compelling reason for consumers to choose their brand.

- Topaz had little data on their customers, despite the high footfall through their 330 sites each week. This lack of data meant that the brand had no visibility as to who their customers were, what they were buying and how often they did so.

To address all of the above, the strategic decision was made to focus the entire business on getting closer to their customers with the sole objective of building sustainable, long-term profitable relationships with them, through the creation of a highly innovative, unique and category-changing Loyalty Strategy.

In February 2013, ‘PLAY or PARK’, the Topaz Loyalty Game was launched and became the first ever Loyalty Programme in Europe to use an on-going game as its central mechanic.

[1] Behaviour & Attitudes (November 2013)

Given the strategic importance of ‘PLAY or PARK’, very ambitious and aggressive targets were set for Year 1:

COMMERCIAL OBJECTIVES:

- Retain #1 position in the market.

- Arrest decline in (1) market share (2) fuel volume and (3) sales.

- Arrest decline in Diesel volume by 0.5%

- Arrest decline in Unleaded volume by 0.5%

- Increase YOY Fuel Card volumes by 1%

- Increase YOY Non-Fuel/shop turnover by 1%

MARKETING OBJECTIVES:

- To establish a tangible and compelling point of difference for Topaz amongst its competitive set in order to retain their customers.

- To strengthen brand equity by creating a truly unique, innovative version of loyalty that is more meaningful for customers and one that they would actively participate in.

- To acquire valuable customer data on a mass scale to provide the business with on-going visibility of its customers, their behaviour and purchases in order to communicate with them in the most relevant manner and also to drive preferential behavioural change.

CUSTOMER ENGAGEMENT OBJECTIVES:

In achieving the above Commercial and Marketing objectives, mass consumer engagement and ongoing participation became mandatory and as such, the following objectives were set for Year 1.

- Recruit 200,000 fully registered members.

- Deliver high levels of customer participation:

- 400,000 PLAYS

- 30% Topaz Treat redemption on a monthly-basis

- 5% uplift in average-transaction-value from loyalty members

- Establish a meaningful, regular dialogue with customers via a highly personalised experience each month.

The ambition was extremely challenging - create a highly innovative, category-changing Loyalty Programme that has the ability to actively engage consumers on a regular basis and utimately has the potential to drive preferential behavioural change (ie: purchase behaviour). And by doing so, reverse the decline in market share, fuel volume and drive loyalty.

However, making this ambition a reality presented an array of very significant obstacles:

1. PRICE PREMUIM WITH NO PERCEIVED PRODUCT DIFFERENTIATION

There is little perceived product differentiation among the various brands operating within this category. Despite this, Topaz continually invest in their products to ensure an enhanced, superior performance of their fuels which in turn delivers greater efficiencies for their customers (eg: a fuel additive that delivers up to 24km more per tank). Such an approach results in Topaz fuels being retailed at a slight premium when compared to the market, in particular, its closest competitor, Applegreen. This inevitably compounds the task of defending a market leading position in a highly priced-driven/sensitive market.

2. LACK OF CONSUMER LOYALTY

Consumer loyalty as traditionally thought of does not exist in this category. As shown above (section 2 – Introduction & Background), research showed that 72% of customers claimed to “either know the exact price of fuel or have a good idea of the price” and 36% claimed to choose their stations solely based on the cheapest price. As such, there is one dominant type of loyalty that exists in this category – Price Loyalty. And to a lesser extent, assuming a minimal or neutral price difference, Convenience Loyalty (ie: choosing a petrol station based on geographical proximity/convenience) may also exist. This made the task of creating a deeper, more meaningful connection with consumers all the more challenging.

3. CONSUMER OVERLOAD WITH LOYALTY PROGRAMMES IN THE IRISH MARKET

One of the biggest challenges was the proliferation of Loyalty Programmes in the Irish Market and the fact that customers only actively participate in half of the programmes that they belong to - therefore having little or no impact on their affinity with the brand or future purchasing behaviours. To compound this challenge further, Topaz did not have the benefit of ‘first mover advantage’ in this category as Applegreen, Topaz’s largest competitor, had launched their loyalty programme 14 months prior to the launch of Topaz’s ‘PLAY or PARK’. During this time, approximately 100,000 customers had joined their rewards programme that mirrored the standard 'purchases = points = prizes' model.

4. COMPLEXITY OF INTEGRATING MUTIPLE BUSINESSES

Among the 330 individual fourcourts, there is a mix of company-owned and individual dealer-owned sites. This presented an array of challenges from a financial, implementation and internal adoption perspective. In addition, Topaz Home Heat business also needed to be included as part of this programme.

To address the above challenges and make the ambition of presenting consumers with a truly category-changing proposition, Topaz undertook extensive research to fully understand why customers do and do not engage with loyalty programmes.

The feedback from the initial phase of research provided very concise direction – the programme (1) must present customers with something of genuine value and (2) give them relevant and tangible rewards each month.

Three Loyalty models were developed – two being more in line with traditional approaches but the third model having a game at its core.

This research presented the key insight that became the strategic rationale for the Loyalty Programme; ‘Customers wanted permission to PLAY’.

- Play is a transformative act that moves customers from passive recipients to being participants, stakeholders, players.

- Gaming wasn’t new – but the gamification of relationships was.

- Play is fun. In this market, at this time, fun is currency! And ‘fun’ is proven to be a most effective means to changing behaviour (ref: VW’s Fun Theory).

By having a game as the programme’s central mechanic, it ensured ‘PLAY or PARK’ was more playful, more rewarding and in turn, ensured Topaz’s rendition of loyalty was more engaging, more participative and more distinctive. And thereby creating a compelling reason for consumers to choose Topaz above its competitors.

WE COULD HAVE CREATED ANOTHER LOYALTY PROGRAMME, BUT A LOYALTY GAME THAT CUSTOMERS WANTED TO PLAY…. ‘THAT’S BETTER’.

This approach also strongly leveraged the emerging consumer behaviour whereby consumers were favouring brands who incorporated an element of gamification into their strategies such as Heineken and Nike+ (Nike Fuelband).

The ambition with ‘PLAY or PARK’ was to create a mass participative platform for the brand to regularly engage its customers and so, each month registered customers receive a suite of highly personalised communications that are carefully choreographed around each monthly game to maximise excitement and participation.

Also, of paramount importance, was the ease with which customers could PLAY. Each customer was invited to PLAY via a FREE text, the ‘PLAY or PARK’ App or their personalised web page on ‘PlayorPark.ie.

Such multiple touch-points and real-time integration between the game tag, app, website and forecourt means that customers can PLAY 24/7, creating a seamless customer experience that fosters deep, regular engagement and makes rewards feel tangible.

Free Treats and the chance to win big prizes was a lovely way for Topaz to say thank you to their customers. But in keeping with the brand’s overall promise of ‘That’s better’, we needed to do it in a way that felt more playful, more exciting and more fun.

PLAY or PARK is an identity very deliberate in design.

- First and foremost, it works extremely hard to drive clear comprehension for what is the central mechanic of the programme.

- Secondly, it instantly establishes the core decision that the customer needs to make each month in order to participate. Thereby also serving as a strong call-to-action for customers.

- Thirdly, from a language perspective, ‘PLAY’ champions the fun aspect of the programme and reinforces the existing brand values, while ‘PARK’ offers a very brand-centric expression of ‘do nothing’.

The single minded proposition of ‘filling up has never been so much fun’ was consistently brought to life across all touch-points via copy, visual imagery and the technology employed to create real-time interaction. Furthermore, the proposition was rooted in the genuine customer experience of ‘PLAY or PARK’.

At every opportunity, customers were invited to engage with the programme. For example, Shazam was used as the call-to-action on the launch TVC whereby customers used the Shazam app to be brought from the TVC to the App store to download the ‘PLAY or PARK’ App. Topaz were the second company in Ireland to use Shazam in their TV campaign but the first to use it as part of their Loyalty Programme.

The creative approach needed to leverage the already established ‘Topaz’ look and feel. However, this was fully extended across all consumer touch-points to include the ‘PLAY or PARK’ App, website, emails, and on-site POS. Additional characters were introduced to interact with screens and icons, staff training videos and in-store POS.

The visual expression of this is a figurative journey motif, truly bringing to life the choice the customer has to make each month and firmly rooting it within the existing Topaz World.

The Experiences-of-a-Lifetime and Topaz Treats imagery was rendered in Topaz’s trademark illustrative style, allowing us to incorporate them seamlessly into the Topaz world. This visual synergy reinforced the notion that PLAY or PARK was a programme that is strongly borne of the parent brand.

Use of channels

PLAY or PARK employed a truly integrated approach whereby the strengths of each individual media/channel were fully utilised to manage the customer from awareness to activation.

The initial launch phase was primarily tasked with establishing strong ‘front-of-mind’ awareness and to drive engagement. The PLAY or PARK TV campaign ran across six weeks with heavy weight periods applied across national and multi-channel platforms. The innovative use of Shazam in the TV commercial allowed consumers to interact with the TVC and this ultimately brought viewers directly to the Topaz App in the App Store.

In addition, high profile digital placements were used to generate impact and deliver high reach among the target audience. The high profile digital campaign included full page take-overs and half page formats. These formats were specifically employed to bring the ‘PLAY or PARK’ experience to life for consumers, delivering real-time engagement and stimulating high volume onsite visits.

Radio and Digital were fully used to drive recruitment (e.g. registrations). The strategy on radio was two-pronged where focus was placed on creating mass awareness of the ‘PLAY or PARK’ proposition whilst actively driving App downloads. Radio was aired during key drive time segments to ensure large scale reach, high messaging frequency with a strong relevant context.

Mobile advertising (both search and display) was deployed in a direct response mode to also actively drive App downloads. Paid search was also used as a support channel.

For the initial launch phase, Branded Content was developed for social channels and the PlayorPark.ie website. All content (including ‘how to PLAY’ infomercials) were developed to drive comprehension of how ‘PLAY or PARK’ works.

Finally, a most crucial channel for the success of ‘PLAY or PARK’ was the company’s 330 forecourts. Given the grudge nature of each purchase, Topaz clearly identified this channel as the key recruitment channel. Furthermore, it presented another key opportunity to drive comprehension via staff interaction with customers – at the all important point-of-purchase.

Once fully registered, the more direct, personal channels were utilised (email, in-App and SMS) to drive on-going participation. Using the data provided, consumers enjoyed a highly personalised experience with bespoke monthly communications tailored around their individual behaviours/purchases, each displaying their total points and available ‘Plays’.

Each month, consumers received a series of three very carefully choreographed communications, each designed to bring the individual consumer through the entire ‘PLAY or PARK’ game experience:

- 1st of the month: This communication is designed primarily to inform the customer that his/her Topaz Treat is waiting for them in-store. The secondary message is announcing that this month’s game has started and incorporates a prompt to ‘Play’

- 20th of the month: This communication is very much focussed on the prompt to ‘Play’ this month’s game, clearly displaying how many points and corresponding ‘Plays’ the individual customer has. In this instance, the Topaz treat is the secondary message.

- 25th of the month: This communication serves as a final prompt to ‘PLAY’ the monthly game, again clearly displaying how many points and corresponding ‘Plays’ the individual customer has. In addition, it champions the time remaining until the games closes. Secondary messages include the following month’s Experience of a Lifetime in the case whereby the consumer wants to ‘PARK’ his/her points. Also, the previous month’s winner is featured.

Within the above three monthly communications, each are tailored using the individual customer data to ensure the most appropritate prompt for the individual consumers (eg: those with over 200pts = ‘Play’ this month or those with less than 200pts = fill up before the dealine, collect points and then ‘Play’ this month). The data is segmented by metrcis such as value, gaming history, purchase and transactional behaviours.

All the above three communications would only be sent via the customers self-nominated preferred channels (email, in-App and SMS), thereby completing the integrated loyalty experience.

From an on-going perspective, both social channels and the brand’s forecourt sites became the lead channels to maintain awareness and drive continuous engagement in ‘PLAY or PARK’s monthly games. Each monthly ‘Experience of a Lifetime’ was championed on the forecourt, with strong prompts to ‘PLAY’. Social channels were also used to stimulate excitement, conversation and ultimately participation for each monthly game via timely and playful posts promoting the up and coming Experience of a Lifetime and relevant treats – and, previous winners were also championed in these channels.

Within its first year, PLAY or PARK has delivered exceptionally across all objectives and in all cases the targets were exceeded.

COMMERCIAL OBJECTIVES:

- Topaz retained #1 market position and increased fuel market share by +1.2% (outperforming the market by 6.5%). [2]

- Increased market share, fuel volume and sales. [2]

- +15% increase in YOY Diesel volume (and against a target of arresting volume decline by 0.5%). It is worth noting that this result is considerably stronger than the market increase of +5%.

- +1% increase in YOY Unleaded volume (against a target of arresting volume decline by 0.5%). It is worth noting that this result is an exceptional acheivement as the overall market decreased by -6% during the campaign period.

- +10% increase in YOY Fuel Card Volumes (against a target of +1%).

- +4% increase in YOY Non-Fuel/shop turnover (against a target of +1%).

- The ability for ‘PLAY or PARK’ to target and drive specific sales lines/products was clearly demonstrated during the Double Points promotion on Breakfast products. This promotion resulted in a +25% increase in sales on breakfast products during the 4-week promotional period. [2]

MARKETING OBJECTIVES:

- Independent research has clearly shown that ‘PLAY or PARK’ has without doubt created a tangible and compelling point of difference for Topaz among consumers against the competitive set.

- In November 2013, it states that 23% of customers have now “switched to Topaz” due to ‘PLAY or PARK’ [1]

- Even more impressive is that 26% of customers now “only choose to fill up in Topaz” due to ‘PLAY or PARK’. [1]

The commercial value of both the above results is significant. And such achievements are made all the more remarkable, when one considers the category in which the brand operates – where fuel is considered by consumers to be very much a grudge purchase, brand choice is almost exclusively based on price…. And Topaz’s fuels are priced at a slight premium.

- There were unprecedented increases in the key brand equity scores with the NPS increasing by +7% (to 45%). In addition, there were further strengthening of the brand’s #1 position in the forecourt/convenience sector for the ‘Leadership’ Brand KPI by +10%. (+20% vs closest competitor). [1]

- This database of actively engaged customers now affords Topaz full visibility of customers and their transactional behaviour. Such visibility enables Topaz to clearly segment their customer base and drive specific, preferential behavioural change for each customer group (e.g. increase share of tank or drive non-fuel purchases among customers only purchasing fuel). This inevitably will optimise the lifetime value of each individual customer. Already in Year 1, we have seen the positive commercial impact of such an approach (+4% increase in YOY Non-Fuel/shop turnover). [2]

CUSTOMER ENGAGEMENT OBJECTIVES:

From a customer engagement and participation perspective, the numbers tell a very compelling story. The ambition to create a mass participative platform for the brand to regularly engage its customers has clearly been delivered on. [3]

Within the first 11 months, ‘PLAY or PARK’ has delivered the following:

- Recruited 215,000 members in only 11 months (8% ahead of target with 1 month to go!)

- Drove high levels of customer participation and a greater share of wallet.

- Over 580,000 PLAYS since launch. (45% ahead of target)

- 250,000 FREE Topaz Treats issued with a 56% redemption rate, way ahead of the category norm and 26% ahead of target

- 18% increase in fuel ATV for loyalty members. (against target of 5%)

- The monthly communications provide a dynamic and highly relevant platform to ‘PLAYfully’ engage with customers, with participation rates far exceeded market norms.

- 45% monthly email open-rate (v’s industry av. of 30% for Loyalty Programmes).

- Active participation in social media, resulted in a ten-fold increase in Facebook likes and average post reach of 30% (over 50% at launch). Facebook average = 16%

- No. 1 App download during launch with 45,307 downloads

- 30,924 site visits from launch digital display

Finally, the unique achievements of ‘PLAY or PARK’ are especially impressive when viewed in relation to its impact on the Irish Loyalty Market and its main competitor.

- In its first year ‘PLAY or PARK’ has beaten well established Loyalty Programmes on the Customer Participation Metric - the key metric to success for Loyalty Programmes [4] including Applegreen, Easons and Brown Thomas. Most impressively, Topaz is tracking 12% ahead of Applegreen.

NOTE REFERENCES/DATA SOURCES:

[1] Behaviour & Attitudes (November 2013)

[2] Topaz Sales data

[3] Covali Data

[4] Amarach The Loyalty Performance Index (2014)

As outlined in the above section, ‘PLAY or PARK’ has had transformative effect on how Topaz customers think, feel and, most importantly act and how the business engages with customers.

POSITIVE IMPACT ON CUSTOMER ATTITUDES (‘THINK/FEEL’)

Since the launch of ‘PLAY or PARK’, there have been significant increases across the brand’s KPI’s including a +7% in NPS and +10% in ‘Leadership’. [1] In fact, Topaz is now ranked 1st across 9 (out of 12) brand KPI’s when compared to all competitors.

Possibly most telling is that Topaz is also now ranked 1st against the KPI ‘A brand I can trust’ (+8% ahead of nearest and main competitor, Applegreen).

POSITIVE IMPACT ON CUSTOMER BEHAVIOUR (‘ACT’)

Independent research carried out in November 2013 states that 23% of customers have now “switched to Topaz” due to ‘PLAY or PARK’. Even more impressive is that 26% of customers now “only choose to fill up in Topaz” due to ‘PLAY or PARK’. [1]

The above shifts in consumer attitudes and behaviours has resulted in consumers spending more in Topaz per visit (eg: +4% increase in YOY Non-Fuel/shop turnover).

In addition, consumers have demonstrated their receptiveness to loyalty promotions promotions via ‘PLAY or PARK’ (eg: during the Double Points promotion on Breakfast products. This promotion resulted in a +25% increase in sales on breakfast products during the 4-week promotional period).

In summary, Topaz customers are now (1) visiting Topaz more often, (2) spending more per visit and (3) actively engaging more regularly with Topaz as a result of ‘PLAY or PARK’.

As a final point, it is important to note that, despite launching 14 months after their nearest competitor, Applegreen, Topaz now has more than double the number of customers actively participating in their loyalty programme …. their ‘loyalty game’. [1]

‘PLAY’ will be to the 21st Century what work was to the Industrial age – our dominant way of knowing, doing and creating value”. Pat Kane, Author of ‘Play Ethic’.

The first fundamental learning from ‘PLAY or PARK’ is the transformative effect ‘fun’ can deliver in driving increased participation in loyalty. Again, there is a global trend where successful brands are beginning to bring an element of gamification into their strategies.

The second key learning from ‘PLAY or PARK’ is the need for real-time experiences as this reflects how consumers now live, consume products and messages and spend time with brands.

‘PLAY or PARK’ has delivered a considerably positive commercial effect for Topaz – within its first year!

Central to it’s success and more importantly, it’s future potential is a live, dynamic database that provides consumer insights and in turn, business intelligence which enables the business to drive incremental value from individual customers.

Furthermore, ‘PLAY or PARK’ has had a transformative effect on the brand’s relationship with its customers, moving them from indifference to preference.

It is an excellent example of what can be achieved with big, bold ambitions and a genuine desire to present customers with something new and something exciting.